As the world faces rising temperatures, extreme weather events, and environmental disruption, the need to mitigate climate change has never been more urgent. As global efforts to limit climate change intensify, more and more countries have set net-zero emissions targets. However, questions remain about whether these climate pledges will be met, as current and announced policies are insufficient to achieve the temperature target (1.5°C) set in the Paris Agreement. Therefore, additional mitigation efforts are needed to meet this environmental constraint and political commitment.

This paper analyzes the economic and fiscal costs of these necessary mitigation efforts, according to the alternative policy instruments available to implement them. One mitigation policy to encourage the transition is for the government to charge private agents for the quantity of greenhouse gases in proportion to their level of pollution. This policy is commonly referred to as "carbon pricing". Because this policy faces issues of acceptability or social equity - requiring lower consumer expenditures - the government can also support the transition by bearing part of the cost through public investment in abatement technologies or by subsidizing the private sector in its own abatement efforts. While carbon pricing policies generate revenues for the government, supporting the transition through public spending measures entails significant budgetary costs that can make public debt unsustainable. Rising public debt in turn leads to a higher probability of default and an increase in the sovereign risk premium. This can further increase the cost of financing the green transition, especially if it spills over to private sector financing conditions.

Our contribution lies at the intersection of two strands of literature. On the one hand, we rely on a macro-climate real model that allows us to analyze the dynamics of the economy in the presence of the greenhouse gas externality. On the other hand, we exploit the literature that integrates public debt sustainability issues into macroeconomic models. As a result, the dynamic general equilibrium approach we develop takes into account the macroeconomic implications of the green transition and its consequences for public finances. As an extension, we also consider the spillover effects of public debt sustainability issues on private sector financing conditions, which turn out to modify the macroeconomic effects and the performance of different mitigation measures.

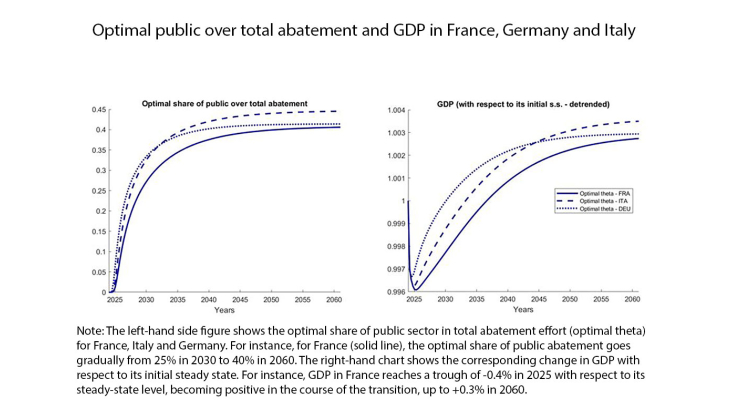

Our results show that government over-reliance on expenditure-based policies threatens public debt sustainability by increasing the probability of sovereign default, leading to higher interest rates on government bonds. On the other hand, carbon pricing policies make the transition more viable for public finances at the cost of higher economic costs and larger consumption losses. However, when spillovers to private sector financing conditions are included, we show that policies leading to higher government interest rates increase the macroeconomic costs (lower GDP and consumption) of the transition to a low-carbon economy. These spillovers are even larger when the government is highly indebted. Indeed, our results clearly point to the key role of initial debt conditions, explaining that highly indebted countries are the most likely to suffer the negative repercussions of transition policies on public finance. In contrast, the negative effects of carbon policies on GDP and consumption are reduced because they lead to a general easing of financing costs, benefiting from fiscal consolidation. When analyzing a welfare-maximizing policy mix, we find the optimality of a balanced approach, where the share of mitigation efforts undertaken by the public sector increases gradually between 2030 and 2050 (ranging from 25% to 40%) because of higher mitigation costs for the private sector.

In light of the findings of this paper, policymakers are urged to exercise prudence in designing transition policies, recognizing that their fiscal implications extend far beyond the immediate macroeconomic effects. A balanced approach that safeguards public finances, recognizes initial debt conditions and anticipates spillovers is essential to ensure the effectiveness and sustainability of the green transition. The imperative of a low-carbon future should not blind us to the complex fiscal landscape that surrounds it, as a misstep in this area could undermine the very goals we seek to achieve.

Keywords: Climate Change, Mitigation Policies, Environmental Taxes and Subsidies, Public Finances

JEL classification: D58, E63, H23, H63, Q54