1. How did the shock to Russian gas affect wholesale and retail prices of natural gas and electricity?

The shutdown of Russian gas supplies placed pressure on wholesale prices

Prior to the war in Ukraine, Europe was heavily reliant on Russia for its natural gas imports. According to the International Energy Agency, Europe imported 155 billion cubic metres (bcm) per year from Russia, out of total annual consumption of 388 bcm. Disruptions to Russian gas supplies began at the end of 2021 when Gazprom imposed its first rations. However, Russian gas exports to the European Union (EU) really started to fall dramatically with the shut off of the Yamal pipeline to Poland in May 2022, and the closure of Nordstream 1 in early September of that year. The two pipelines accounted respectively for 32 bcm and 57 bcm of gas exports in 2021.

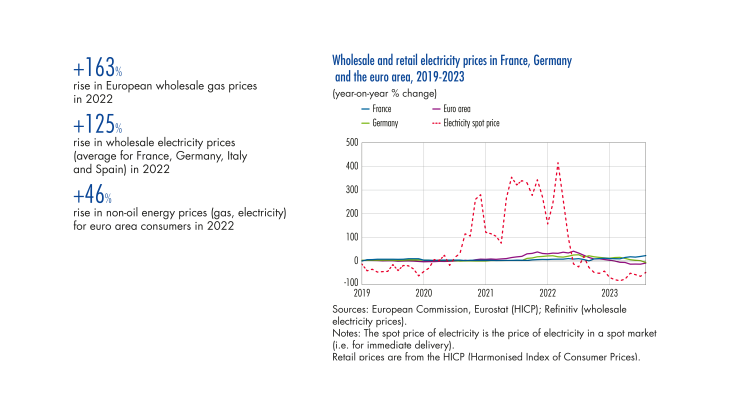

The immediate consequence of these negative “supply shocks” was a surge in market prices of natural gas, especially in the Dutch Title Transfer Facility (TTF), which is the European benchmark index (see Chart 1). The TTF soared from an average of EUR 47/MWh in 2021 to EUR 132/MWh in 2022, with a peak of EUR 311/MWh reached in August of that year. It has nonetheless fallen back sharply since summer 2022’s high, and stood at EUR 28/MWh at the end of January 2024. As natural gas is used as an input by some electricity power stations, these inflationary (and then deflationary) effects were passed through to wholesale electricity prices (see Chart 1). The transmission mechanisms between gas and electricity prices are described in detail in the next section.

Faced with the 2021 22 gas shock, Europe successfully managed to counter the supply shortages, which in part explains the sharp drop in wholesale prices since 2022. First, European countries increased their imports of liquefied natural gas (LNG), notably from the United States: LNG inflows rose by 53 bcm in 2022 and 57 bmc in 2023 compared with 2021 (see Chart 2), partially offsetting the drop in Russian supplies (falls of 86 bcm and 126 bcm respectively in 2022 and 2023 relative to 2021). Second, the economic slowdown, rise in gas prices, energy saving measures by economic agents and mild winter all helped to lower European gas consumption by 13% in 2022 relative to 2021.