Post n°319. The impact of higher inflation varies across insurance categories. Insurers are facing an erosion in the value of non-inflation indexed assets and of their real returns, some of which is associated with an increase in liabilities . However, they have different levers at their disposal to adapt to this environment and meet their commitments towards policyholders.

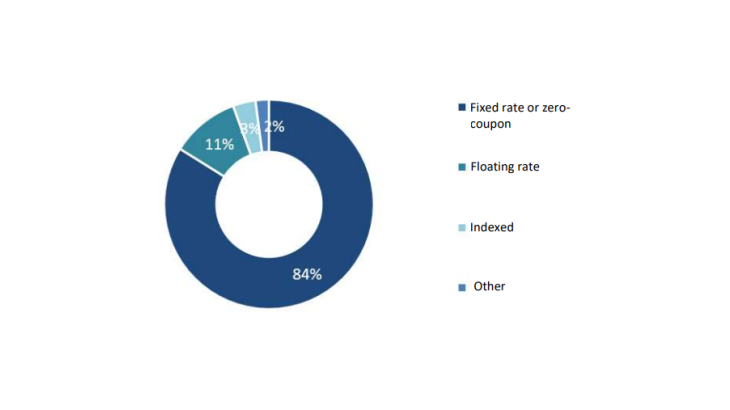

Source: ACPR - List of assets inS.06.02 template from Annual Solvency II Reporting at 31/12/2022

Note: Calculations are based on all bonds, including those held through investment funds.

In 2022, the harmonised index of consumer prices rose by 5.9% year-on-year, with a steady accumulation of increases over the year as a whole, whereas since 1997, inflation in France has been above 2% only occasionally and very moderately. According to the Banque de France macroeconomic projections, inflation will return towards 2% by 2025.

Non-life insurance is particularly exposed to inflation

As is often the case in insurance, very different effects across insurance categories (savings/pension, personal insurance, liability insurance, fire, accident and miscellaneous risks, etc.) are to be expected. In life insurance, annuities and capital are not generally indexed to inflation. In non-life and liability insurance, the events underlying current inflation have heightened the pressure already present on certain expense items for several years: disruption of supply and production chains, unavailability of certain repair parts, scarcity of materials (metals, wood, etc.), rising labour costs and expert fees. However, changes in the components of claims costs (building materials, car parts, health costs, etc.) vary widely. It is therefore difficult to draw up a general picture of the situation.

This drift in the cost of claims is in some cases compounded by a rise in the number of claims, especially in the area of climate loss ratios, as in 2022. Efforts to reduce the cost of claims (prevention, recycling of spare parts, regulated rates or rates negotiated with professional networks, etc.) and control expenses (whether through internal or external solutions) will therefore be decisive in enabling non-life insurers to limit future premium increases.

The impact could be more marked in business lines with long-term guarantees

The risk of a mismatch between a premium calculated on the basis of insufficient inflation expectations and the actual increase in claims costs is all the greater when settlement dates are staggered over time. Indeed, for a given level of inflation, the effect on the average cost of claims is amplified for contracts that give rise to a settlement several years after the latter has been underwritten. Inflation is therefore above all a challenge for non-life insurers operating in business lines with long-term guarantees, where inflation can weigh over several years on premiums that cannot be reviewed and adjusted.

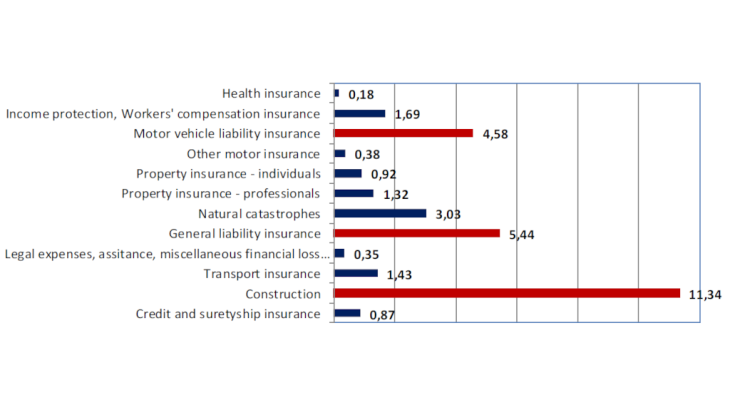

The ratio of the amount of technical provisions set aside to cover all incurred and unpaid claims (provisions for claims outstanding - PCO) to the amount of premiums received each year is an indicator of the length of commitments undertaken by insurers (Chart 2). It shows that liability insurance has the longest settlement times. This is particularly true of ten-year construction liability insurance, motor liability insurance and liability cover for professionals (general or professional liability).

Source: ACPR - Summary tables of income composition in FR.13.02 and FR.13.03 templates from of the Specific National Reports

Inflation affects the real return on assets in different ways

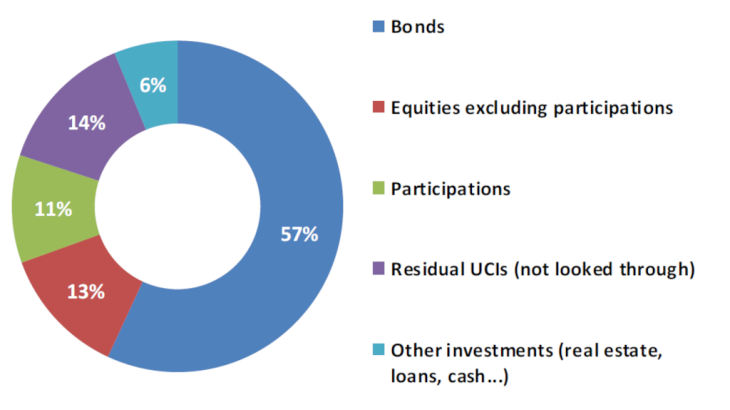

Rising inflation also has an impact on insurers' investments. Insurers invest the premiums paid by policyholders in a wide range of financial assets: bonds of various kinds, equities, units of collective investment undertakings (CIUs), unlisted securities, real estate, cash. The portfolios are structured so that the inflows received from assets (dividends, coupons, rents, bond redemptions, securities resales) adapt as much as possible, in terms of duration and amount, to the outflows generated by the guarantees offered. While some benefits payable are inflation-sensitive, the returns on most financial assets do not adjust mechanically to inflation.

At the end of 2022, bonds accounted for 57% of the value of French insurers' investments (after applying the look-through approach to assets in collective investment schemes). Shares accounted for 24%, including 11% of intra-group holdings (Chart 3).

Source: ACPR - List of assets in S.06.02 template from Annual Solvency II Reporting at 31/12/2022

Note: After applying the look-through approach to collective investment undertakings (CIUs)

Inflation has a negative effect on assets with a fixed rate of return, such as fixed coupon bonds whose income does not adjust to inflation. There are two options for protecting bond investments from inflation. The first consists in purchasing variable-rate bonds where the coupon is indexed to a fluctuating rate, usually short-term. With this type of bond, it is possible to collect higher coupons when rates rise, which is generally the case during periods of inflation. The second option is to hold inflation-linked bonds where the coupon and principal adjust directly to price changes. However, inflation-linked bonds are supplied by a limited number of issuers that are able to withstand an inflationary shock, i.e. mainly governments.

At the end of 2022, only 11% of the outstanding bonds held by French insurers were variable-rate bonds and only 3% were index-linked bonds. Zero-coupon and fixed-rate bonds accounted for 84% of their bond portfolio (Chart 1).

Indirect effects could arise from changes in policyholders’ behaviour

Beyond the direct effects on non-life insurance described above, given the pressures on their margins, companies could choose to reduce their hedges.

In addition, in individual life insurance, changes in policyholders’ behaviour could expose insurers to:

- dissaving due to the rising cost of living;

- a move by policyholders towards other indexed or higher-yield products (such as bank savings accounts);

- switching between unit-linked contracts, where the risk is borne by policyholders, and euro-denominated contracts, where the insurers’ commitments are much greater, particularly in terms of revaluation.

In order to provide policyholders with incentives not to switch out of life insurance policies, insurers may, however, increase the premium paid by using the significant amount of profit-sharing reserves set aside in recent years.

While the inflationary shock is impacting underwriting and insurers’ profitability, insurers have various levers to adapt. In insurance, time scales remain long, which gives time to make changes to products and asset management with, for example, more inflation-indexed products and shorter portfolio durations.

Updated on the 25th of July 2024