The Governing Council of the European Central Bank (ECB) meets every six weeks or so to decide on euro area monetary policy and particularly on policy rate levels (the main refinancing operations, marginal lending facility and deposit facility rates). These policy rates influence all short-term interest rates in the euro area, which in turn – via the financial markets – influence long-term rates. These long-term rates play an essential role in the transmission of monetary policy as they have a direct impact on economic decisions (whether to consume or to invest). By analysing the determinants of long-term rates, we can understand how monetary policy and the commitment to achieve the inflation target are perceived and transmitted by markets.

Long-term interest rates can be understood as the sum of two components: (i) an expectation of future short-term interest rates; and (ii) risk premiums (although the latter are not considered in this blog post). Generally, central banks raise their policy rates to combat inflation, which leads to an increase in short-term interest rates. An increase in short-term rates tends to lower demand and curb inflation. Thus, financial markets' expectations of future short-term interest rates should naturally depend on inflation expectations, but also on the perceived responsiveness of monetary policy to inflation. This blog post proposes a simple approach for separating out the two factors’ contributions.

Identifying financial markets’ perception of monetary policy

To distinguish between the two factors and to identify the financial markets' perception of the responsiveness of monetary policy to inflation, we regress expected short-term rates, derived from interest rate swaps, on expected inflation, derived from inflation-linked swaps. The resulting coefficient indicates market participants’ perception of the responsiveness of monetary policy to inflation, daily and over different horizons. The constant term in the regression analysis can be read as the neutral rate perceived by the financial markets, i.e. the prevailing interest rate if inflation was at its 2% target. Finally, in order to identify any changes in market-perceived monetary policy, the coefficients are allowed to vary over time using the technique described by Goulet Coulombe (2023). Bauer et al. (2022) and Cuciniello (2024) propose alternative approaches to identifying changes in the perception of monetary policy.

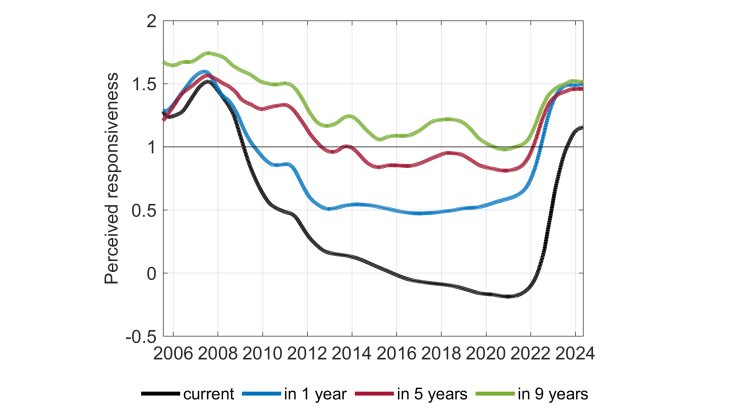

Chart 1 plots the responsiveness of monetary policy to inflation, as perceived by the financial markets, for four different time horizons: one year forward (in black), and one year forward one year from now (in blue), five years from now (in red), and nine years from now (in green). A coefficient of 0 means that the financial markets do not foresee a link between the interest rate and inflation. A coefficient greater than 1 means that they expect interest rates to rise more than inflation, i.e. real rates to rise in line with inflation, which is generally considered necessary to stabilise inflation.

How have perceptions evolved?

Chart 1 showing the financial markets' perception of the responsiveness of monetary policy to inflation raises four main points.

First, prior to 2008, perceived responsiveness was greater than one across all the time horizons, suggesting that the ECB’s commitment to its price stability mandate was considered credible.

Second, perceived responsiveness declined between 2012 and 2022, particularly over shorter time horizons, where it was near zero. This reduced responsiveness is consistent with the fact that rates were at their lower bound at the time, and with the ECB Governing Council’s forward guidance. Nevertheless, longer-term expectations of short rates continued to react to expected inflation during this period, which suggests that the financial markets continued to anticipate that the Eurosystem would respond to inflation in the medium and long term.

Third, from mid-2022 to mid-2023, perceived responsiveness increased for all of the time horizons to levels comparable to those observed before 2008. During that time, the ECB raised the deposit facility rate by 450 basis points. On the other hand, the smaller rise in short-term sensitivity could be a result of the specific nature of the 2022-23 shock: due to the shock’s transitory and unusual character, short-term rates did not rise as much as inflation. Market participants clearly took this monetary policy to be a response to a specific inflationary shock. Ultimately, the action taken by the ECB and communication from the Eurosystem helped to convince market participants of the Eurosystem's commitment to doing whatever was necessary to achieve its price stability objective (while taking account of the specific nature of the shock the euro area faced).

Fourth, since the last interest rate hike in September 2023, perceived responsiveness has remained stable, at high levels. Consequently, recent variations in medium to long-term interest rates are likely to be the result of changing inflation expectations rather than changes in the perception of monetary policy responsiveness to inflation.

Quality of the estimation and limitations of the approach

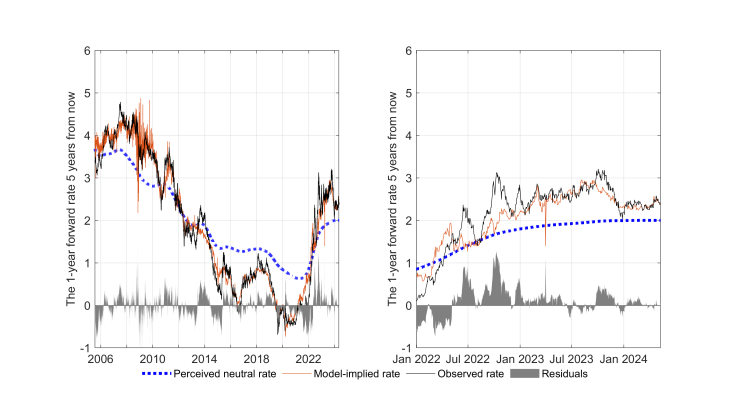

Chart 2 breaks down one-year forward rates five years from now. The part left unexplained by the model (grey shaded area at the bottom of the chart) may arise from the non-systemic aspect of monetary policy, from the monetary policy response to other factors such as economic activity, or from movements in risk premiums.