- Home

- Publications and statistics

- Publications

- Central bank collateral policy and bank ...

Post n°66. Central banks have adopted new unprecedented strategies to fight recent financial crises. In the euro area in 2012, one such tool allowed banks to use a wider set of corporate loans as guarantees when they borrow from the Eurosystem. Two recent studies show that this policy has been critical in fostering banks’ lending to firms during the crisis.

Source: Cahn, Duquerroy and Mullins (2017).

Note: This chart plots the average growth rate in credit for firms that became eligible in February 2012 against ineligible firms rated one notch lower. The sample consists of independent, single-bank French SMEs.

During times of financial stress, such as the euro area in the latter part of 2011, the amount of liquidity available in the banking system is greatly reduced. To avoid a credit crunch, the central bank can act as the lender of last resort, lending central bank money (or reserves) to banks against adequate guarantees, referred to as collateral. The central bank therefore needs a collateral framework which defines the set of assets which are eligible as collateral and their associated haircuts. A notable feature of the Eurosystem’s lending operations is the large portion of non-marketable assets, including bank loans to firms, which are pledged as collateral, alongside more traditional, marketable assets such as government bonds. Between 2007 and 2011, the share of non-marketable assets over total pledged collateral increased sevenfold, from 3% to 23% (see, for example, Bignon et al., 2016).

However, in a time of financial stress, the collateral value of eligible assets in the banking system may decline due to falling valuations and rating downgrades. To smooth the effects of the crisis, the Eurosystem chose to accept a wider set of assets as collateral, by announcing the Additional Credit Claims (ACC) programme in December 2011, right after the introduction of two “long-term refinancing operations” (LTROs) of three year maturities. The measure aimed to ensure that euro area banks had enough collateral to borrow at this unprecedented long maturity. In France, the ACC programme was implemented in February 2012 and involved an unexpected extension of eligible collateral to the loans of medium-quality firms (with a maximum one year default probability of 1%).

Cahn, Duquerroy and Mullins (2017) and Mésonnier, O’Donnell and Toutain (2017) conducted two recent studies in order to investigate the impact of the ACC programme on bank credit supply to French firms. The first study measures the effects of the ACC on lending to independent SMEs and highlights the importance of the bank-firm relationship in the transmission. The second study quantifies the impact of the measure on the interest rate of loans offered to newly eligible firms and shows that the transmission is stronger for banks that pledge higher shares of corporate loans as part of their collateral. Overall, these studies are supportive of an active collateral channel of monetary policy transmission which allows the central bank to affect banks’ funding costs independently of its decision to change its policy rate.

How effective can a targeted collateral policy be in supporting bank lending?

Looking first at quantities lent to small and medium-size standalone firms, Cahn, Duquerroy and Mullins (2017) find evidence that collateral policy measures can be an effective tool to support bank lending to SMEs and reduce contagion during times of financial distress. The main hypothesis is that the ACC programme, by targeting the loans of specific firms, acts to reduce banks’ marginal costs in funding these loans. Banks should then adjust their corporate lending portfolio in favour of these newly eligible firms, thereby improving the financial outcomes of these firms.

The main result is that newly eligible, standalone SMEs experienced an 8% increase in borrowed credit, relative to non-eligible, but otherwise similar SMEs, in the year following the policy (see Chart 1). These firms also experienced lower likelihoods of payment defaults to suppliers (-1.5% of the amount of payables) and credit rating downgrades relative to those who did not. Interestingly, this effect is strongly driven by firms with single bank relationships. There is also suggestive evidence that during 2011, single-bank firms were substantially more credit constrained than firms with multi-bank relationships.

The results also reveal the transmission of the programme based on firm balance sheet characteristics. The effect is driven by single-bank firms with stronger lending relationships, and stronger observable characteristics, such as low leverage and high levels of tangible assets.

Demand for pledgeable collateral and the “eligibility discount”

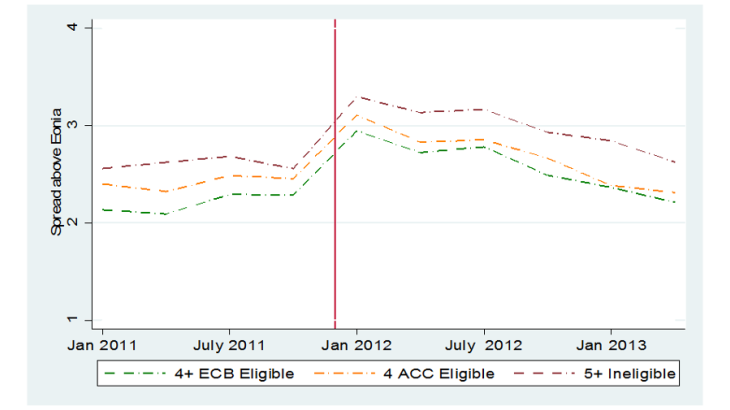

Mésonnier, O’Donnell and Toutain (2017) show that collateral eligibility may also impact banks’ loan supply due to their demand for pledgeable collateral. As a consequence, the loans of eligible firms may benefit from a relative reduction in their interest rates, an effect dubbed by the authors the “eligibility discount”. The authors find robust evidence of an eligibility discount for newly eligible, medium-quality firms. On average the relative loan spread offered to these firms decreased by 7 bps due to the programme relative to slightly higher quality eligible firms. Although it may look small in absolute terms, this reduction amounts to one third of the ex-ante average difference in interest rates between newly eligible firms and similar firms just one credit-notch above. Furthermore, the authors find that this eligibility discount is associated with a relative increase in the quantity of credit lent to firms affected by the programme. The combination of both a lower interest rate and an increase in the quantity lent is indicative that the ACC programme succeeded in supporting bank credit supply.

Note: This chart plots the average spreads for firms which are eligible (4) for the ACC programme compared to firms already eligible (4+) and firms which are never eligible (5+).

Next, the authors examine how the effect of the programme differs across banks. There are several reasons why banks may react differently to the programme. Firstly, banks may have different liquidity or collateral needs, therefore banks which are more constrained ought to benefit more from the programme. Secondly, some banks may find it more advantageous to pledge credit claims as collateral rather than marketable assets. This may reflect differences in business models or informational advantages in issuing loans. The authors find that the average eligibility discount is mainly driven by the response of the banks which, prior to the programme, pledged higher shares of credit claims as part of their collateral with the Eurosystem. By contrast, no effect is found that results from banks' ex-ante capitalisation, or from the collateral-strain potentially induced by their LTRO-uptakes. This suggests that it is the banks that faced the lowest opportunity cost in pledging credit claims, which benefited most from the programme.

Together, these studies show that an extension of eligible collateral to the loans of firms, most of which are SMEs, enhances the monetary policy transmission channel by allowing these firms to borrow more and at cheaper rates. However, collateral policy not only affects the assets which become eligible, but also the counterparties which hold these assets. Therefore, an active collateral policy can be an effective alternative tool for reducing banks funding costs, especially at times when conventional monetary policy hits its zero-lower bound.

Updated on the 25th of July 2024