Large banking groups generally have substantial activity in financial markets, through dealer subsidiaries in the US. These activities have caused concern during the 2007-2009 financial crisis. What these financial institutions do is subject to controversy. Proponents of US post-crisis regulation, and some macro-finance academic papers argue that they have trading strategies (“proprietary trading”) that led to the crisis. However evidence on the underlying strategies remains loose, beyond the fact that they involve leverage. Others argue that dealers simply provide a liquidity service to investors: buying from those eager to sell and conversely. Thus, they argue, prudential regulation impairs liquidity provision, decrease asset prices and decrease corporate investment.

In this paper I reconcile the two views in the US corporate bond market: dealers trade like hedge funds: this means they find that some bonds a trade at too low prices with respect to other bonds, even after taking default risk or maturity into account. Thus they buy the “cheaper” one and borrow and sell, i.e. they short-sell the more expensive. This activity implies leverage: buying a bond implies borrowing cash, and short-selling implies borrowing a bond. It also tends to compress cheap bonds’ risk premia, as dealers buy more of them. This activity can also be viewed, if properly done, as liquidity provision: if a bond trades at low price, it may be because investors are eager to sell it, and conversely. It may also reflect gambling, if existing price differentials are fully justified by credit risk or maturity. The question of whether dealer trading is liquidity provision or gambling is important, but requires appropriate credit risk measurement: this is beyond the scope of this paper.

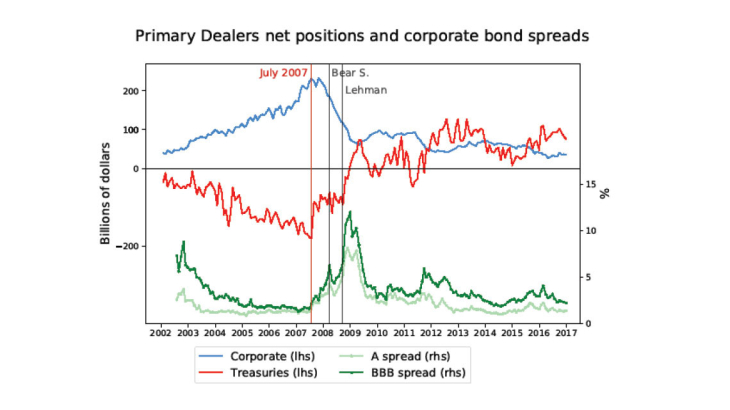

Crucially, dealers’ trading compresses spreads between corporate bonds and Treasury bonds, which are well-known leading indicators of economic activity and crises. I show that dealers short-sell Treasury bonds and buy corporate bonds, especially in the 2000s until the financial crisis (cf. Figure 1). This reflects dealer perception of a safe asset or liquidity premium on Treasury bonds that does not exist on corporate bonds.

I also suggest that the Volcker rule, which bans bank-affiliated dealers’ proprietary trading, may not address important risks related to proprietary trading: financing constraints (capital requirements, repo haircuts, …) may bind before the trading strategies pay off, forcing premature liquidation of positions. The Volcker rule answered the concern that banks took excessive trading risk because they were too-big-to-fail, implying their trading losses would be borne not by bankers, but by taxpayers.

However, data suggest an abrupt tightening of capital requirements in July 2007, following an increase in Treasury bond volatility. Dealers short Treasury position was reduced by half, i.e. by $100bn (Figure 1). They were thus left with $100bn in corporate bonds unhedged from risk-free rate changes by Treasury bonds sold short. This occurred a few weeks after an abnormal increase by about 50% in Treasury bond price volatility. Dealers face regulatory capital requirements that have to be matched each day, which increase in asset volatility. Thus the increase in Treasury bond volatility would have raised capital requirement for Treasury bonds. These facts suggest that dealers have been forced to reduce their short Treasury position to match increased capital requirements; as they were left with more risk on corporate bonds, they liquidated much of their corporate bond holdings over the year 2008, depressing corporate bond prices (increasing spreads).

This overall suggests that the underlying problem with proprietary trading stems from short-term capital requirements, which has two implications: first, the problem is likely to arise even outside the banking sector, as in the LTCM crisis in 1998; and second, other instruments for public intervention, ex ante or ex post, may be needed..