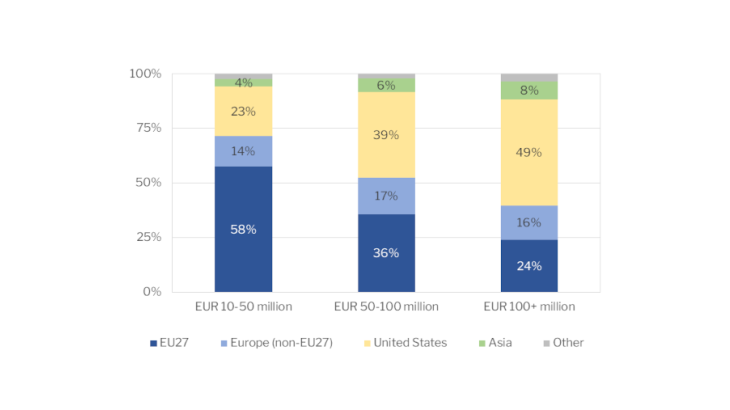

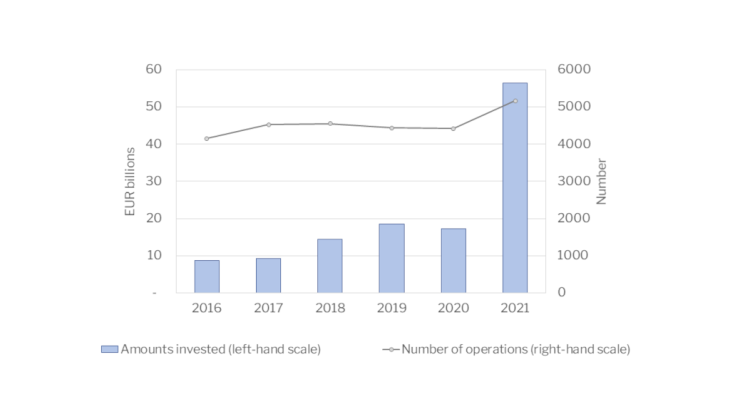

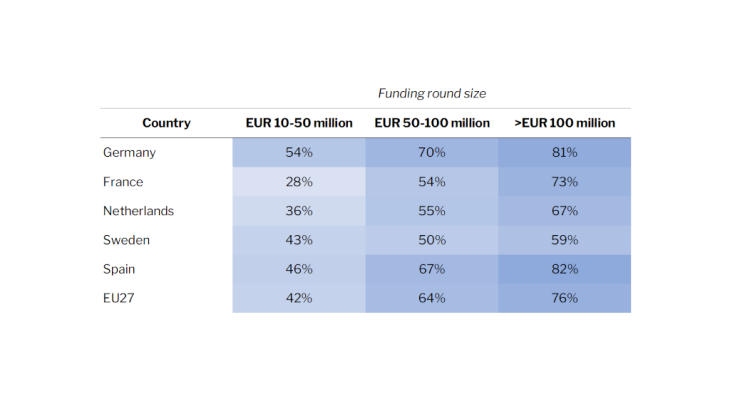

In this phase of rapid EU catch-up, non-European funds – particularly US funds (Pitchbook 2021) – seek out relatively smaller valuation levels in the EU than in the US (EUR 34 million on average in Europe between 2016 and 2021 compared with EUR 130 million in the United States). It is also worth noting that among these non-EU investors, non-traditional investors (sovereign wealth funds, hedge funds, private equity funds) are becoming increasingly active in European start-ups funding rounds.

These funds fill a financing gap for European growth-stage start-ups that has been recognised for some time (Ekeland et al., 2016; Duruflé et al., 2017; Tibi, 2019). However, the ongoing market correction in the United States might lead to a decline in non-EU capital flows in the second half of 2022.

Exceeding the limitations of European venture capital

Although the EU has a significant savings surplus (an average financing capacity of more than EUR 300 billion per year during the past five years), European financing is still insufficient during the growth phases of start-ups. This is due to the particular characteristics of European investment funds as well as how private savings are structured.

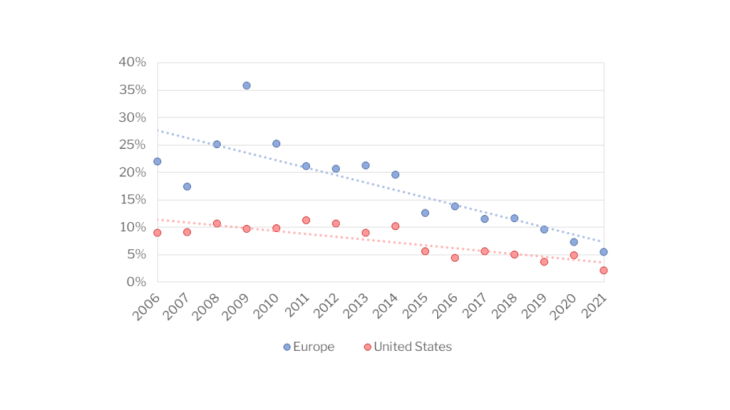

European venture capital funds are far smaller than their US and Asian counterparts and non-traditional funds. For example, the largest venture capital fund created in the United States in 2021 raised a total of EUR 5.7 billion (see the annual report of the US National Venture Capital Association) compared with EUR 1.6 billion in the EU. The necessity for European funds to diversify their exposures thus limits their capacity to invest in large-scale operations.

One reason regularly put forward to explain why Europe lags behind in this regard is that institutional investors have less appetite for this asset class (Hafied et al., 2021). This is based on several main factors. First, there are less pension funds in Europe than in other countries where they play a significant role in financing the growth of start-ups. Second, the prudential regulations applicable to insurers (Solvency II) impose high capital requirements for holding unlisted equities. Lastly, European households, notably because they are more risk averse than in the US (Bekhtiar et al., 2019), tend to prefer guaranteed investments. In order to offer this type of savings products, institutional investors favour safe, liquid investments, thus diverting them from investing into start-ups.

A strategic imperative that necessitates better channelling of European savings

The development of European venture capital impacts the EU’s economy and strategic autonomy. The EU's lack of venture capital capacity, particularly in late-stage funding, partly explains why it lags behind in developing European alternatives to US or Asian technology companies. Furthermore, the involvement of non-resident investors may weaken the entrepreneurial ecosystem in the long term by encouraging start-ups and talents to relocate abroad (Braun et al., 2019).

The fragmentation of European capital markets presents a barrier to the development of continental-scale venture capital players. The European Commission’s action plans for the Capital Markets Union (CMU) aim to encourage an increase in the size of funds and the development of cross-border investments (particularly through the reforms of the EuVECA – European Venture Capital Funds – regulation of 2017 and 2019, the aligning of corporate insolvency regimes and a single European access point to company information). The number of cross-border venture capital deals in the EU thus grew sharply between 2019 and 2021 (Demertzis et al., 2022). Lastly, in order to promote this asset class, it is necessary to develop exit opportunities for investors, through the public listing of start-ups (IPOs) or their acquisition by larger companies.

The deepening and further integration of venture capital will help companies access capital within the EU (particularly companies supporting the green and digital transition), while strengthening the EU’s strategic autonomy. While public financial support, such as the European Investment Bank’s recent creation of a fund dedicated to scale-ups (companies in their late-stage development), plays an important role, it cannot substitute to private capital (see, for example, the German government’s new start-up strategy). Strengthening European venture capital will thus depend on the successful implementation of the CMU, targeted public financial support and, more generally, a more mature entrepreneurial and financial ecosystem.