- Home

- Publications et statistiques

- Publications

- Demand for banknotes : linkages with the...

Post n°172. The demand for banknotes in the euro area has grown faster than GDP since the creation of the euro. Yet, paradoxically, the use of cash as a means of payment is tending to decline. The increase in the demand for banknotes seems to be mainly due to an increase in precautionary demand from economic agents.

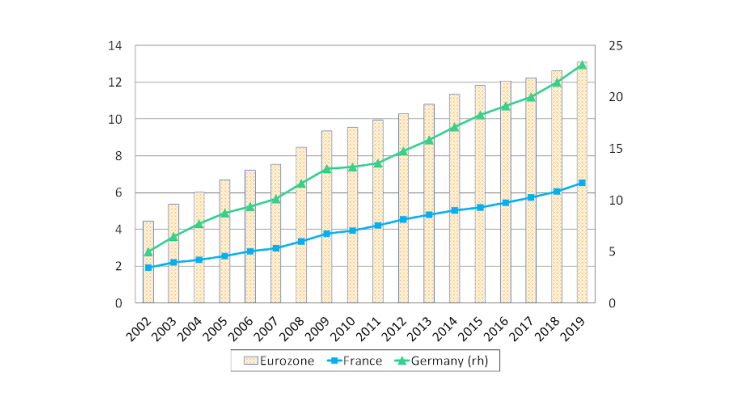

Sources: Banque de France (BdF), Currency Information System (CIS) of the Eurosystem and OECD

Banknote issuance has grown faster than economic activity in the euro area (Chart 1) despite a decline in the use of cash for payments. Transaction purposes alone do not therefore explain the growth of currency in circulation (Rua, 2019 and Bartzsch, Rösl and Seitz, 2011). This trend is more pronounced in Germany (6%-22%) and the euro area as a whole (5%-11%) than in France (2%-6%).

A rise in the demand for banknotes followed by a return to the long-term trend in the euro area?

… understanding the concepts of stocks (holdings) and flows (use)

Cumulated net issuance of euro banknotes corresponds in France to the stock of banknotes issued by the Banque de France since the introduction of the euro (gross issuance), minus the banknotes returned to its counters since this date. This issuance increases by the volume of net issuance, i.e. the difference between withdrawals (outflows) and deposits (inflows) of banknotes. It therefore constitutes a stock, whereas outflows and inflows are flows.

The difference between inflows and outflows, i.e. net issuance, results from various factors: domestic demand for transaction and hoarding purposes, foreign demand and banknote migration between euro area countries.

However, cumulated net issuance does not reflect the demand for banknotes in a country. In France, for example, at the end of June 2020, cumulated net issuance (EUR 158.2 billion) neither corresponded to the volume of banknotes in circulation in the country (banknotes issued by other NCBs circulate in France) nor to the banknotes issued by France circulating throughout the world.

… A focus on the first months of the crisis

Euro banknote holdings (cumulated net issuance) increased in March 2020, in proportions close to those observed in October 2008 (EUR 36 billion compared with EUR 43 billion in October 2008), despite an already significant fall in transaction volumes (between 16 and 31 March, the number of interbank card payments fell by 43%). This strong growth in the holdings of euro banknotes resulted from an abrupt and short-lived discrepancy between the flows of withdrawals and deposits of banknotes at the counters of the national central banks (NCBs). The difference between the two thus increased from EUR 5 billion to EUR 36 billion in one month. This rise was driven by high denominations, particularly in Germany.

Since April, the trend in cumulated net issuance in euro has moved closer to the long-term trend. It rose by EUR 11 billion in June, compared with an average monthly increase of around EUR 8 billion over the last two years.

The historical decline is still too small to determine the extent to which substitution effects between means of payment are being accentuated by the crisis and whether there will be a hysteresis effect (Ashworth, Goodhart, 2020). However, contactless transactions more than doubled in value in June compared to the same month last year. At the same time, contact card payments decreased by about 10% and cash withdrawals by 15%.

… A peak caused by domestic factors

In the week from 16 to 22 March, a net issuance of EUR 18.8 billion was recorded.

This was driven by two factors:

- A surge in purchases and withdrawals from ATMs. Banknote deposits then dropped very quickly following the closure of retailers.

- A peak in domestic hoarding. The banks boosted their cash holdings in order to prevent a possible interruption of supply channels, particularly in Germany. Individuals also withdrew larger amounts than usual in anticipation of mobility restrictions.

However, in contrast to previous crises, non-resident demand for euro banknotes contributed little to the rise in net issuance. This is probably due to air freight difficulties in the context of the health crisis.

Are there any specific features relating to the different denominations in France?

Here, we assess the actual net issuance for each denomination between the first quarters of the years 2003 and 2020.

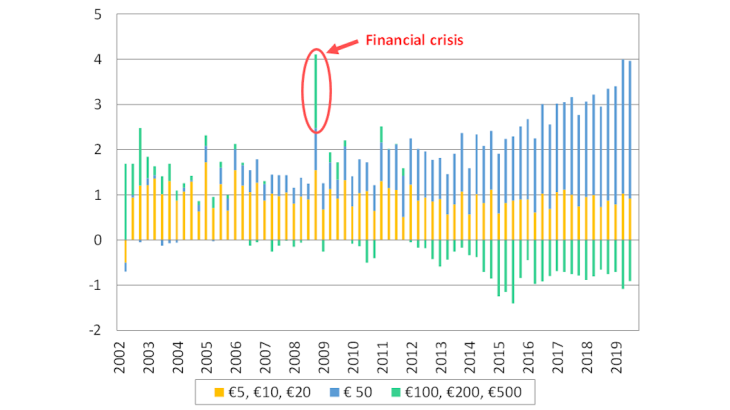

Sources: BDF and the CIS of the Eurosystem

Net issuance appears to result from specific factors. The 2008 crisis was marked by a surge in the use of high denominations (100, 200 and 500€, see Chart 2). However, these denominations, which have been in sharp decline since 2012, did not recover significantly during the health crisis. The €50 banknote, which was in high demand in 2008, has been the main driver of French net issuance since 2014. Used for both transaction and hoarding purposes, its share has continued to increase during the health crisis. As a general rule, the share in value of €10 and €20 banknotes, which are mainly intended for transactional use, is declining.

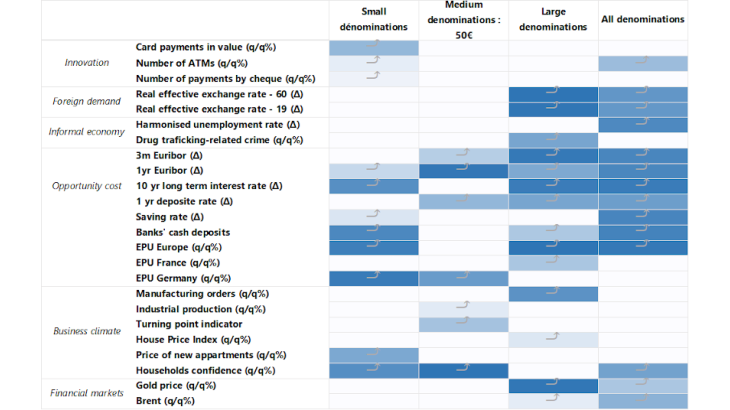

Source: Authors’ calculations

Note: the blue cells indicate the existence of causality: the darker the squares, the more significant the relationship. EPU: Economic Policy Uncertainty

The causality analysis shows that new means of payment are tending to replace small denominations. They are also sensitive to economic uncertainty, as measured by the EPU, see Chart 3). The €50 banknote reacts to short-term interest rates, industrial production and household confidence. The high denominations, for their part, react to commodity prices (gold, brent etc.), real exchange rates (international arbitrage), short-term interest rates, as well as to the informal economy (drug trafficking, etc.).

Moreover, across all denominations, only the uncertainty indicators and the exchange rate have a significant causal effect. Lastly, it is useful to compare the effects of exogenous shocks on the demand for banknotes.

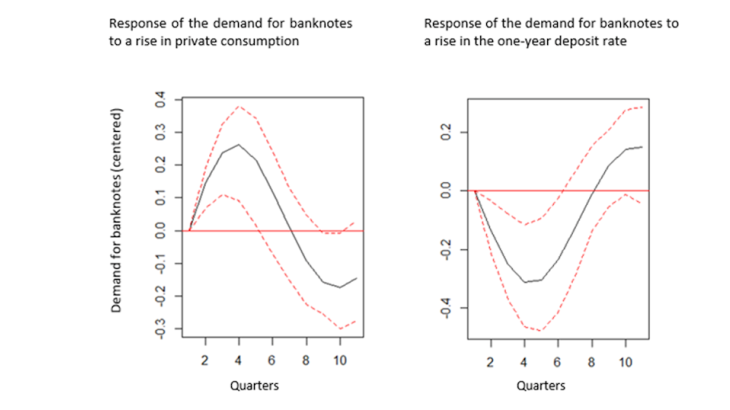

Is there any latitude to switch between holding money and holding assets?

Here, we use a vector autoregressive (VAR) model, a dynamic system of equations in which each variable is explained by its own past values and by those of the other variables in the model. The VAR is applied to the cyclical components of total banknotes, private consumption and the rate of return on deposits with a one-year maturity. By studying the cyclical fluctuations of these variables around their trend, it is possible to assess the effects of various shocks stemming from the business cycles on the demand for cash (see Chart 4).

We estimate that a positive shock to private consumption results in an increase in the demand for banknotes over six quarters. Conversely, the same type of shock to the one-year deposit rate leads to a decline in the demand for banknotes also over six quarters. The trade-off between holding money (transaction purposes) and financial assets (less liquid but profitable) must therefore be considered.

While the use of cash for transaction purposes is declining, it has not completely disappeared. On the contrary, precautionary motives appear to have become the main driver of the demand for money. Despite their current level, interest rates remain a real opportunity cost for holding cash. To sum up, developments in cash use during the first months of the health crisis will have to be analysed in the light of traditional explanatory factors. The strong growth in contactless card payments could thus accelerate the substitution of electronic payments for cash, with a marked impact on transaction denominations.

Updated on the 25th of July 2024