Interventions on the foreign exchange market are important. Most central banks still follow exchange rate objectives and over 80% of countries are on fixed exchange regimes. Japan recently renewed with a long tradition of interventions to try to prop up the yen, spending $36bn in a day. Yet, practitioners and academics disagree on the effectiveness of interventions. Our understanding of central bank interventions is limited, as interventions are often endogenous to market conditions; a central bank intervenes in reaction to a market shock. Here I identify these market shocks at a daily frequency to better measure the impact of interventions on exchange rates. To identify these shocks, I analyze narrative evidence about market conditions written by Bank of England officials. I clearly identify days when the currency is hit by negative news that are not related to the intervention of the central bank. I get this measure by analyzing the text from the daily reports written by Bank of England employees. To test the robustness of my narrative analysis, I rely on both an external assessment and machine learning in the form of Natural Language Processing (NLP).

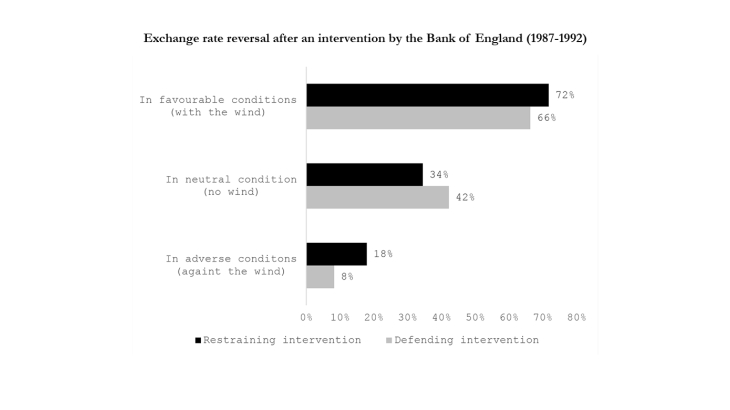

I find that when discounting for operations not meant to impact the exchange rate, the Bank of England is only successful around 8% of the time (chart below). That is when it is trying to make the exchange rate appreciate against a bearish market (going “against the wind”). These are times when interventions really matter. This complements other studies in the literature that find higher success rates, without accounting for market news. Fratzscher et al. (2019) find success rates of over 80% when central banks aim to manage volatility. Their study is the most comprehensive attempt to understand foreign exchange interventions to date. Presenting evidence from 33 countries, they argue that central bank interventions were effective in attaining the goals set by policymakers from 1995 to 2011. The paper does an excellent job at analyzing new data, but like most papers on the topic does not offer a bulletproof identification strategy.

More than half of the interventions considered successful using the previous standard methodologies no longer count as successful with my approach. When measuring whether good or bad news (independent from central bank interventions) was circulating on a given day, success drastically changes. Intervention is particularly ineffective when attempting to reverse the direction of the exchange rate after negative news affecting the currency. Another finding is that Bank of England intervention was more effective when trying to tame the appreciation of sterling (“restraining intervention”) than when trying to avoid a depreciation of sterling (“defending intervention”). This makes intuitive sense. Markets are more likely to believe a central bank with unlimited domestic currency it can print than a central bank with scarce dollar reserves.

The main contribution of this paper is to show that by not accounting for intraday news, most papers on intervention effectiveness provide biased estimates. An intuitive example allows us to understand this shortcoming and how this paper deals with them. Imagine that today, the People’s Bank of China (PBOC) was trying to make the renminbi appreciate through foreign exchange intervention. At 10am, they buy renminbi with their dollar reserves, hoping this will bolster the renminbi’s price. Now imagine that an hour later at 11am, the American administration announces dropping planned tariffs, sparking a stark appreciation of the renminbi. Most studies on intervention would simply assume that the 10am interventions were successful, completely ignoring the news later which change the direction of the exchange rate. In other terms, they assume that any interventions during that day were going against the wind. That is, that they were going against the market. These studies would count this intervention as successful. My narrative approach accounts for other news during the day to assess whether the intervention was really going against the wind, or if it merely happened to go in the same direction as the market.