- Home

- Publications et statistiques

- Publications

- How many banknotes are circulating in Fr...

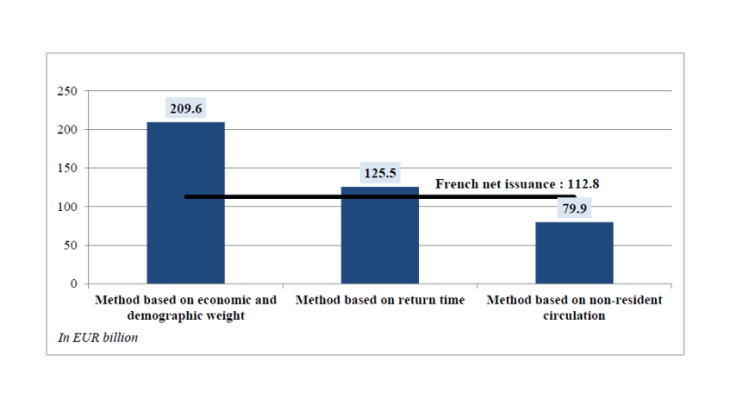

Post n°71. Within a monetary area, the quantity of banknotes circulating in a given Member State is unknown as banknotes move back and forth across borders and cannot be tracked. There are various estimates but these have the drawback of varying by up to a factor of three. But the issuance of the new series of euro banknotes, combined with surveys, enable these figures to be more specific. Only 10% of the banknotes issued in France are apparently used for transaction purposes in the country.

Source: BdF, based on Eurosystem’s Currency Information System data

Measuring the quantity of banknotes in circulation in France is important for several reasons: to assess national needs as accurately as possible when banknotes are replaced, to better understand and manage changes in the quality of the banknotes in circulation, and to gain greater knowledge of cash use and cash use trends over time.

Traditional methods of calculation have considerable limitations

The first method of calculating banknote circulation is based on the country’s share of the euro area’s total population and gross domestic product, with each factor given an equal weighting. The main drawback of this method is that it assumes that banknotes are used identically throughout the euro area, whereas in fact payment habits vary from country to country (Esselink and Hernandez, 2017). Compared with its European neighbours, France uses less cash and more cards when making payments. Another disadvantage is that, according to the ECB’s estimates, a third of euro banknotes in circulation are held outside the euro area.

The second method uses the average return time of banknotes in the euro area, i.e. the average length of time between the issuance of a euro banknote and its lodgement with a central bank. This “circulation time” of a banknote (in months) multiplied by the volume of banknotes returned to the Banque de France enables the number of banknotes in circulation in France to be estimated.

As with the first method, this calculation is misleading as it includes banknotes held outside the euro area, a factor which lengthens the estimated return times as these banknotes rarely return to the central bank. This method therefore tends to overestimate circulation in a given country.

It also assumes that return times are the same in all euro area countries, which is not the case. For example, the extent to which recirculation of banknotes by private cash handlers has developed in a given country also affects return times.

These two methods result in the highest estimates (EUR 210 billion and EUR 125 billion respectively in 2015), which are apparently overestimates as they take into account euro banknotes in circulation outside the euro area. Note that household final consumption expenditure amounted to EUR 1,143 billion in 2015.

Replacement of euro banknotes enables better estimates

Since 2013, the Eurosystem has been gradually replacing the banknotes issued since 2002 with a new series of banknotes with enhanced security features. The replacement has made it possible to refine these estimates.

It is therefore possible to identify the moment when the new series replaced the existing banknotes. As this happened quite rapidly, the volume of new banknotes issued provides a rough idea of national circulation, without the excessive distortion caused by cross-border migrations of banknotes. As from the substitution date for each denomination, the trend in the quantity of money in circulation is recalculated based on the pace of growth in household final consumption expenditure. The results provided by this method seem robust at the substitution date. But, beyond this date, the assumption of growth in circulation in line with growth in household expenditure does not take more structural factors into account, such as growing use of cashless payments.

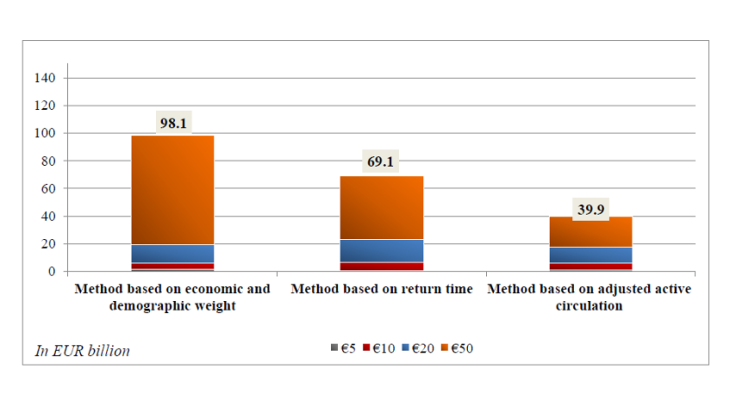

Another method estimates “active” circulation across Europe, i.e. banknotes used for transaction purposes, by applying the European return time of the €10 banknote to €5 to €50 notes. The €10 denomination is used as it is the banknote most typically used for transaction purposes and is less likely to be hoarded. The circulation thus estimated at the euro area level is then broken down by country according to the weight of each country in the euro area’s population and GDP. Lastly, an adjustment is made to reflect national preferences with regard to use of denominations (see Chart 2).

These various methods give intermediate results and, above all, are limited to denominations of €5 to €50, which are the only ones to have been replaced by the new series to date. Moreover, they will have little relevance for banknotes with high face values, which are frequently hoarded.

Source: BdF

Note: the results of the first two methods are limited to denominations of €5 to €50 in order to make them comparable. The method based on series replacement is not included as the issuance date of the €50 banknote is still too recent.

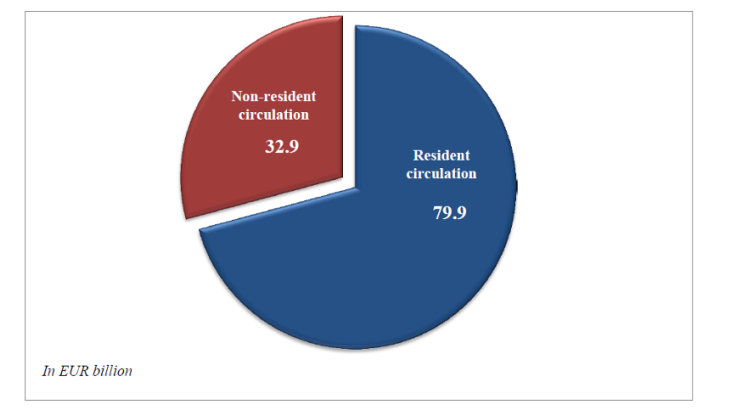

The contribution made by approaches based on direct measurement of cash

The first of these approaches is based on the difference between net national issuance (EUR 113 billion at end-2015) and non-resident circulation. French net issuance corresponds to the difference between the total value of banknotes issued by the Banque de France and the total returned to it since 2002. The demand for banknotes outside the euro area (banks and currency exchange offices) is derived from the balance of payments and international investment position data: this gives an amount for non-resident holding of cash (EUR 33 billion). By subtraction, we can deduce the share of French net issuance held in France by residents (EUR 80 billion) (see Chart 3).

This is a minimum, however, as the balance of payment data does not include the other channels for outflows of banknotes, such as tourism, migrant workers’ remittances and the ‘non-observed economy’. The migration of banknotes linked to tourism is or seems significant: at the end of 2015, €20 banknotes represented 62.5% of French net issuance in volume versus only 4.4% of Eurosystem net issuance excluding France. These figures suggest that France is a net exporter of €20 banknotes within the euro area, even though this denomination is more frequently used in France than elsewhere.

Source: BdF, based on balance of payments and international investment position data

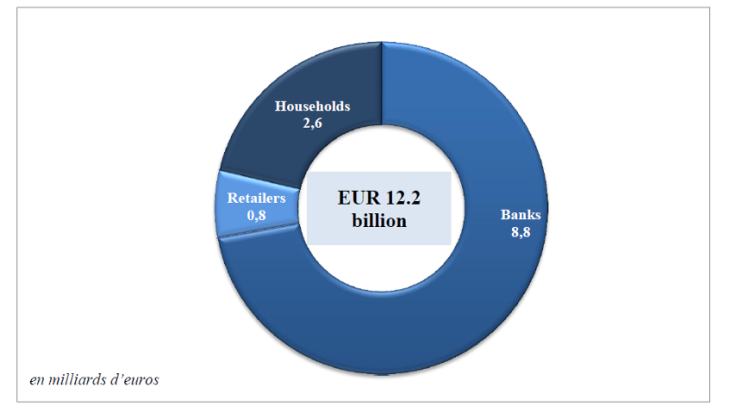

A second approach is based on qualitative interviews with representatives of the French cash cycle (banks, cash-in-transit companies, retailers). It directly measures the transactional cash held by economic agents. All in all, it estimates the stock of cash held for transactional purposes in France at EUR 12.2 billion in 2015, breaking down as follows (see Chart 4):

- EUR 8.8 billion in bank safe deposits and with cash-in-transit companies;

- EUR 2.6 billion held in wallets by households;

- EUR 0.8 billion held by retailers.

This result, which corresponds to around 10% of national net issuance, is consistent with the results of comparable European studies, for example in Germany (Bartzsch and Uhl, 2017).

Source: BdF, based on qualitative data obtained from interviews

Comparison of the results obtained by the various methods used to assess the quantity of banknotes in circulation reveals substantial differences. Moreover, with a transactional cash floor that represents only 10% of French net issuance, a substantial ‘residue’ remains unexplained: 90% of French net issuance is apparently hoarded or held abroad. The main challenge now is to assess hoarding and non-resident holding of banknotes, which would explain why the methods produce such widely differing results.

Updated on the 25th of July 2024