Greening financial portfolios has become a central topic in the financial community. This has led a growing number of financial institutions to form coalitions to encourage companies to reduce their environmental footprint (e.g., Climate Action 100+) or to make net zero commitments (e.g., Glasgow Financial Alliance for Net Zero). However, there is considerable uncertainty in the assessment of the environmental status of companies, as illustrated by the significant disagreement among ESG scores (measuring their performance with respect to Environmental, Social, and Governance issues; Berg et al., 2021; Billio et al., 2021) or debatable practice from data providers (Berg et al., 2020). Importantly, the lack of a common framework and reliable information on environmental assets creates several risks, such as the dispersion of green investment flows towards non-sustainable assets (Billio et al., 2021), or over-investment in certain easily identifiable green companies that may support the emergence of a green bubble (Borio et al., 2023).

Against this background, this paper examines the dynamic nature of pro-environmental preferences by analyzing green and brown sector valuations in equity markets. We believe that the study of sector valuations is particularly appropriate given the absence of a reliable common definition of green and brown firms. Sector affiliation is arguably a more objective, consensual, and easily observable characteristic than other individual rankings based on environmental scores or carbon emissions, and less easily manipulated. Therefore, green and brown sectors are more likely to accurately reflect pro-environmental preferences than other metrics, providing a better framework for analysis. We study the effect of sector affiliation (i.e., operating in green, neutral, or brown business activity) on stock valuation, here price-earnings ratio (PER), after controlling for a large set of financial and extra-financial characteristics. We estimate this effect by running panel regressions, first over the entiresample period (2018–2023) and then separately for each year to detect possible changes in pro-environmental preferences.

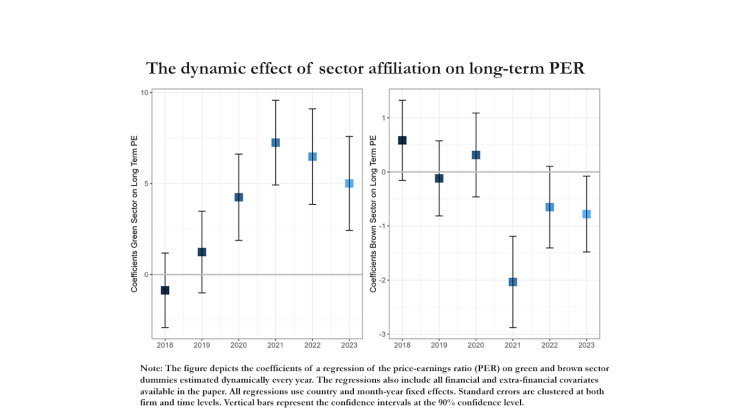

Figure depicts the impact of green and brown sector affiliation on stock valuation over time. The figure highlights a sharp increase in the valuation of firms operating in green business activities from 2018 to 2023. Belonging to the green sectors in 2021 increases a company’s PER by nearly 7.5 points compared with an average PER of 16.8 for neutral sectors (about 45% higher). In contrast, the PER of companies in brown sectors appeared higher than the rest of the market in 2018, then slowly declined and became lower than that of neutral companies in subsequent years. Overall, these results indicate that pro-environmental preferences have become more prevalent among investors.

Understanding whether pro-environmental preferences are priced at the sector level is essential for financial practitioners and regulatory authorities. First, this information can provide important insights into the effect of positive and negative screening in portfolio allocation strategies on equity valuations. Second, this research question is important for policymakers developing classification systems aimed at channeling public and private investment toward environmentally sustainable economic activities. Finally, our analysis can help identify potential financial stability risks associated with the emergence of a green bubble or a negative reassessment of the value of brown securities.

Keywords: Environmental Preferences, Green Bubble, Stock Market, Stranded Assets, Valuation Ratios

JEL classification: G10, G32, Q54