- Home

- Publications and statistics

- Publications

- European Union debt, a new benchmark ass...

Post n°264. The European Union is going to issue close to EUR 800 billion of debt to finance the NextGenerationEU recovery plan, making it one of the largest public debt issuers in the euro area. European debt has some key advantages that would make it ideal as a benchmark asset. However, it still needs to reach the critical mass required to ensure a sufficiently liquid secondary market.

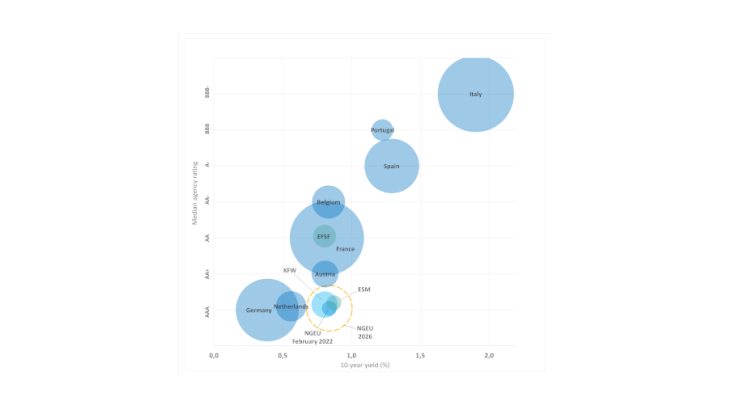

Note: The size of the blue circles is proportionate to the amount of outstanding debt; the yellow circle corresponds to the amount of outstanding NGEU debt in 2026.

The benchmark assets for euro-denominated bonds are currently German and French sovereign debt securities (respectively Bunds and OATs): both have strong credit ratings and both have a highly liquid yield curve. However, these national debt securities are vulnerable to idiosyncratic shocks. A safe and liquid pan-European asset would provide a benchmark synthetic index for the European bond market and would help to deepen financial integration in the euro area. European Union (EU) debt meets some of the conditions for this role, with EUR 800 billion set to be issued by 2026, equivalent to the current outstanding amount of Spanish government debt (Chart 1).

AAA rating and partial use of the green label offer key advantages for the new European debt

In 2019, the supply of safe assets in Europe (sovereign bonds rated AAA/AA) amounted to just 37% of GDP, compared with 89% of GDP in the United States (Gossé and Mourjane, 2021). Yet there is a strong investor appetite for this type of asset, notably due to the tightening of prudential regulations. NextGenerationEU (NGEU) bonds can be attractive to diversify risk-free portfolios, as the EU’s credit ratings (rated AAA by Fitch and Moody’s and AA by S&P) make it one of the safest issuers in the euro area (Chart 1).

European debt is considered low-risk because it is backed by the EU budget. Indeed, the EU recently raised the maximum amount of funds the Commission can request from Member States (the Own Resources ceiling) by 0.6% of gross national income (GNI). This temporary increase will apply until the last NGEU bond has matured (i.e. 2058), and comes on top of the permanent Own Resources ceiling of 1.4% of GNI. The Commission also plans to introduce new own resources to boost the EU budget: a contribution based on non-recycled plastic waste, the channelling of a share of revenues from the emissions trading system to the EU budget, the carbon border adjustment mechanism, a digital tax. However, this guarantee mechanism is contingent on the ability of Member States to contribute to the EU budget: the EU does not have a sufficiently large standalone fiscal capacity, meaning that its debt is vulnerable to a deterioration in the credit rating of one or more Member States.

In addition, the NGEU funding plan differs from other euro area sovereign issuance programmes in that it includes a high proportion of green bonds. The EU aims to raise up to 30% (EUR 240 billion) of NGEU funding through the issuance of green bonds, potentially making the EU the largest green bond issuer in the world. A green, safe and liquid European asset would help to satisfy the strong demand from investors who are increasingly incentivised to decarbonise their portfolios, at a time when only 1.3% of euro area sovereign bonds are classified as “green” (see also Bui Quang et al, 2019). The issuance of the first NGEU green bond in October 2021 confirmed the strong investor interest for this new asset, with a record issuance amount of EUR 12 billion and order books exceeding EUR 135 billion. To ensure its debt is attractive, the Commission has also adopted an ambitious NGEU Green Bond framework which guarantees traceability and transparency in the use of the funds.

A full NGEU yield curve needs to be developed to offer comparable levels of liquidity to benchmark issuers

To be really attractive, European debt should offer good liquidity to allow investors to buy and sell the securities in the secondary market with limited price variation. The volume of bonds in circulation, the range of maturities available and the number of transactions in the secondary market are all key to building a liquid yield curve.

The European Commission’s issuance strategy is to develop a full yield curve, using similar methods of issuance to the main sovereign issuers: a regular issuance calendar, use of auctions in addition to syndications, development of a network of primary dealers. Ultimately, the aim is for the European debt yield curve to include a broad range of medium and long-term maturities (3 to 30 years), in addition to short-term maturities (up to 1 year). The European Stability Mechanism (ESM), and now the EU, are the only supranational bodies in the euro area to issue short-term securities, even though they are widely used by the main sovereign issuers. However, the NGEU programme currently has a limited timeframe, with issuances set to end in 2026, adding uncertainty for investors.

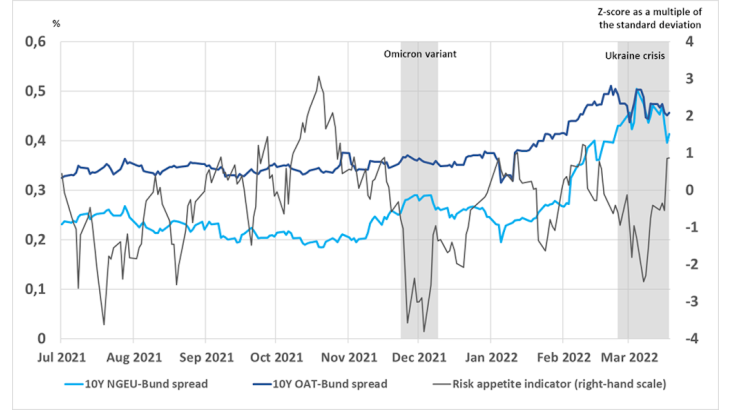

Moreover, NGEU bonds are still not as liquid as securities from large issuers such as France and Germany, notably because the yield curve for NGEU bonds is still recent. Bid-ask spreads in the secondary market, which are an indicator of liquidity, average 0.9 basis point for the 10-year NGEU bond, compared with 0.4 basis point for OATs and Bunds with an equivalent maturity (Chart 2).

Note: 7-day moving average spread in basis points.

In addition, only EUR 71 billion of NGEU bonds were issued in the market in 2021 (excluding short-term maturities), which means there is an insufficient volume effect to guarantee high levels of liquidity. This liquidity premium may explain why NGEU bonds are more vulnerable to episodes of risk aversion than securities such as Bunds or OATs, which investors regard as safe-haven assets. During the most recent episodes of risk aversion (the Omicron variant in November 2021, the Ukrainian crisis in February 2022), the NGEU-Bund spread widened more than the OAT-Bund spread (Chart 3), even though European debt has a better credit rating than French debt.

Note: Grey-shaded area shows changes in risk aversion (Omicron variant and Ukraine crisis).

In the medium term, some market analysts think the development of a repo market for European debt could increase liquidity by allowing primary dealers to act as liquidity providers in the secondary market. In the longer term, they also suggest that the development of a futures market, such as that for French and German debt, could make NGEU bonds more liquid – provided there is a genuine demand for it in the market.

Updated on the 25th of July 2024