Note: Weekly average overnight interest rates, volume-weighted. GIIPS = Greece, Ireland, Italy, Portugal, Spain and Cyprus. Pre-OMT: July 2011 - July 2012; OMT: August 2012 - June 2014; TLTRO: July 2014 – December 2015

Interbank market fragmentation: why does it matter?

In normal times, the interbank market is central to the entire financial system because it is the main venue for banks to obtain short-term financing and its smooth functioning matters for financial stability. Liquidity tensions, notably related to fears that counterparts in the interbank market might default, have been a powerful channel of shock transmission across borders during recent financial crises.

For two banks characterised by a similar risk-profile, access to the interbank market and the interbank interest rates they pay should not differ significantly depending on the country in which they are headquartered. Throughout 2011-15, however, banks headquartered in GIIPS countries (Greece, Ireland, Italy, Portugal, Spain and Cyprus) paid higher interest rates on average (volume-weighted) than banks headquartered in core economies (see Figure 1). The difference was especially large in December 2011, before the Eurosystem’s first 3-year liquidity refinancing operation, and before the announcement, in August 2012, that the ECB might undertake Outright Monetary Transactions (OMTs) in secondary government bond markets.

By affecting the funding capacity of banks, interbank market fragmentation can hinder the smooth transmission of monetary policy and thus impair the provision of credit to the real economy. In the euro area, interbank fragmentation has been fuelled by the sovereign-bank nexus: in GIIPS countries, banks have been affected by their own governments' debt problems and vice-versa (Fahri and Tirole, 2018). The need to mitigate financial fragmentation and implement a single euro area monetary policy has been an important motivation for unconventional monetary interventions.

Exposure-based and sovereign-based fragmentation

The fragmentation considered in the next section of this blog refers to the difference in market access and interest rates paid due to counterparty risk arising from exposure to the GIIPS economies (exposure-based fragmentation). Through this channel, the effect of larger exposure to GIIPS economies should affect borrowing banks to the same extent irrespective of whether they are headquartered in a GIIPS or core economy. In the final section, we consider the sovereign-based source of fragmentation, i.e. the fact that banks headquartered in GIIPS countries might pay more for their funding because they are less likely to be bailed out than banks headquartered in core economies, due to the higher default risk of their sovereign.

Measuring fragmentation, in the context of unconventional monetary policy

To estimate exposure-based fragmentation, we combine lender-borrower (bank-to-bank) unsecured loan data identified from TARGET2 payments in 2011-15 with detailed supervisory information disclosed since 2011 by the European Banking Authority (EBA) on capital positions and exposures of 115 European banks (for more details on the datasets, see Gabrieli and Labonne, 2018). For each loan we observe the lending and the borrowing bank, the date, the volume and the interest rate of the loan. Through EBA data we observe the cross-border and cross-sector (sovereign, corporate, retail) composition of banks’ exposures. We use this information to construct, for each bank, several measures of GIIPS-related credit risk. Through this unique dataset, we can study the impact of sovereign and balance sheet risk, as measured by the size and quality of exposures to GIIPS, on the probability of finding a lender in the interbank market and on loan interest rates.

In theory, before the ECB’s announcement of OMTs on sovereign debt securities, we expect interbank rates (market access) to increase (decrease) according to the size and riskiness of bank exposures to GIIPS assets. After the OMT, we expect lenders to reassess the riskiness of GIIPS assets. This could mitigate interbank fragmentation.

We identify the exposure channel of fragmentation by comparing borrowing terms across banks headquartered in core economies only. We look at the effect of the size and quality of their GIIPS exposures on interbank lending conditions, after taking into account other bank-specific risk characteristics (size, rating and capital ratio) and country-specific risk factors (e.g. via sovereign CDS). Furthermore, by comparing the variation in costs across core and non-core banks due to their exposures to GIIPS assets we can distinguish exposure-based from sovereign-based fragmentation.

Before the OMT, fragmentation was driven by bad balance sheets

First, we find that, all other things being equal, high non-performing loan (NPL) ratios on GIIPS assets hindered the access of core banks to the interbank market before the announcement of OMTs. Higher NPL ratios on GIIPS assets decreased the probability of finding a lender over this period.

Second, the larger its exposures to GIIPS sovereign debt, the more a core bank paid for interbank loans. More specifically, a 1 percentage point increase in the share of GIIPS sovereign exposures raised interest rate spreads (relative to the deposit facility rate) by 1.3 basis points. This represents 13% of the average spread paid by core borrowers during this period.

OMT and TLTROs have reduced this source of fragmentation

After the OMT announcement, and after the announcement of the first series of TLTROs in June 2014, the effect of high NPL ratios on GIIPS assets on the probability of finding a lender becomes negligible. Moreover, the effect of banks’ exposures to GIIPS on interest rate spreads turned from positive to negative.

Home country risk

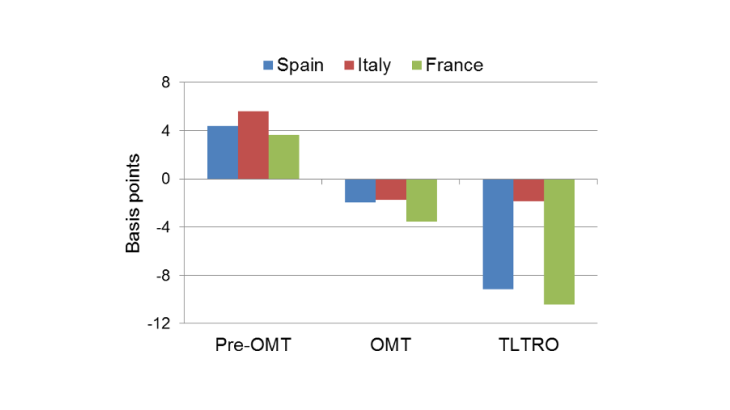

Finally, if we enlarge the sample of banks to include GIIPS as well as core banks, we can compare the change in interest rate spreads paid due to the location of the home country. We do this by exploiting a set of borrower-country effects from the interest rate spread estimates. These account for any time-varying development at the level of the home country of the borrower, especially sovereign risk. We find positive home country effects in interbank spreads, e.g. for Spanish, Italian and French banks, but only before the OMT; the effects became insignificant and slightly negative after the OMT and turned to discounts after the introduction of TLTROs (see Figure 2). Thus, home country risk appears irrelevant after the OMT.

Overall, the OMT has curbed both sources of fragmentation: it has reduced the cost of borrowing by banks exposed to GIIPS and increased the probability of finding a funding source in the interbank market; it has also reduced pure home country-related risk.