Since the beginning of the 2016 US electoral campaign, trade deficits, trade agreements, exchange rate management and tariffs imposition have been at the core of the economic policy debate. In the subsequent years there has been an escalation in trade tensions between US and China, a period that is often referred to as the Sino-American «trade war», whereby both countries have implemented bilateral tariffs aimed at harming key sectors of the opponent's economy, in an attempt to force it into a more favorable trade treaty.

As to the consequences of trade tensions for the global economy, academics and policy makers are still struggling to quantify the extent to which such tensions have spoken to the global economic slowdown of 2019. In this regard, the dominant view argues that “the weakness in growth is driven by a sharp deterioration in manufacturing activity and global trade, with higher tariffs and prolonged trade policy uncertainty damaging investment and demand for capital goods” (Gopinath (2019)). There are several channels through which tariffs can hamper global economic activity. For example, higher tariffs increase the price of imported goods, shifting demand towards domestic production and reducing revenues for foreign producers. Such losses may be further amplified by second-round effects through the global value chain (i.e. production-reducing exporters in turn decrease their demand for intermediate goods) which can eventually feed back into the tax-imposing country. Another channel is related to risk: tariff threats might increase uncertainty around the profitability of investment projects, thus making them less appealing and leading to a delaying of investments with detrimental on the economic outlook. There is not however a strong consensus on which of these channel prevails or on the quantification of the effects of rising trade tensions. For example, general equilibrium models based on trade elasticities produce sizable effects of trade barriers only when assuming large shocks. Recent contributions have also suggested that these results might be driven by significant asymmetries in the response to tariffs (Furceri et al. (2018)), or by changes in exchange rate adjustments mechanism over the last decade (Eichengreen (2017)).

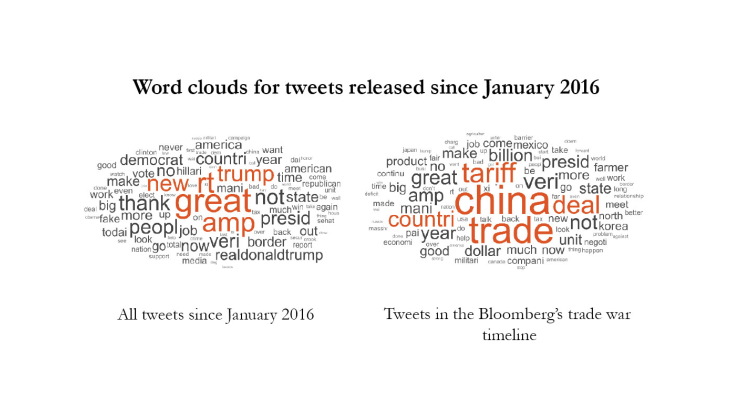

Against this backdrop, our paper proposes three innovative contributions to the existing literature. First, we construct a proxy for trade tensions shocks by adopting a novel approach, which is based on textual analysis. Specifically, we use a supervised machine learning algorithm to assess the relative “protectionism content” of a large set of announcements in the Sino-American “trade war”. The time series of such scores provides a trade tension measure, which can be used to quantify their impact on the global economy. Second, we show that the constructed measure is exogenous to financial market developments (both domestic and global), thus supporting the main assumption that announcements have been largely unanticipated by markets. This result is indeed relevant as allows to use the indicator as a measure of unexpected trade-policy surprises. Finally, we use the index to assess the reaction of financial agents to an increase in trade tensions. We show that a trade tension shock leaves the US stock market almost unaffected, except for those companies heavily exposed to China, while also inducing a contraction of stock market indexes both in China and other emerging market economies (EMEs). Moreover, the same shock entails an appreciation in the US dollar, a broad depreciation in EMEs currencies, while safe heaven currencies remain almost unaffected. The absence of safe-haven effects seems to suggest that trade tension shocks are interpreted by international investors as a negative demand to Chinese production rather than as a global risk aversion shock, with the US dollar appreciation simply reflecting a trade re-balancing. This intuition is further reinforced by the results for fixed income markets. While, indeed, US long term yields do not react significantly to the shock, market participants in EMEs tend to substitute stocks with bonds, thus effectively re-balancing their portfolios.