Monetary policy nowadays is decided by committees

A popular saying goes that "two heads are better than one”. Groups are thought to be superior to individual decision-making because of the pooling of knowledge, the diversity of views or the checks that the group provides against extreme preferences or autocratic power of one individual. Along these lines, monetary policy decisions nowadays typically arise from the deliberation and vote of a committee, like the Federal Open Market Committee (FOMC) of the Fed, the Governing Council of the ECB or the Monetary Policy Committee (MPC) of the Bank of England.

Because the setting of policy in a committee involves the aggregation of different views of the world into a collective decision, markets pay a lot of attention at who is sitting in these committees with the aim to forecast the path of future policy. This is a complex process, raising several questions and uncertainty.

When it comes to choosing policymakers, the dynamics of views within a committee and implications for monetary policy, we can draw some lessons from the history of the Fed and the FOMC, the group that decides on U.S monetary policy. The FOMC is made up of 12 voting members - seven members of the Board of Governors, the New York Fed president as a permanent voting member, and four regional Fed presidents, the voting positions of which rotate annually among the 11 regional Feds.

1. Policymakers do have types, such as “hawk” or “dove”

In considering the lessons from history in choosing a Federal Reserve chair, Romer and Romer (2004) stressed that narrative records of their economic beliefs such as writings, testimonies and speeches before joining the Fed were particularly informative about the economic views they held as a Fed chair. For instance, they argue that the economic views expressed by Martin, Volcker and Greenspan, before taking the job, were good predictors of the views they held and sensible actions they took during their tenures. Miller’s views were also a good predictor of the policies and outcomes under his tenure (mostly poor, in their view), but didn’t receive much attention during his Senate confirmation.

Unsurprisingly, the approach that Romer and Romer (2004) suggest is the daily business of financial analysts and commentators on monetary policy who do the Fed watching, aiming to forecast future policy. To summarize their economic beliefs and policy leanings, Fed watchers often use the labels ‘hawk’ and ‘dove’, where a hawkish central banker is assumed to assign more priority to fighting inflation and the dovish one to support more output and employment.

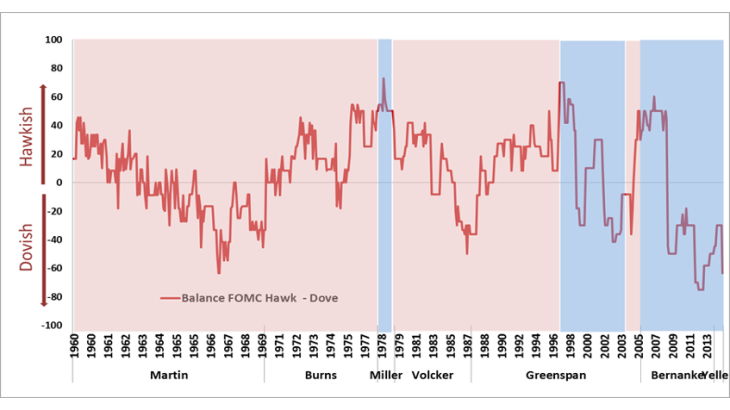

Istrefi (2018) collects and quantifies the hawk and dove perceptions of the FOMC. These perceptions are based on the narrative records in U.S newspapers and financial reports with respect to all FOMC members that served during 1960 to 2015. To build the Hawk-Dove measure, about 20,000 articles or reports, from more than 30 newspapers, referencing to 130 members have been read (human reading instead of text mining algorithms) to collect quotes that are informative on the policy preference of each member. These quotes are quantified as perceptions for hawk or dove. Perceptions are traced year by year, for the whole tenure of the FOMC member.

The Fed has a dual objective for monetary policy: maximum employment and stable prices. Perceptions in real time, as expressed in the media, show that some of the Fed chairs were expected to be inflation-fighting hawks (Burns, Volcker, Greenspan and Bernanke) and some others to be leaning more towards growth and employment (Miller and Yellen). For instance, when President Reagan nominated Greenspan to replace Volcker, the New York Times (1987) described him as: "[] like Mr. Volcker, [he] is an avowed inflation-fighter who believes that excessive growth of the nation's money supply is the primary cause of inflation.” When looking at their full tenure at the FOMC, Istrefi (2018) finds that Martin, Burns and Volcker were perceived as all-time hawks and Miller, Bernanke and Yellen as doves (see the red and blue shaded areas, Figure 1).

2. …but over time policymakers can change their tune

Perception about Greenspan’s type changed over his mandate. He was initially perceived as a hawk, swinging to a dove in 1997 and back to hawk in 2004. He was not the only swing. Close to one fourth of the FOMC members that served during 1960-2015 were perceived to have changed camps. Bordo and Istrefi (2017) show that large swings in types are observed during the Great Inflation of the 1970s, in the early 1990s with discussions on inflation targets, and in the late 1990s following Greenspan’s view on the accelerated productivity of the mid-1990s and inflation. For instance, in 2002 the Wall Street Journal writes: “Former Fed officials said Mr. Kohn's views are close to those of Mr. Greenspan, who has been labeled a dove in recent years for his willingness to see how fast the economy could grow without fueling inflation.”

3. The center of gravity of the committee matters … as does committee management

The Hawk-Dove balance of the FOMC shows that very often the center of gravity of preferences did not match that of the Fed chair (Figure 1). These mismatches are predominantly observed during Martin’s, Miller’s, Volker’s and Bernanke’s mandates as Fed chair. Narratives on monetary policy since 1960s and the evolution of inflation suggest that at certain points these differences were crucial for monetary policy.

Most important is what happened during the 1960’s. Meltzer (2005) relates the origins of the Great Inflation mostly to the personality of the Fed chair and the economic beliefs at the time of the FOMC. To Meltzer, Martin seemed the most unlikely person to preside over monetary policy that eventually led to the Great Inflation. Martin was the longest serving Fed chair (1951-1970). He was considered an inflation hawk and the Fed under him had a very good track of low and stable inflation. But Martin believed that policy should be made by consensus. And during 1963-1965 the FOMC was strongly divided, as the Hawk–Dove balance in Figure 1 shows. Dissents on policy were high, up to 5 in one meeting, for both tighter and easier policies. With inflation picking up and a divided FOMC, Martin often waited, thinking that discussion, events, and perhaps collegiality would help form the consensus. To Melzer, this situation contributed to delays in taking prompt anti-inflationary action.