Post No. 401. According to US Treasury data, holdings of US debt securities by French residents have increased significantly over the past two years, but this figure is probably overestimated. Indeed, Banque de France data show that purchases have been much more moderate. That said, data on securities holdings are more reliable when measured from the perspective of the holding country.

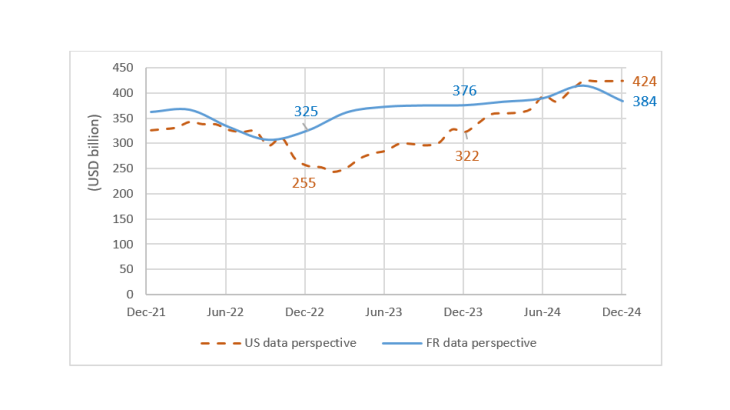

Chart 1: Holdings of US debt securities by French residents

Note: Securities at market value

According to some analyses widely reported in the public arena, holdings of US debt securities by French residents have increased sharply over the past two years. These analyses are based on holding data published by the US Treasury. The aim of this blog post is to explain why these holdings, when measured from the perspective of the issuing country (the United States), appear to be overestimated when compared to those measured by the Banque de France from the perspective of the holding country (France).

How do we measure securities holdings?

Financial securities (equities, bonds, and investment fund shares/units) can be managed either directly by the issuer (‘registered securities’), which then keeps track of the holders, or, more commonly, through intermediaries (bearer securities) to whom the management is delegated. These intermediaries play an essential role in ensuring the registration of securities, the execution of orders and the protection of the holders' rights, in particular by guaranteeing the payment of dividends and the exercise of voting rights.

These intermediaries include, first and foremost, the central securities depository, appointed by the issuer, which centralises information on securities ownership holdings and ensures that there is a constant balance between the issue of securities and their circulation. Then, custody account keepers (CACs, or more simply ‘custodians’) act as mandatory intermediaries for securities holders, which must use a securities account opened with one of these players. Custodians register their clients' securities with the central depository, either directly or indirectly via another custodian, thus forming a “custody chain”.

Securities holding statistics are generally compiled using data collected from custodians and supplemented by other sources: reporting by regulated entities in the financial sector (e.g. banks, insurance companies and investment funds) or administrative data (tax returns for France, for example).

When a resident of country X holds securities issued by an entity in country Y, this holding can be measured either from the perspective of holding country X (in which case it is referred to as "assets"), or from that of issuing country Y (in which case it is referred to as "liabilities").

Chart 2 illustrates a custody chain where the relationship between the issuer and the ultimate holder goes through a central depository and three custodians (in different countries).

As regards liabilities, the statistician of issuer country A, by contacting the central depository or, more generally, the first custodian ‘a’, will usually only be aware of custodian ‘b’ in country B, without being able to identify the ultimate holder in a third country C. The statistician in country A is generally unable to collect data from the custodians of the ultimate holders when they are abroad (for example, custodian ‘c’ in the chart). Ultimately, when statisticians in the issuer country try to provide details on liabilities, such as a breakdown by holder country, they can do so for the first non-resident custodians identified (such as possibly custodian ‘b’ in the example), but this can differ significantly from the actual breakdown by country of the ultimate holders.

Chart 2: Example of a custody chain

This limitation is the main weakness of holding statistics derived from liabilities. Other difficulties related to the quality and availability of data must also be taken into account. In particular, custodians may struggle to differentiate between residence and nationality, for example, by assigning a holding to a parent company rather than its subsidiary. The distinction between legal and beneficial ownership can also make it difficult to correctly measure repurchase agreements and temporary transfers of securities. According to international standards for securities and balance of payments statistics, these temporary transactions do not involve a permanent change in ownership. This principle may be more or less difficult to apply depending on the custodians and the countries.

These limitations explain why, in terms of ownership, preference is generally given to asset statistics, which by their very nature identify the holder, even if such statistics also have their own limitations in terms of the securities held. More specifically, they may not include securities holdings managed by non-resident custodians. However, for financial sector holdings, whose outstandings are the highest, this shortcoming can be remedied by collecting data directly from financial intermediaries. Furthermore, for non-financial corporations, data from tax returns can be used to estimate holdings by non-resident custodians. Statistics on assets supplemented in this way are therefore much more reliable than those on liabilities. Their main limitation remains the measurement of offshore assets held by households, which are difficult to estimate and are the subject of much research, for example by the European Commission.

A concrete application: the increase in purchases of US debt securities by the French are overestimated in US liability data

Holdings of US debt securities illustrate the differences between the ‘assets’ and ‘liabilities’ approaches and the fragility of estimates of liabilities.

The US Treasury collects information from the financial sector and US securities custodians, which it then uses to publish data on financial securities holdings in general and US Treasury and debt securities holdings specifically (while clearly indicating the limitations of these statistics due to the fact that the ultimate holders are unknown). The breakdown by holder country shows a very sharp recent increase in holdings of US debt securities by French residents.

According to these US Treasury statistics, French holdings increased from USD 255 billion at the end of 2022, to USD 322 billion at the end of 2023, then to USD 424 billion at the end of 2024 (Chart 1). This rise can be attributed mainly to net purchases, which are expected to reach USD 200 billion in 2023 and 2024 (plus valuation effects).

However, we do not observe these amounts or trends in the French asset statistics in the United States compiled by the Banque de France. According to the Bank, between end-2022 and end-2024, outstandings increased from USD 325 billion (EUR 305 billion) to USD 384 billion (EUR 370 billion); mainly due to net inflows of USD 61 billion (or EUR 56 billion) since end-2022.

The same differences can be observed for US Treasury securities alone, with net purchases since end-2022 of USD 187 billion according to US data, compared with only USD 54 billion according to French statistics.

Compared with the US Treasury's liabilities data, the sources of uncertainty in French assets data are, however, much less significant and should therefore be favoured when measuring French residents' holdings

When the comparison is extended to other European countries, similar discrepancies appear.

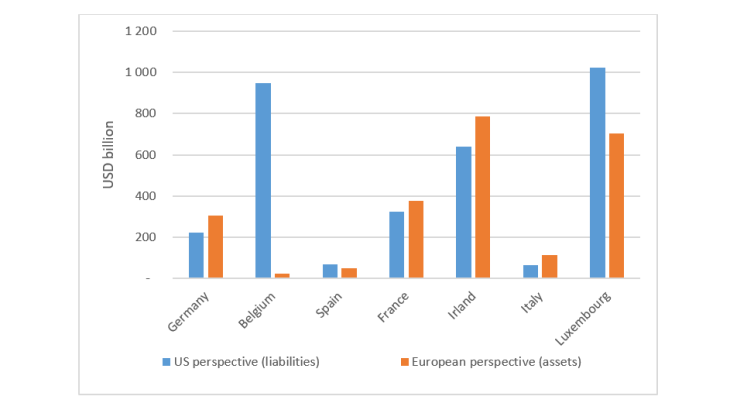

Chart 3: Comparison of US debt securities holdings: from the US perspective (liabilities) and from the euro area holder countries' perspective (assets)

These discrepancies between the European statistics on assets and the US statistics on liabilities are significant, particularly for Belgium and Luxembourg. Given the weight of the financial sector in these two countries, they are mainly explained by US custodians’ difficulty in identifying the ultimate securities holders: they can only identify the first link in the custody chain, such as Euroclear in Belgium and Clearstream in Luxembourg. Germany, for its part, displays very similar discrepancies to those of France.

Download the full publication

Updated on the 15th of April 2025