- Home

- Publications and statistics

- Publications

- Macroeconomic interim projections – Marc...

In order to contribute to the national and European economic debate, the Banque de France periodically publishes macroeconomic forecasts for France, constructed as part of the Eurosystem projection exercise and covering the current and two forthcoming years. Some of the publications also include an in-depth analysis of the results, along with focus articles on topics of interest.

- The macroeconomic scenario in these interim projections includes the assumptions in the budget for 2025, enacted on 14 February last. It also takes account of the 10 percentage point increase in US tariffs on imports from China, as well as the measures taken by China in response. It does not directly take account of the increase in customs duties on Mexico and Canada currently under discussion, nor those that may be upcoming on European goods (see box); however these indirectly affect the projections through the effects of uncertainty. Moreover, neither the recent proposals by the European Commission to increase military spending nor those likely to be submitted to Parliament in Germany have been factored in.

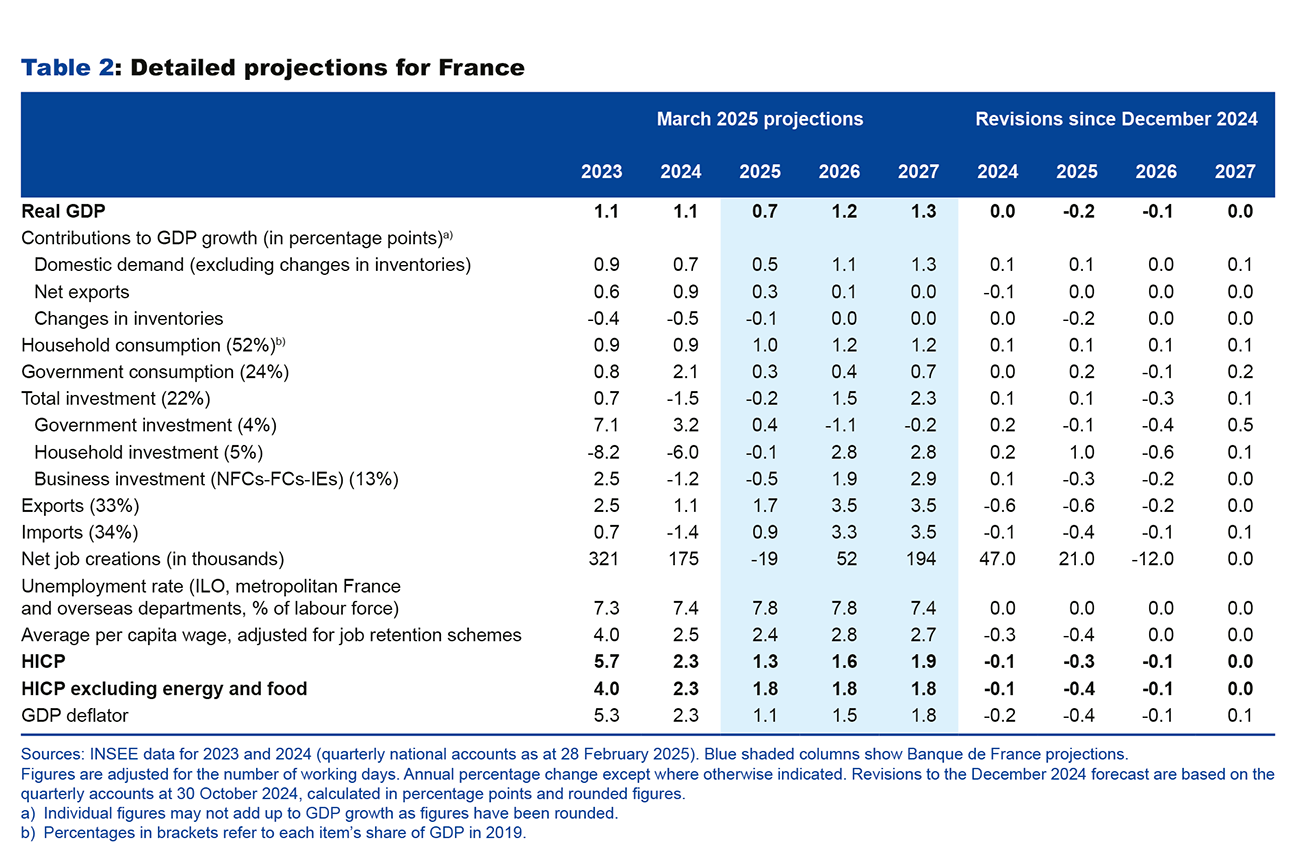

- After the slight downturn in activity observed at the end of last year – a temporary payback after the positive effect of the Olympic Games in the summer of 2024 – GDP is expected to grow at a still moderate rate in the first half of 2025, before gathering pace in the second half of the year. Over 2025 as a whole, activity is expected to slow down but growth should remain positive, at an annual average rate of 0.7% (after 1.1% in 2024), before rising in 2026 and 2027 to 1.2% and 1.3%, respectively, close to the medium-term potential rate. Our forecast therefore confirms that the French economy is unlikely to fall into recession.

- Compared with our December 2024 forecast, the downward revision to growth in 2025 (and more marginally in 2026) is due notably to the adjustment of our very short-term forecasts based on our latest monthly business surveys. In addition, the impact of less fiscal consolidation than envisaged last autumn should be offset by the uptick in international uncertainty and by current wait-and-see attitudes in view of the domestic situation.

- After reaching an annual average of 2.3% in 2024, headline inflation should continue to fall significantly, to below 2% over the projection horizon. In 2025, it will be particularly low at 1.3%, due to the drop in services and electricity prices. In 2026 and 2027, headline inflation is forecast to remain moderate at 1.6% and 1.9%, respectively. Inflation excluding energy and food is expected to remain stable at 1.8% over the three-year period. This should drive a continued recovery in the purchasing power of wages – wages are rising faster than prices on average – and gradually boost household consumption.

- There is still much uncertainty surrounding this forecast, linked to the geopolitical situation and, in particular, the uncertainties surrounding US trade policy and possible European responses. Overall, the risks to our GDP projection remain to the downside, although new upside risks could arise at the end of the period from an increase in military spending.

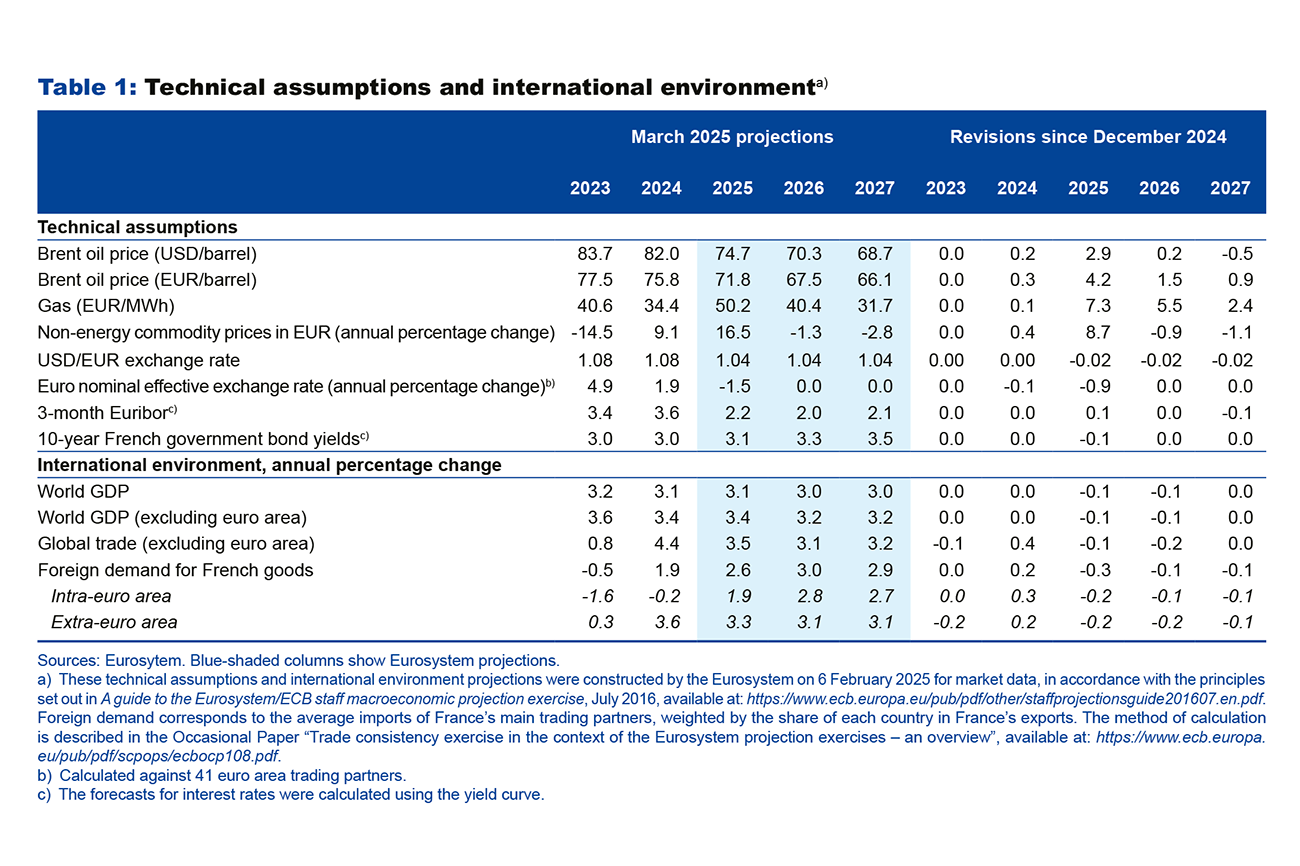

These projections are based on Eurosystem technical assumptions, for which the cut-off date is 6 February 2025 (see Table 1). They incorporate final HICP (Harmonised Index of Consumer Prices) inflation figures for January, published on 18 February 2025, as well as the detailed figures for the fourth quarter 2024 national accounts published on 28 February 2025. In relation to our previous projections, fiscal assumptions have been adjusted to reflect changes to the budget for 2025, enacted on 14 February 2025.

The decline in inflation in 2025 should reflect the marked slowdown in services prices and the sharp drop in regulated electricity prices

In 2024, headline inflation (Harmonised Index) fell sharply to 2.3%, from 5.7% in 2023 (see Chart 3). This was attributable to smaller increases in prices of manufactured goods and food, whereas services inflation proved to be more persistent. According to INSEE's provisional estimate, headline inflation was 0.9% in February 2025, after 1.8% in January. The sharp drop in February mainly reflects the 15% cut in regulated electricity tariffs. In 2025, the decline in electricity prices and the slowdown in services prices – linked to lower wage growth – should contribute to a sharp fall in inflation, to an annual average of 1.3%. Inflation is expected to increase in 2026 and 2027, but remain below 2%. Inflation excluding energy and food should fall to 1.8% in 2025, down from 2.3% in 2024, before stabilising in 2026 and 2027. The contribution of services prices to inflation is expected to fall significantly in 2025, before remaining generally stable over the following two years (see Chart 4).

When compared to our previous projections, headline inflation in 2025 has been revised downwards by 0.3 percentage point. The sharp fall in services inflation since our December 2024 projections, in the wake of lower-than-expected wage increases, accounts for most of this revision. Moreover, the higher than previously expected decrease in regulated electricity tariffs has been more than offset by higher assumptions for oil, and particularly natural gas prices. In 2026 and 2027, our forecasts for headline inflation have only changed slightly, to 1.6% and 1.9% respectively, and the composition also remains virtually unchanged.

Nominal wages, while slowing further in 2025, should continue to rise faster than prices

The average per capita wage has continued to rise faster than prices since the second quarter of 2024 (growth of 2.2% year-on-year in the last quarter of 2024 in market sectors, compared with 1.7% for consumer prices – see Chart 5), and this trend is expected to continue over the entire projection horizon. Compared to our December projections, the latest information available on negotiated wages at industry and firm level (which shows an average expected increase of around 2% in the base wage in 2025, i.e. excluding composition effects and bonuses) has led us to revise annual average per capita wage growth down by 0.4 percentage point for 2025, to 2.4%. However, the sharper than previously anticipated drop in inflation in 2025 (a 0.3 percentage point fall) means that the forecast increase in real wages remains virtually unchanged for the same year (1.2% growth in the purchasing power of wages). Average wages should continue to rise by more than prices in 2026 and 2027.

Moreover, employment and unemployment forecasts have been revised by very little compared to our December projection (see Chart 6). In particular, in 2025, the upward revision to public sector employment should offset the negative effect of lower activity on private sector employment, and the latter is expected to begin rising again in 2027. As forecast in December, the unemployment rate is expected to peak at an annual average of 7.8% in 2025 Moreover, employment and unemployment forecasts have been revised by very little compared to our December projection (see Chart 6). In particular, in 2025, the upward revision to public sector employment should offset the negative effect of lower activity on private sector employment, and the latter is expected to begin rising again in 2027. As forecast in December, the unemployment rate is expected to peak at an annual average of 7.8% in 2025 and 2026, before dropping back to 7.4% in 2027. Within the market sector, the real wage bill is therefore expected to grow by an additional 0.6% in 2025, following an increase of 0.8% in 2024.

A slowdown in activity in 2025, before a rebound in 2026

Based on the estimate derived from our business survey at the beginning of March, GDP growth in the first quarter of 2025 is likely to range between 0.1% and 0.2%, which is slightly lower than forecast in December. In addition, the new technical assumptions are generally less favourable, with global demand revised downwards compared with December, and energy prices revised upwards. Consequently, we have lowered our growth forecast for 2025 to 0.7%, compared with 0.9% previously (see Chart 1). The main downward revision concerns exports, which are expected to be impacted by uncertainty over trade barriers and less buoyant global demand than forecast in December. Growth in 2025 should continue to be driven by private consumption, which has been revised slightly upwards as a result of a carry-over effect and a fiscal adjustment that should weigh less heavily on household incomes. However, these positive impacts are expected to be partly offset by the current wait-and-see attitudes regarding the domestic political and fiscal situation. From 2026 onwards, despite being revised downwards slightly, the recovery in business investment should help to boost GDP growth (see Chart 2). The GDP growth forecast has been revised down marginally for 2026, to 1.2% (from 1.3% in the December projection), as a result of less favourable international assumptions. For 2027, the forecast remains unchanged at 1.3%.

Box

In our December 2024 projections, we presented a qualitative analysis of the threat of trade tensions and the potential impact on growth and inflation in France. While there is still a great deal of uncertainty surrounding the measures that will actually be introduced, making accurate quantification a difficult task, the various announcements by the Trump administration now make it possible to make rough estimates of quantified impacts.

The international scenario underlying the Eurosystem forecasts, on which our macroeconomic projections for France are based, factors in a 10 percentage point increase in US tariffs on imports from China, as well as measures taken by China in response. However, these shocks would only have a small impact on France. Our projections also take into account the uncertainty created by the other potential tariff measures referred to by the Trump administration. We estimate the impact of this increased uncertainty on French GDP growth at -0.1% for 2025.

Among the risks not yet included in our central scenario, but whose probability has increased over the recent period, is the temporary or permanent 25 percentage point increase in US customs duties on imports from the European Union (EU). This increase would raise the price of our exports for American buyers and have a direct impact on the volume of goods exported from the EU to the United States, and therefore on growth in European countries, including France.

For illustrative purposes only and to present an order of magnitude, we estimate, using the ECB-global multi-country model (see Georgiadis (G.), Hildebrand (S.), Ricci (M.), Schumann (B.) and van Roye (B.) (2021), « ECB-Global 2.0: A global macroeconomic model with dominant-currency pricing, tariffs and trade diversion », Working Paper Series, No. 2530, European Central Bank, March.), that the impact of such an increase of 25 percentage points would crystallize within a few quarters, and reduce euro area GDP by around -0.3% within between one and two years. This includes the direct impact of the tariffs on European exports as well as the indirect effects via a US and a global economic slowdown. Indeed, US monetary policy is very likely to be tightened to limit the inflationary fallout from tariffs. The slowdown in the US economy together with potential increases in risk premiums could spread to the rest of the world, accentuating the direct impact of higher tariffs.

The impact on European inflation and GDP would depend on the reaction of the euro/dollar exchange rate as well as on any European response:

- Any appreciation of the US dollar against the euro would increase the price of imports;

- Any European response would have an inflationary effect of varying intensity, depending on whether or not it was targeted at highly substitutable products on which American exporters would be likely to squeeze their margins. This inflationary impact would erode household purchasing power and weigh on GDP;

- Moreover, other factors could push down European inflation. For example, a greater shift in Chinese exports to the European market than forecast under the central scenario would have a negative effect on European inflation and growth.

All in all, risks to inflation appear to be relatively double-edged and probably not very significant.

The impact on the French economy would be qualitatively similar but quantitatively smaller. Indeed, the exposure of French goods exports to the US market (1.7% of French GDP) is around 40% lower than that of the EU as a whole (2.8% of EU GDP). In any case, the impact of an increase in customs duties on the French and European economies remains highly uncertain as it will depend on the timing, scope and scale of the measures introduced.

Appendix

Download the full publication

Updated on the 13th of March 2025