The European Union (EU) has enacted recent legislation aiming at increasing the security of its supplies in critical raw materials (CRM) and make itself more strategically autonomous (Critical Raw Material Act, 2024). While the energy transition will require large quantities of CRM, mining and processing of CRM is geographically concentrated in countries that are geopolitically distant from the EU. For instance, 73% of all cobalt is mined in the Democratic Republic of the Congo (DRC), 69% of rare earth elements are mined in China and half of the global nickel supply is mined in Indonesia (USGS, 2023). The concentration of supply raises concerns that dominant countries may use their market position as leverage to pursue other strategic priorities, highlighting an urgent need to strengthen the EU’s raw material strategy.

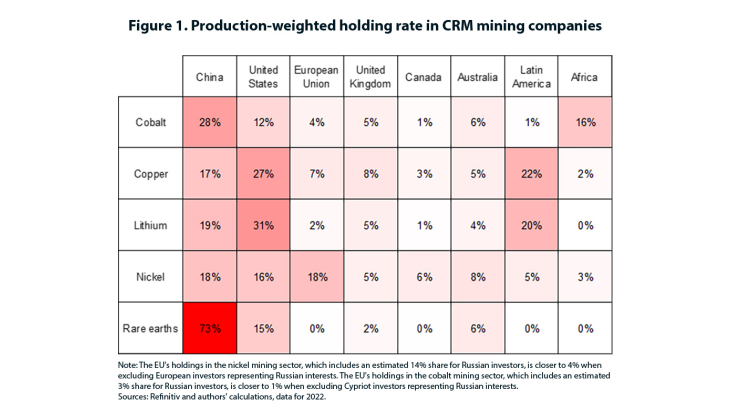

Against this backdrop, this paper analyzes who controls the capital of global listed companies involved in the mining of CRM. While the geographical concentration of resources is well documented, the ownership interests in extractive companies is less so. Yet documenting the sources of control of mining companies is essential for assessing strategic dependencies. We fill a gap in literature by designing a comprehensive database documenting the origin of shareholders of global listed companies involved in the mining of cobalt, copper, lithium, nickel and rare earths. We develop several indicators to map the geographical origin of capital-owners, including production- and market capitalization-weighted holding rates, complemented by indicators focused on majority holdings. All indicators suggest that non-EU investors control a significant share of the capital of CRM listed mining companies. Figure 1 summarises ownership rates by investor origin for the five selected metals.

China’s leading position is especially notable in the extraction of rare earths, cobalt and, to a lesser extent, lithium. By contrast, European investors hold limited stakes in CRM mining companies. The EU’s relatively high stake in the nickel sector partly reflects investments located in Cyprus representing Russian interests. Besides China, investors from the United States also have significant holdings, especially in the lithium and copper sectors. Although Latin American investors hold a significant share of the capital of firms producing lithium and copper, they are underrepresented with respect to the region’s share of global production. The weight of Australian investors is also relatively limited for lithium, given the importance of the country’s lithium resources. While Australia accounts for half of the world’s lithium production (USGS, 2023), two of its biggest lithium mines are owned by Chinese companies. Hence, we highlight the discrepancy that can prevail between the geographical concentration of production and that of investors analysed through firm ownership. US investors, and, to a lesser extent, EU and UK investors, play a higher role in the copper and lithium supplies, compared with the production located in their respective countries. By contrast, Chinese investors have significant stakes in nickel and cobalt companies, while these minerals are predominantly mined in Indonesia for nickel and the DRC for cobalt. In contrast, for rare earths, production and capital ownership are aligned, with both the US and China being major producers and investors.

We also document the preponderance of strategic investors such as state-owned enterprises in the ownership of firms involved in the mining of rare earths, and, to a lesser extent, in the mining of cobalt, lithium and copper. Our results suggest that Chinese investors are overwhelmingly strategic investors, which concurs with literature. Strategic investors also play an important role in the exploitation of lithium and copper resources located in Latin America.

Overall, our analysis underpins the need to enhance the EU’s strategic autonomy and suggests the need for a metal-specific strategy. In particular, the database could be valuable for informing investment decisions, should European entities wish to increase their shareholdings in major CRM firms.

Keywords: Energy Transition, Critical Raw Materials, Geo-Economic Fragmentation, Ownership, Economic Security, Strategic Autonomy

JEL classification: Q02, Q5, Q42, L72, G3, Q3