- Home

- Publications et statistiques

- Publications

- An identifier to characterize groups’ gl...

Post n°201. The descriptive data associated with large enterprise identifiers (LEIs) provide up-to-date information on groups’ ownership structure, as well as on the legal form and location of their operations, including those in off-shore financial centres (OFCs). Extending the obligation to have an LEI would thus help to make global financial transactions more transparent.

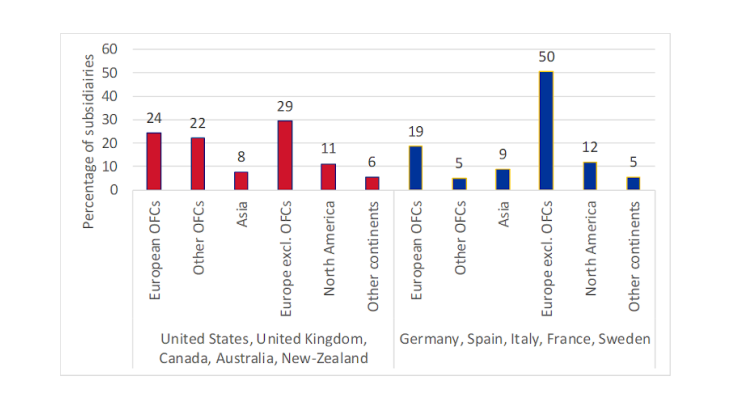

Note: 22% of the subsidiaries of companies registered in the United States, the United Kingdom, Canada, Australia and New Zealand are located in non-European OFCs.

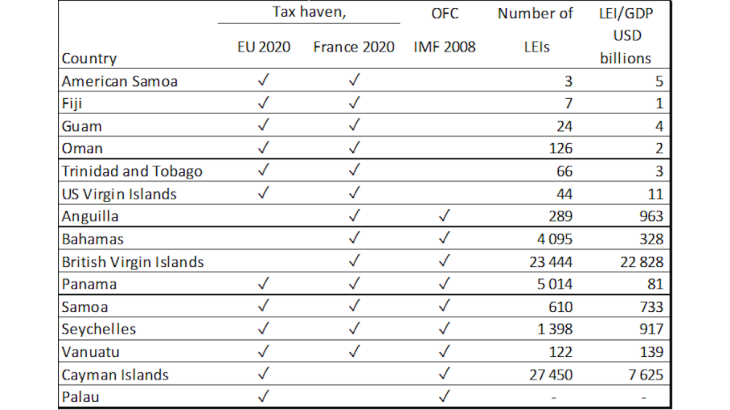

OFCs are defined as countries or jurisdictions that provide financial services to non-residents on a scale that is incommensurate with the size and the financing of their domestic economy. Only a portion of them are considered to be tax havens, that is countries that offer a high degree of financial secrecy and thereby facilitate tax evasion and the financing of illicit activities. The lists depend on the purpose for which they are used. France and the European Union publish a blacklist of tax heavens that are non-cooperative for tax purposes. The IMF last published a list of OFCs in 2008, as part of an initiative launched in 2000 to increase transparency and international tax cooperation.

For international groups, there are numerous advantages to carrying out financial transactions in OFCs. As a result, many of these centres have become major financial hubs and need to be monitored closely by authorities in order to safeguard global financial stability. The dissemination of LEIs in OFCs facilitates this surveillance, as the database provides up-to-date information on entities located there that are parties to financial transactions.

LEIs provide up-to-date information on groups’ ownership structure

An LEI is a 20-character alphanumeric code that is used to identify financial and non-financial legal entities. The Global LEI System (GLEIS) is tasked with the governance, attribution and publication of LEIs. It was set up by the G20 following the collapse of Lehman Brothers, with the aim of making it easier to identify counterparties in financial transactions. Compared with national identifiers, LEIs have the advantage of being unique global identifiers, written in Roman alphabet, and containing information that is updated on an annual basis (name, address, legal form). In addition, among the descriptive data submitted when applying for or renewing an LEI, entities are required to provide the LEIs of their direct accounting consolidating parent as well as their ultimate accounting consolidating parent. In cases where these parents are not physical persons and there is a majority shareholder required to publish consolidated accounts, the LEI makes it possible to trace the group’s entire ownership structure and locate its different subsidiaries, including those in OFCs. It is thus possible to distinguish intragroup financial transactions from other transactions transiting via these international financial hubs.

Although OFCs do not themselves require resident entities to have an LEI, the codes may be compulsory under the regulations applicable in other jurisdictions. For example, since 2018, the European regulation on markets and financial instruments (MiFIR) has required companies to have an LEI in order to issue, purchase or sell financial products on a European trading platform. Entities located in OFCs, even outside Europe, are hence obliged to have an LEI if they want to carry out transactions in financial products in Europe. Between end-2016 and end-2018, the number of up-to-date LEIs in OFCs rose by 333% compared with an increase of 160% for all LEIs.

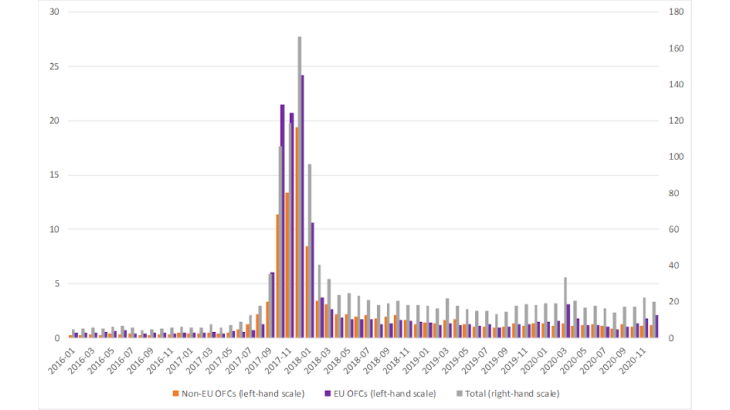

Chart 2 shows the impact that the implementation of MiFIR had on requests for LEIs, including in non-EU OFCs. At end-December 2020, there were more than 1.7 million LEIs in existence, of which 20% were registered in an OFC.

Note: In December 2017, 167,000 new LEIs were issued globally, of which 19,000 were in non-EU OFCs, and 24,000 in EU OFCs.

The same applies for companies located in tax havens. The GLEIS database can thus help to support efforts by states and international organisations to combat tax erosion. The British Virgin Islands, which are on the French blacklist, and the Cayman Islands, which are on the European list, are now among the top three countries in terms of the number of LEIs per billion dollars of GDP (Table 1). LEIs also provide additional transparency by specifying the legal form of entities registered in those locations. For example, the Cayman Islands has entities identified as “exempted companies” and as “non-resident ordinary companies”, which enjoy specific legal and tax benefits.

However, progress still needs to be made to ensure more groups are described adequately. First, the use of LEIs needs to be extended among non-financial groups, which are currently not subject to the same regulatory requirements as financial groups. Action also needs to be taken to ensure entities effectively renew their LEI every year: there is currently no obligation to do so, including under MiFIR, and some 30% of LEIs are not renewed annually, which impacts the quality of the data. Last, improvements need to be made to the reporting of parent linkages, which are currently only declared for 7% of entities, by specifying what information is required when accounting consolidation does not apply.

LEIs shed light on groups’ global expansion strategies

Although its scope could be extended, the information already available in the GLEIS database allows us to map groups’ overseas operations and determine the role played by OFCs in their global expansion strategies. To better appreciate how international groups use OFCs, we examined the parent linkages reported in the March 2019 LEI database, looking only at LEIs updated within the last year.

Companies domiciled in Anglo-Saxon countries have a higher proportion of foreign subsidiaries in OFCs than European companies (Chart 1), be they in European OFCs (24% compared with 19%) or in extra-European OFCs (22% compared with 5%). There is a clear geographical specialisation: 66% of OFC-located entities that have their headquarters in the United States are in the Cayman Islands, which is defined as a tax haven by the European Union, while 19% are located in Ireland and Luxembourg. Of the 1,150 legal entities established in OFCs that declare their parent company is in France, 44% are located in Luxembourg and 14% in Asia or the Middle East. Due to the over-representation of financial entities in the LEI database, 64% of these 1,150 entities report having a parent company that carries out a financial activity. 22% report carrying out a specialised activity (legal or accounting consultancy), which is even more notable.

The positioning of OFC-located entities within their respective group also shows that OFCs tend to have a specialisation. An ultimate parent is defined as an entity that has subsidiaries but is not consolidated, a “conduit” is defined as an entity that is both consolidated and consolidating, and an “ultimate child” as an entity that is consolidated but not consolidating.

Lebanon, Lichtenstein, Bermuda and the Bahamas have a high proportion of ultimate parents (Chart 3). By contrast, the Netherlands and Singapore are specialised in conduits, which account for 30% or more of their LEIs. Last, OFCs with a strong asset management sector, such as Luxembourg, have more ultimate child companies.

Note: 20% of LEIs in Lebanon (LB) are ultimate child entities, 20% are conduits and hence 60% are ultimate parents.

AE United Arab Emirates; BB Barbados; BM Bermuda; BS Bahamas; CH Switzerland; CY Cyprus; GG Guernsey; GI Gibraltar; HK Hong Kong; IE Ireland; JE Jersey; KY Cayman Islands; LB Lebanon; LI Liechtenstein; LU Luxembourg; MC Monaco; MH Marshall Islands; MT Malta; MU Mauritius; MY Malaysia; NL Netherlands; PA Panama; SG Singapore; VG British Virgin Islands.

Updated on the 25th of July 2024