High Voltage: Financing the Path to Zero Coal

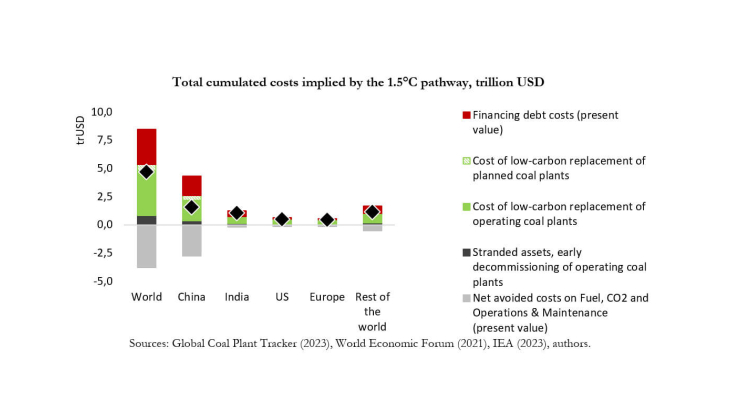

Working Paper Series no. 960. Keeping global warming under 1.5°C requires a complete phase-out of coal for electricity generation by 2040 according to the International Energy Agency’s Net Zero Emissions by 2050 (NZE) scenario. In this paper, we use unit-level data from the Global Coal Plant Tracker database to build a phase-out priority score and identify the coal-fired power plants that would need to be decommissioned now to comply with this pathway. We assume the other coal power plants continue to operate to the end of their lifetime. We show that 70% of the capacity of the operating coal fleet should be shut down now, which corresponds to stranded assets worth $842 billion globally. Replacing the coal capacities by equivalent low-carbon capacities would imply a much larger one-off cost of $4.5 trillion worldwide. This upfront investment would also imply large debt financing costs, estimated at $3.1 trillion globally, which would drive up the total cost to $8.4 trillion. But coal plants have much higher operational costs than low-carbon ones, in part because they need fuel to operate, and the cost of CO2 emissions need to be priced. We show that cumulated net operational gains linked to replacing coal plants with low-carbon alternative to comply with the 1.5°C would amount to $3.8 trillion worldwide, thus offsetting close to half of the total costs. By lowering financing costs and increasing carbon pricing in line with the International Energy Agency’s NZE scenario, the total equation could become positive, that is, total savings from the transition to clean energy would be higher than the total costs.