1 The forward guidance puzzle

From the early 2000s onwards, central banks significantly increased their communication on monetary policy decisions. In particular, announcements about the future direction of monetary policy – known as forward guidance – began to be used as a tool in their own right. Following the global financial crisis of 2008, when policy rates were stuck at their effective lower bound, forward guidance was one of the main unconventional policy tools used to stimulate the economy. Forward guidance stems from a key intuition of New Keynesian models: monetary policy not only influences aggregate demand through current policy rates but also through expectations of future policy rates. Savings and investment decisions typically depend on long-term yields, which depend heavily on expectations of future policy rates. In baseline New Keynesian models, aggregate demand yt depends on expectations of future real interest rates rt+k through the dynamic IS curve, which represents equilibrium in the goods and services market where s is the intertemporal elasticity of substitution and Et (rt+k) is the expectation at time t of the real interest rate at time t+k.

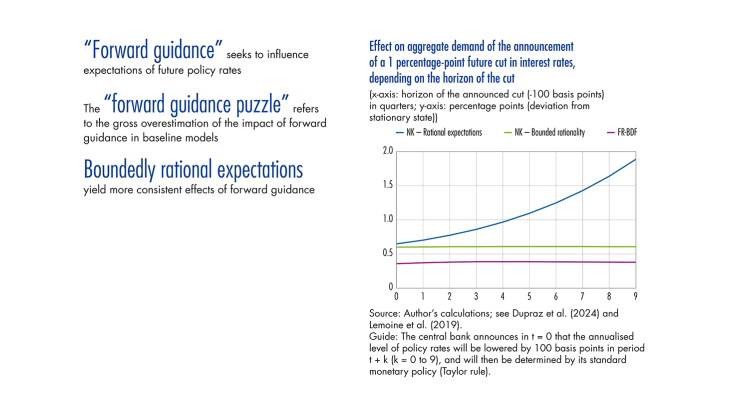

In terms of real interest rates, the IS curve stipulates that the expected short-term rate rt+k at any time horizon k has the same effect on current aggregate demand as the current short-term rate rt.

However, the impact of future rates becomes much stronger when we consider nominal short-term rates, i.e. those that the central bank controls directly and on which it can communicate or make a commitment. The real rate rt+k which is the one that matters for aggregate demand, is the nominal rate it+k minus expected inflation Et (Pt+k+1). If the central bank commits to lowering its policy rate by 1 percentage point in one year’s time before raising it again, aggregate demand and hence inflation will rise in the subsequent year. If households and firms anticipate this higher inflation – which they are assumed to do under rational expectations – the real interest rate will fall, even if the policy rate remains unchanged. Due to this inflation expectations channel, future policy rates have a larger effect than current policy rates, through the future nominal rate and through future inflation.

Worse still, the longer the horizon of the announced rate cut, the more powerful the inflation expectations channel: expected inflation reduces a larger number of future real rates.

This is represented by the blue curves in the chart on ….