Macroprudential policy has been extensively developed for more than a decade now, with the purpose of preserving financial stability. In particular, capital requirements have been essential to the macroprudential policy toolkit, with key innovations introduced by the Basel III framework like the countercyclical capital buffer (CCyB). This measure requires banks to hold additional capital (up to 2.5%) during expansion periods, in order to limit credit growth. In adverse times, supervisors may allow banks to draw on this buffer during downturns, in order to avoid deleveraging and an excessive tightening of credit conditions, which could further depress activity.

In addition to the question of their effectiveness, the increasing use of countercyclical macroprudential tools has raised the issue of their interaction with monetary policy, especially in influencing bank financing conditions. Whether the two policies could reinforce each other appears critical in times of crisis, when financing conditions may dramatically tighten.

In this regard, the COVID-19 crisis provides a convenient quasi-natural experiment to study the individual and combined effects of macroprudential and monetary policies on credit conditions. Starting in March 2020, central banks across the globe eased their monetary policy, while macroprudential authorities reduced the CCyB buffer for the first time since its implementation.

In this paper, we investigate whether the interaction of monetary policy easing and CCyB relief has significantly eased credit conditions at the height of the COVID-19 crisis. To this end, we follow a two-step approach. First, we theoretically assess the transmission of a CCyB release and its complementarity with monetary policy through the lens of a New Keynesian model including a banking sector and financial frictions. Second, we empirically study the predictions of the model through a difference-in-difference (DID) approach across a sample of 54 countries.

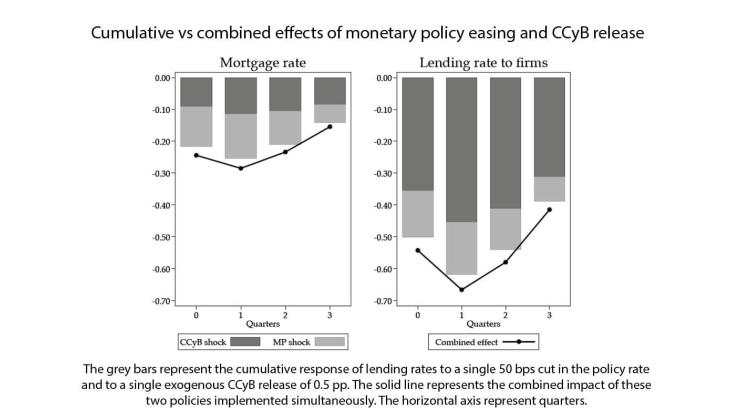

In our theoretical model, we show that individually, both monetary policy easing and CCYB release lowers bank lending rates. However, as shown in Figure 1, their joint action lowers BLRs by more than the sum of their individual effects, thus suggesting complementarity. Nonetheless, the effect on mortgage rates to households appears lower compared to lending rates to firms.

We empirically confirm this finding by a difference-in-difference analysis comparing countries that released their CCyB with countries that did not. Results confirm that the CCyB release and monetary easing have complemented each other to put downward pressure on BLRs during the pandemic, albeit modestly. On average, for countries having released the CCyB, every 1 pp of release translates into an additional 11 bps decrease of corporate BLRs, compared to countries that did not. Importantly, the lower the policy rate the greater this effect, suggesting that the CCyB gave policy space to economies close to the effective lower bound. Mortgage rates also react to CCyB release, but to a much smaller extent. Additionally, the CCyB relief improved the pass-through of monetary policy easing to corporate BLRs. In countries having released their CCyB (compared to countries that did not), BLRs decreased by 18 bps more for any 100 bps cut in the policy rate.

Keywords: Countercyclical Capital Buffer, Monetary Policy, Policy Complementarity, Lending Rates, Covid-19

JEL classification: G21, G28, E52, E44