The hegemony of the dollar on the International Monetary System (IMS) has long been the subject of controversy, going back to Valéry Giscard d’Estaing denouncing the “privilège exorbitant” in the 1960s. Today, dollar dominance means that policy in dollar-dependent third countries is constrained by a Fed-driven global financial cycle. A hegemonic supplier of global safe assets might also be problematic for global financial stability, as growing demand for safe assets might outstrip the fiscal capacity of the United States, giving rise to a “New Triffin Dilemma”.

Some policy makers outside of the United States have long been arguing in favour of a transition to a more multipolar IMS (Villeroy de Galhau, 2022; Carney, 2019). More recently, the decision by the United States and its allies to freeze the reserves of the Russian central bank has spurred a new debate regarding the sustainability of dollar hegemony in the current geopolitical context.

Is a transition of the IMS out of dollar dominance on the cards? And what would such a transition look like?

The hegemony of the dollar has given rise to a Dominant Currency Paradigm (Gopinath et al., 2020), where network effects and strategic interactions give rise to a winner takes-all equilibrium in the IMS. However, looking at the history of global currencies, Eichengreen et al. (2017) have argued how a more multipolar IMS has been the norm in the past and could be sustained conditional on policy-cooperation.

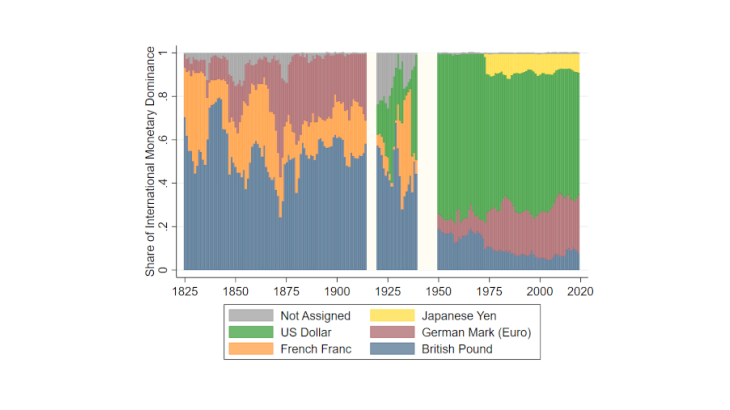

Adding to previous historical quantification of the IMS, Vicquéry (2022) provides a new continuous measurement of the relative importance of global currencies over two centuries. A simple algorithm, based on foreign-exchange co-movement models, is employed to compute an international monetary dominance weight for global currency candidates since 1825. This indicator, which builds on an original dataset spanning the London foreign exchange market at weekly frequency since the early 19th century, highlights the singularity of the hegemony of the dollar over two centuries (Chart 1).

The Dollar Differs Markedly from Past Hegemonic Experiences

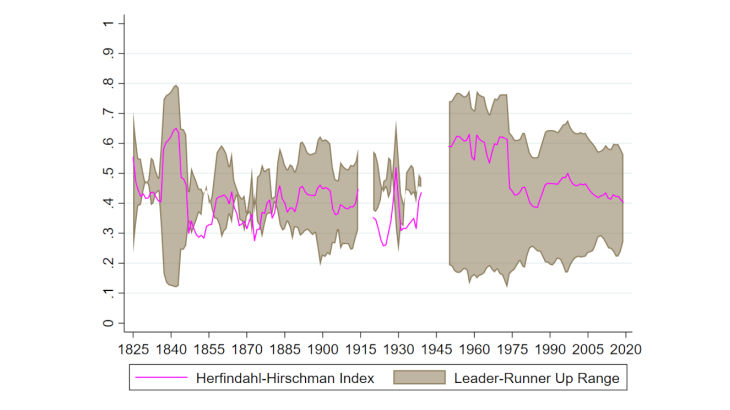

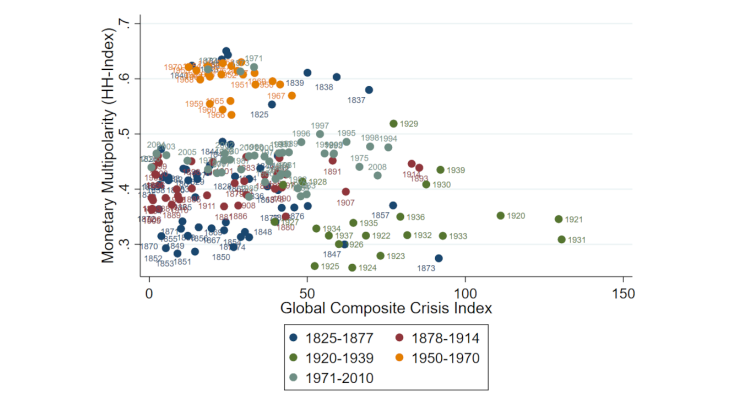

Based on the estimated weights, it is also possible to quantify the structure and competition intensity of the IMS over two centuries. A key takeaway results from this exercise: the extent, stability and persistence of dollar dominance since WW2 contrasts markedly with the experience of the IMS over the preceding 150 years. As shown in Chart 2, no global currency leader has been able to sustain such a large lead over its closest competitor for such a prolonged period.

The pound sterling can be characterised as a global currency hegemon over the 1825-1939 period. However, close competitors frequently challenged its leadership. Such challenges have been historically associated with episodes of regional monetary integration. It was the case with the rise of the French franc in the run up to the establishment of the Latin Union in the 1850s. It was the case twice for the German mark, from the late 1860s as the German unification was underway, and in the 1970s, when the end of Bretton Woods kick-started European monetary integration.

Looking at the interwar period, which is confirmed to be a two-century peak in global currency competition, the dollar briefly overtook the sterling a first time in the late 1920s and then again at the eve of WW2. The devaluation of the pound in 1931 also marks a - previously overlooked -important discontinuity, as the IMS experienced strong French franc dominance until 1936.

Thinking about the future of the IMS, the unprecedented character of dollar hegemony raises the question of a possible mean-reversion to the historical norm. One could speculate that unprecedented levels of hegemony could well translate into unprecedented levels of disruptions, if any discontinuity was to occur.

Of course, a more benign interpretation is equally possible. The persistence of dollar hegemony could be consistent with structural changes occurring in the last half a century, significantly strengthening the network effects of international monetary leadership compared to the experience of the pound sterling. A large lead of the dollar over its competitors might be in itself an indicator of future stability in its hegemonic status, looking at the model of global safe assets competition by Farhi and Maggiori (2018).