News outlets (i. e. newspapers, news platforms) are vital channels for disseminating economic news, often influencing market participants and households more effectively than direct central bank communications. Media not only filter and interpret information but can also amplify its reach, with important economic consequences. Studies have shown that they can contribute to asset price bubbles, accelerate bank runs, and drive business cycle fluctuations. Thus, understanding how the media select, present, and release central bank information is crucial, as it can shape investor reactions to it.

We document media behavior in covering the US Federal Reserve (Fed) and how it impacts financial markets. Our analysis focuses on two key aspects: (i) the extent of editorial specialization in covering Fed-related topics, and (ii) the homogeneity of coverage—both in topic and tone—over time and around Fed events. Our study draws on over 350,000 news articles discussing the Fed, published by major U.S.-based media outlets such as Dow Jones, The Wall Street Journal or Reuters, spanning the period from 1998 to 2021.

Media coverage of the Fed is time-varying. Coverage is especially high during key periods such as the low interest rate environment of 2003-2005, the Great Financial Crisis (GFC) of 2008, and the adoption of unconventional monetary policies. Coverage intensifies ahead of FOMC meetings, reaching its highest level on meeting days.

Fed-related news content is diverse. It spans topics from more financial ones (e.g.,, stock and bond market) to more macroeconomic and policy ones (e.g., monetary policy, economic condititions). The intensity of focus on these topics varies over time. In the late 1990s, coverage was heavily centered on stock market news but emphasis shifted toward monetary policy before the GFC. Post-GFC, the focus on Fed-related topics became more balanced across monetary policy, bond and stock markets.

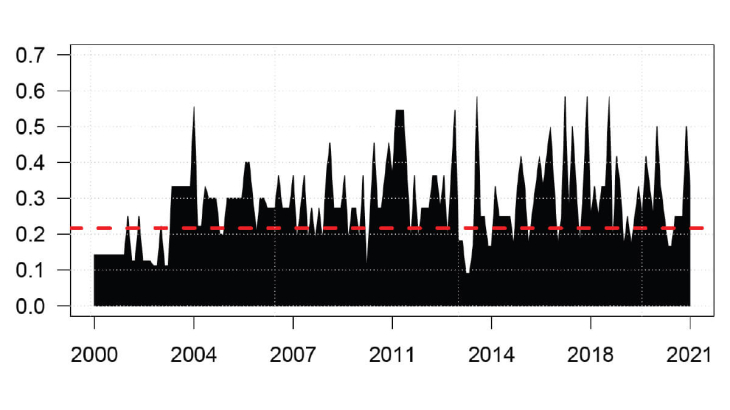

Importantly, we document heterogeneity in media topic specialization when covering the Fed. For instance, general-interest outlets, such as The Washington Post and the Associated Press, cover broader economic policy and political issues in relation to the Fed, while newswires like Dow Jones provide real-time market updates. Despite their specialization, media outlets often converge in their coverage, particularly around FOMC meetings, with a noticeable increase of homogeneity in both topic and tone (see Figure 1) .

Finally, we explore how homogeneity in media coverage influences financial market reactions. We find that on average, topic and tone homogeneity typically dampens stock and bond market reactions. Interestingly, markets react more strongly when the coverage homogeneity centers on the stock market topic. This result suggests that deviations from the usual focus on the monetary policy topic generate newsworthy signals for markets. When focusing on coverage around FOMC meeting days, we find that tone homogeneity amplifies market reactions to monetary policy surprises, irrespective of the topic.

Keywords: Monetary Policy; Media Transmission; Central Bank Communication

JEL classification: C55, D83, E44, E58, G1