- Home

- Publications et statistiques

- Publications

- Interim macroeconomic projections –Septe...

In order to contribute to the national and European economic debate, each quarter, the Banque de France publishes macroeconomic forecasts for France, prepared within the scope of the Eurosystem projection exercise and covering the current year and two forthcoming years. Some of the publications also include an in-depth analysis of the results, along with focus articles on topics of interest.

As of March 2024, the March and September interim projections will be published in a shortened format, as these exercises are now updates of the previous quarter's projections for the main economic variables. The June and December projections will continue to be published in their current format.

Introduction

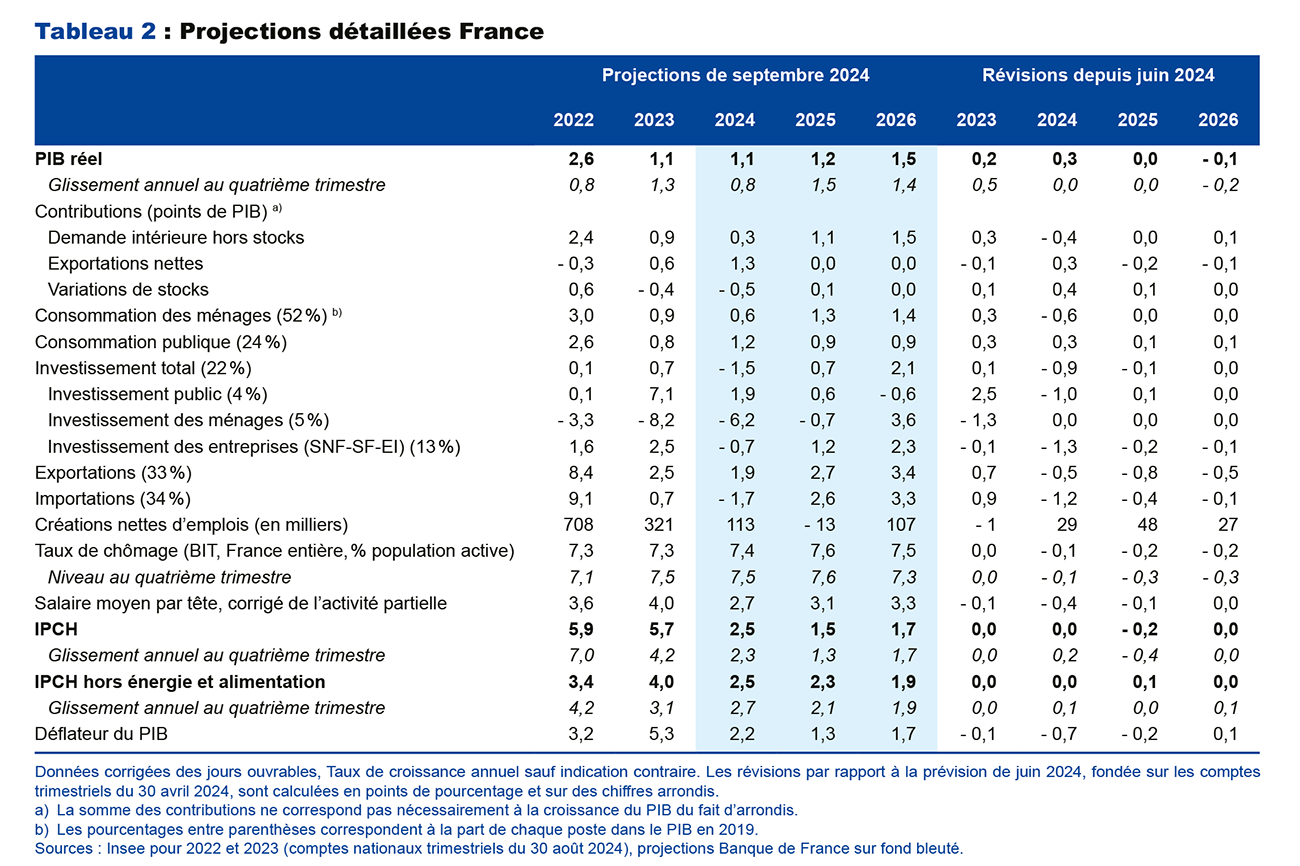

- These interim projections are based on the usual assumption of an unchanged economic policy in the current political context. They confirm the decline in headline and core inflation that we forecast in our previous projections. HICP inflation is expected to fall significantly from 5.7% in 2023 to 2.5% in 2024, and 1.5% in 2025 – mainly due to the announced drop in electricity prices – and to remain low at 1.7% in 2026. After a temporary interruption in the second half of 2024, services inflation should continue to ease, allowing core inflation to drop to 1.9% in 2026.

- As a result of this disinflation, wages are now rising faster than consumer prices, a trend that could intensify in 2025. This increase in real wages should sustain gains in purchasing power and then consumption next year. The unemployment rate is expected to rise slightly in 2025, before resuming its downward trend thanks to the recovery in activity, to stand at 7.3% at the end of 2026.

- When compared with June, INSEE's revisions to the quarterly national accounts for 2023 and early 2024 mechanically increase forecast average annual growth for 2024 (from 0.8% to 1.1%). In the second half of the year, the adverse effect of increased uncertainty should be temporarily offset by the favourable effect of the Olympic Games. Looking beyond 2024, while forecast growth remains unchanged for 2025 (at 1.2%), it has been revised downwards slightly for 2026 (to 1.5%).

- This projection is subject to a large degree of uncertainty. First, the current political uncertainty in France represents a risk to the assumptions relating to public finances and to the impact of the wait-and-see tendancy among businesses and households. Second, this uncertainty is compounded by geopolitical risks (war in Ukraine, the situation in the Middle East, trade tensions, etc.) and their effects on commodity prices and international trade.

These projections are based on Eurosystem technical assumptions, for which the cut-off date is 16 August 2024 (see Table 1). They incorporate the HICP (Harmonised Index of Consumer Prices) inflation figures for July published on 14 August, as well as the second quarter 2024 national account figures published on 30 August 2024, and the data from the Banque de France's monthly business survey for the beginning of September. Our standard fiscal assumptions remain unchanged in relation to those used in our June projections, with a primary structural adjustment of 0.6% of GDP in 2025 and 2026.

Inflation continues to fall as expected and this trend should be amplified in 2025 by the decrease in electricity prices

HICP inflation continues to decline, from 4.2% in the final quarter of 2023, to 2.5% in the second quarter of 2024 (see Chart 3). It stood at 2.7% in July 2024 and 2.2% in August. This decrease was helped by lower food and manufactured goods inflation, which stood at 1.4% and 0.5%, respectively, in July 2024. However, the vulnerability of trade supplies due to geopolitical instability in the Red Sea could drive a slight rise in inflation in these two components in the second half of 2024. Energy prices should be affected by the announced 15% drop in regulated electricity prices in February 2025. Services inflation, which stood at 3.1% in July 2024, has begun to come down and, after a temporary interruption in the second half of 2024, should continue to trend downwards until the end of the projection horizon (see Chart 4).

The inflation forecast for 2024 remains unchanged at 2.5%: the unexpected downward trend of recent months in services and food inflation has been offset by the upward trend in manufactured goods inflation, driven mainly by buoyant pharmaceutical prices. Our inflation forecast for 2025 has been revised downwards to 1.5%, due to the announced cut in electricity prices, partly offset by an upward revision in manufactured goods inflation, also linked to the situation in the Red Sea. The inflation forecast for 2026 remains unchanged at 1.7% and its composition also remains largely unchanged.

Nominal wages are now more buoyant than prices

Per capita wages are now rising faster than prices (by 2.7% year-on-year in the second quarter of 2024 in the market sector, compared with 2.5% for prices), a trend that should continue (see Chart 5). However, they posted a more pronounced slowdown in the first half of 2024 than in our June projections, leading us to revise their average growth in 2024 downwards by 0.4 percentage points.

Moreover, employment should be more dynamic and unemployment lower than in our previous projections (see Chart 6). The partial recovery of past productivity losses is expected to be smaller as these losses are more limited in the 2020 benchmark revision of the national accounts. This upward revision in employment offsets the unexpected downward trend in wages, so that our forecast for the real wage bill over the 2024-2026 period has barely been revised compared with the June projection.

Aside from favourable revisions to past data, growth is expected to strengthen only moderately

Based on the Banque de France's most recent business survey at the beginning of September, GDP growth should be temporarily higher in the third quarter, reflecting underlying growth of between 0.1% and 0.2%, undermined by the current context of uncertainty, plus a positive impact of around 0.25 percentage point attributable to the Paris Olympic and Paralympic Games. This should be followed by a corresponding downward movement that would reduce growth in the fourth quarter. In 2024, growth should average 1.1%, driven chiefly by foreign trade, but held back by destocking, mainly due to the easing of supply difficulties. Consumption is expected to remain sluggish, despite gains in the purchasing power of wages. In 2025, GDP should continue to grow at a similar annual average rate, however household consumption should take over as the main driver; gains in purchasing power should be sustained more by real wages and progressively less of these gains should be saved. In 2026, growth should be bolstered by the recovery in private investment as a result of past easing of interest rates (see Chart 2).

The newly-published quarterly accounts, incorporating the 2020 benchmark revision, mechanically result in higher average annual growth in 2024. However, because the revisions are concentrated around the turn of 2024, year-on-year GDP growth at the end of 2024 remains unchanged at 0.8%, and has come down from 1.3% at the end of 2023 (see Chart 1). For 2025 and 2026, revisions to international assumptions are limited and partially cancel each other out and therefore have no major repercussions. However, exports are likely to be temporarily dragged down until the first half of 2025 by the poor wheat harvests in the summer of 2024. Market shares that have been revised upwards for past periods would also require a smaller catch-up in 2026, leading us to revise export and GDP growth downwards for that year.

Download the PDF version of this document

Updated on the 18th of September 2024