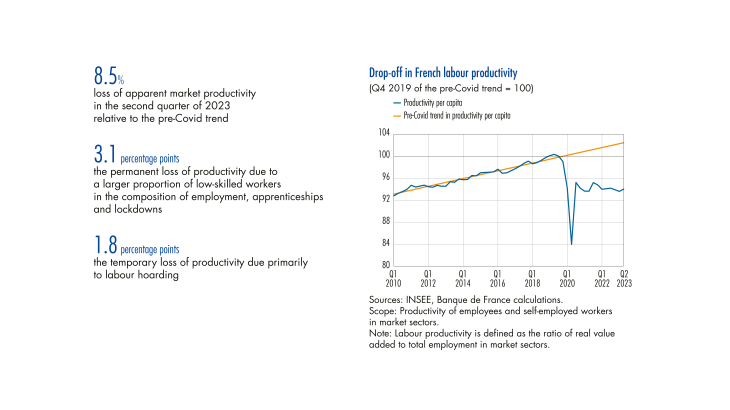

Since 2019, apparent labour productivity has fallen markedly in France. Defined here as the ratio of value added produced to the number of people employed, labour productivity in market sectors was 5.2% below its pre Covid level (final quarter of 2019) in the second quarter of 2023. The loss increases to 8.5% if actual productivity is compared to the level that would have been reached had productivity per capita continued to grow from early 2020 at a pace comparable to that recorded over the 2010 2019 period (see Chart 1). It reflects the fact that job creation far outpaced the economy’s rate of wealth creation. Other euro area countries also experienced productivity drops, but the scale and persistence of France’s disconnect are surprising. In Spain, while the decrease was initially on a par with that of France, it became much smaller from the second quarter of 2022 onwards. In Germany, the gap has been narrow since the end of 2020. Overall, the average gap between productivity per capita in market sectors and the pre Covid trend was just –2.4% in the euro area in the second quarter of 2023.

What is behind this situation? This paper proposes a partial quantification exercise that links the observed productivity drop to a variety of temporary or permanent causes (see Table 1). Among the causes with lasting effects, we consider increased employment of apprentices, workforce composition changes and lockdown related effects. Together, these factors account for 3.1 percentage points (pp) of the fall in productivity per capita. Among the temporary factors, which are responsible for 1.8 pp of the loss, labour hoarding in sectors facing a temporary drop in business make up the lion’s share (1.7 pp). These combined factors account for just over half of the observed decline in labour productivity. After playing a major role at the height of the health crisis, by reducing working time and hence productivity per capita, assuming unchanged hourly productivity, other factors such as sick leave and the French job retention scheme either no longer contribute or contribute only marginally to the productivity drop off. Ultimately, a significant share of the fall, even that linked to permanent factors, does not reflect a loss of French productive potential, but rather increased employment intensity of gross domestic product (GDP) growth via a switchover effect between productivity and labour. …