This paper examines the impact of insolvency framework reforms on non-performing loans (NPLs), extending prior research by considering both creditor and debtor factors. Using a new metric derived from the European Banking Authority's Transparency Exercises, we focus on the insolvency regime of the debtor's country in cross-border insolvencies. For this purpose, we use detailed data on loans granted by banks in domestic and foreign countries, indicating how NPL ratios vary depending on the debtor countries, for a given creditor bank.

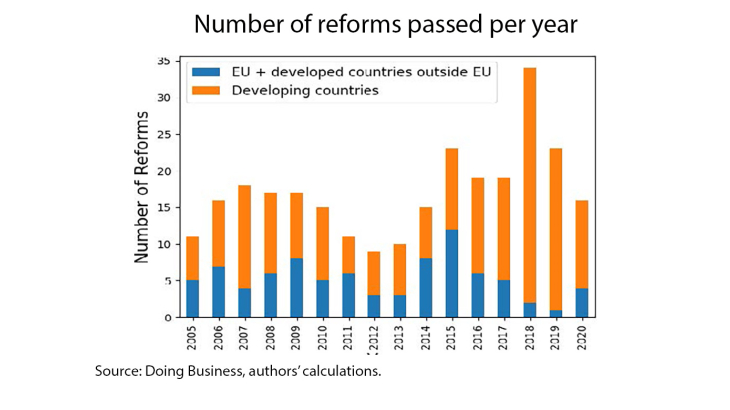

The impact of insolvency regimes is analysed through reforms in that field and their impacts on NPL values and dynamics. We take advantage of waves of insolvency reforms, as shown in Figure 1. Furthermore, we contribute to the creditor vs. debtor-friendly insolvency regime debate by analyzing reforms according to their orientation.

Following the NPL determinant literature, our analysis incorporates macroeconomic, institutional and bank-specific factors to consider these effects and isolate the impact of insolvency reforms. For macroeconomic variables, we consider GDP growth, the inflation rate, and the unemployment rate. Thanks to the granularity of our dependent variable data, we are also able to control for time-varying factors associated with both the bank and its origin country.

We show that insolvency regime reforms are efficient at speeding up the resolution of NPLs, especially during financial distress. This effect is particularly true for big firms and big banks, in a debtor country with an already high NPL level. This result is driven by debtor-oriented reforms, more precisely reforms that aim to facilitate business continuity. Our findings also reveal that such reforms are more efficient in countries with a non-debtor- and creditor-friendly insolvency regime. Conversely, we find that creditor-oriented reforms present a perverse effect, as they are associated with higher NPL levels.

Keywords: Non-Performing Loans, Insolvency Regime, Transparency Exercise, Reform, Banking Sector

JEL classification: G15, G21, G33