How long could it take for labour market pressures to cause more wage increases and subsequently price hikes?

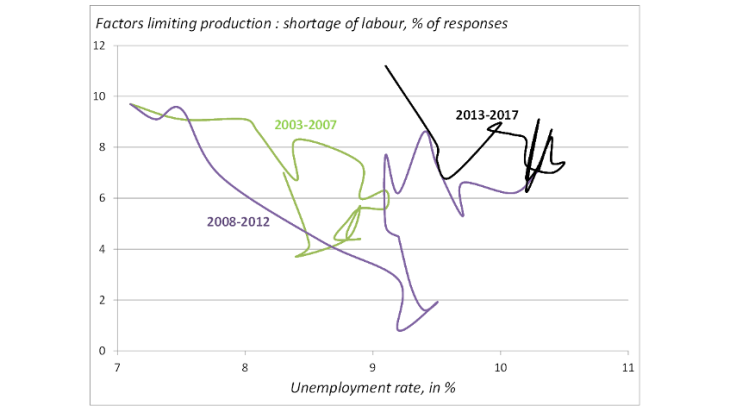

There is a certain degree of leeway that can be leveraged to counter these pressures, particularly boosting the capital utilisation rate and decreasing short-time work and involuntary part-time work, which would help to increase hours worked. The employment survey for example estimated that under-employment (involuntary part-time work or partial unemployment) amounted to 6.0% of employment during first-quarter 2018, higher than the level recorded in first-quarter 2008 (5.4%), when the unemployment rate was at its lowest point of the previous cycle (7.3%).

It should be noted that labour market pressures are not the only wage determinants: other factors could be a drag on wages. For example, during a period of recovery, less skilled workers re-enter the workforce and thus bring down the average wage (Verdugo, 2013). Furthermore, downward nominal wage rigidities during periods of economic slowdown lead to slower wage growth during an economic recovery as companies anticipate the difficulty of future wage reductions (Marotzke et al., 2017).

Certain labour market pressures could also be attenuated in the short to medium term through vocational training to develop skills that are better tailored to job vacancies, which would bring down structural unemployment. Of the 10 job categories expected to face recruitment difficulties in 2018 according to the Besoin en main d’œuvre (labour force requirement) survey, there is a profession requiring long-term training (dentist), an occupation requiring a two-year training (electrical and electronic designers), and also jobs for which less than one year's training is required according to the French government training body, the AFPA (home help, pipe fitters, roofers, vehicle body repairers, etc.). The vocational training reform and the EUR 15 billion set aside as part of the French government's major investment plan (grand plan d'investissement) to create a skilled society, particularly by financing long training programmes that end with a qualification, could speed up this process. A reduction in structural unemployment could also be achieved in the shorter term by enhancing job search incentives as part of unemployment benefit reform or through reforms promoting geographical mobility.

Part of the pressures observed today could thus disappear in the short or medium term, but another part certainly reflects the effect of the economic recovery on the labour market. According to the Banque de France macroeconomic projections, nominal per capita wages for the economy as a whole are expected to gradually grow from 1.1% in 2016 to a little over 2% in 2018 and almost 2.5% at the end of the projection horizon in 2019-20.