- Home

- Publications and statistics

- Publications

- Banque de France Annual Report 2022

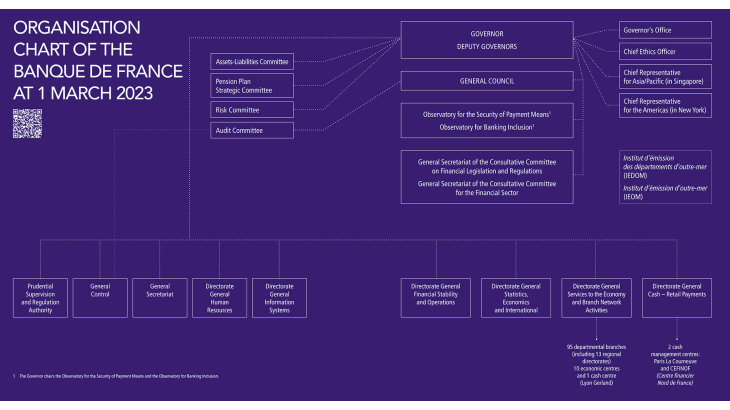

The Annual Report describes the action taken by the Banque de France over the year to fulfil its three core missions: monetary strategy, financial stability and services to the economy and society. It presents the work of the women and men that make up the Bank’s staff, placing particular emphasis on corporate social and environmental responsibility. The final section provides details of the Bank’s financial management and its financial statements for the year.

Governor's foreword

By François Villeroy de Galhau

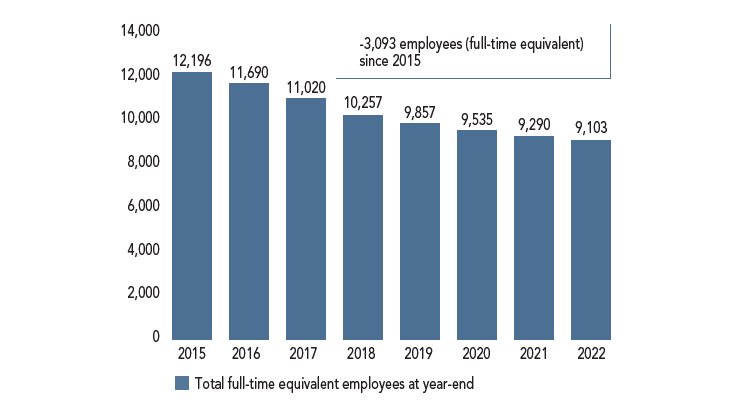

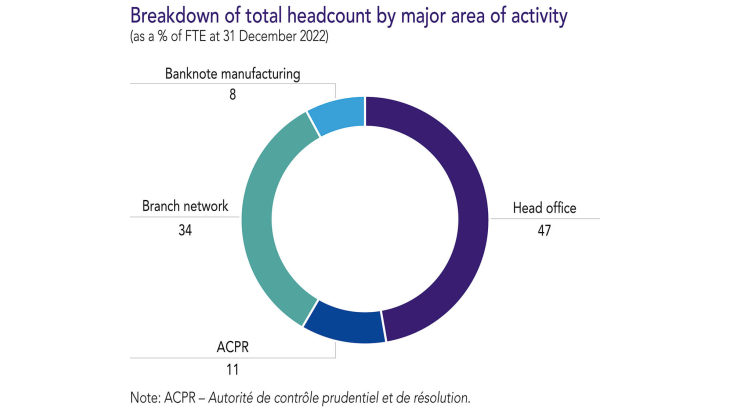

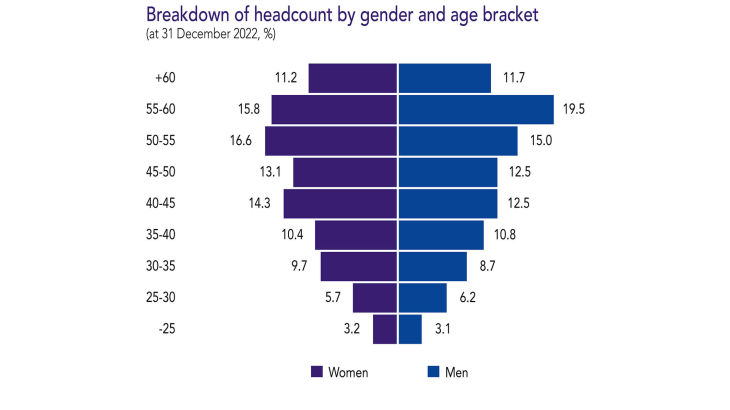

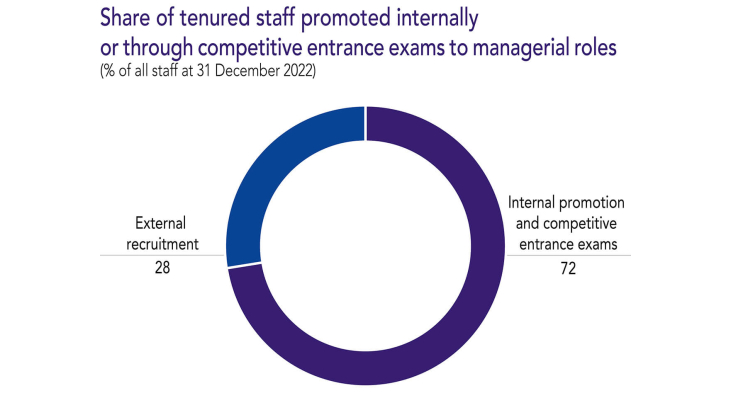

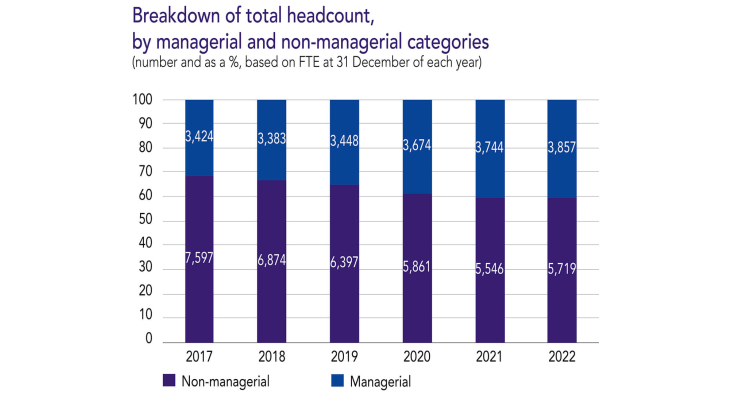

Our country and our continent were severely tested in 2022 by the outbreak of war on Europe's borders, which triggered an energy crisis and set off a chain-reaction of economic effects. The Banque de France acted forcefully to cushion the resulting difficulties and fight inflation. However, to keep the economy on a favourable course, sustainable adjustments to adapt to the new situation are even more critical than protections. The challenge facing us is therefore to achieve three key transformations: the energy and climate transformation, the digital transformation and the transformation of work. This annual report pays tribute to the hard work done in pursuit of this goal by the more than 9,000 women and men who make up the Banque de France’s staff. Despite popular beliefs about the “comfortable” position of public servants, our staff were once again presented with unprecedented challenges in 2022 and responded with resolve and innovative solutions. We will continue to demand the very best from them – such high standards are at the core of public service. In 2022, we also hired more than 500 new employees, invested in our IT system and property, supported career advancement and recognised performance. We extend our warmest thanks to every single member of our personnel.

"The Banque de France is adapting, changing and providing support, as it works to serve the people of France"

A major highlight of 2022 was the economy’s resilience to the consequences of Russia's invasion of Ukraine. In 2022, French growth turned out to be better than feared, reaching 2.6%, although the pace slackened markedly towards the end of the year. The euro area as a whole likewise showed resilience and recorded a 3.5% expansion. However, after a decade of overly low inflation and even a risk of deflation in 2020, inflation made a comeback. At 5.9% in France on an average annual basis, and 8.4% for the euro area, it is above our target and the top concern of our fellow citizens. A firm monetary policy response was needed to counter the spread of higher energy and food prices to many economic sectors, because entrenched inflation would be the worst enemy of confidence and hence of growth. Our monetary strategy commitment is to bring inflation back towards 2% by end-2024 to end-2025, i.e. over a two-year horizon, which is how long it takes for monetary policy to have its full effect. This approach delivered a rapid increase in interest rates, which rose from –0.5% in the first half of 2022 to 3% by March 2023. Higher rates are being passed on to financing conditions in a gradual and orderly manner.

The French financial system proved resilient to the risks posed by the economic slowdown and capable of financing the economy under good conditions. This financial stability made it possible to absorb the shocks linked to intensified geopolitical risks, to be stronger in the face of cyber threats, while incorporating extra-financial information aimed at promoting sustainable financing. In the financial sector, we also provided support for the digital transformation, with the goal of fostering innovation while maintaining fair and safe access for consumers. However, in view of the disrupted developments that have characterised the crypto-asset markets, extreme vigilance continues to be required. The Banque de France and the Autorité de contrôle prudentiel et de résolution (ACPR – Prudential Supervision and Resolution Authority) are advocating for coordinated regulation at international level, according to the “same activities, same risks, same rules” principle. In 2022, we also continued to lay the groundwork for the potential currency of the future, the digital euro, which would work alongside banknotes, offering a new payment solution.

The Banque de France differs from the other main central banks in terms of the importance of its mission providing services to the economy and society: the work that we do locally with households and companies includes managing household debt resolution applications, ensuring access to basic bank accounts and means of payment, company rating and credit mediation. We also continue to make digital diagnostic tools available to companies. The war in Ukraine was a stark reminder of the urgent need to reduce our reliance on fossil fuels and therefore make a successful energy transition. To support the economy in this transformation, we are developing a climate indicator to measure the progress made by companies in the climate transition.

Implementation of Building 2024 Together, our strategic plan, will safeguard our ability to fulfil our missions and innovate. As 2022 drew to a close, we updated our plan to prioritise the inflation challenge and consolidate our activities around four key goals: Anchor stability; Anticipate innovation; Accompany our fellow citizens; Attract talent. Backed by the women and men of both the Banque de France and the ACPR, we share the goal of building one of the Eurosystem's best central banks and one of our country's finest public services. In these times of great uncertainty, we are resolved, more than ever, to be a trusted institution in the service of the people of France.

La Banque de France est une institution indépendante chargée de 3 missions essentielles : 👉 La stratégie monétaire : contribuer à définir la politique monétaire de la zone euro et la mettre en œuvre en France. 👉 La stabilité financière : contrôler les banques et assurances, veiller à la maîtrise des risques et assurer le bon fonctionnement et la sécurité des paiements. 👉 Les services à l'économie et à la société : proposer de nombreux services à l'économie, aux particuliers et aux entreprises. Elle est membre de l’Eurosystème, organe européen qui regroupe la Banque centrale européenne et les banques centrales nationales des pays ayant adopté l’euro pour monnaie.

Rapport annuel 2022 | Banque de France

2022 key figures

The Banque de France in 2022:

3

missions: monetary strategy, financial stability, services to the economy and society

5

values: independence, expertise, sustainable performance, openness, solidarity

105

permanent sites

9,103

full-time equivalent employees

2022 was marked by the war in Ukraine and its impacts in Europe, which affected the wider economy and fuelled considerable uncertainty. Although barely out of the Covid crisis, France showed strong resilience, as growth reached 2.6% and the unemployment rate fell to 7.2%. However, France's government debt stood at 112% of GDP and inflation averaged 5.9%.

In the face of this mixed situation, and against a backdrop of environmental and social concerns, what action did the Banque de France take?

1. Support for the economy through monetary policy

- Increase in energy prices and spread of inflation to other sectors

- Acceleration in inflation

- Resilient activity in France

- Policy normalisation: a forceful response to bring inflation back towards 2%

- Securities purchase programmes halted

- in April for the pandemic emergency purchase programme (PEPP)

- in July for the asset purchase programme (APP)

- recalibration in October of the conditions for targeted longer‑term refinancing operations (TLTROs)

- Increase in policy rates

- On 21 July, the Eurosystem officially stopped providing forward guidance on policy rates

- More responsive monetary policy, with decisions taken according to a meeting-by-meeting approach

- July: initial increase of 50 basis points (bps), or 0.5%

- September: 75 bps increase

- November: 75 bps increase

- December: 50 bps increase

- This raised the deposit facility rate to 2.00%

- Normalisation of financing conditions

1.3%

Interest rate on bank loans in December 2021 (non-financial corporations)

3.2%

Interest rate on bank loans in December 2022 (non-financial corporations)

1.1%

Interest rate on bank loans in December 2021 (French households)

2. Resilience of the French financial system

- War in Ukraine: contribution of technical and operational expertise to prepare and implement financial sanctions against Russia

- Energy crisis: enhanced oversight of French participants’ exposures to these markets

- Cyber risk: proactive role in implementing Europe’s Digital Operational Resilience Act (DORA)

- Uncertainty of the macroeconomic and financial environment: banks and insurers are sound, but precautions required

3. Digitalisation of finance

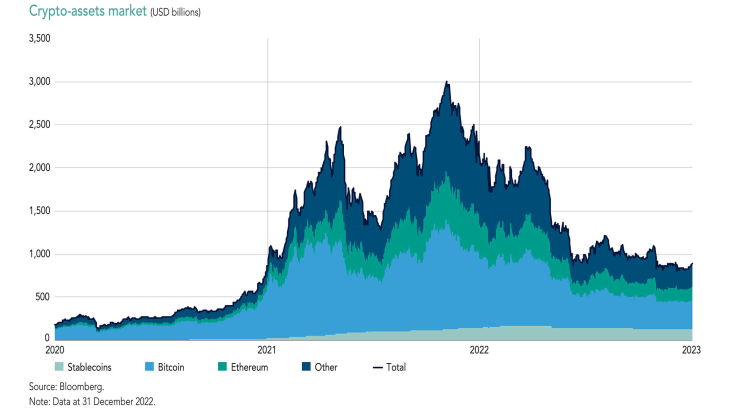

- The crypto-asset market shrank by a factor of around three relative to its peak in November 2021: USD 800 billion in capitalisation

- The European Union adopted its first crypto-asset regulation: Markets in Crypto-Assets (MiCA) Regulation

- Continued work by the Eurosystem on a central bank digital currency (CBDC)

4. The climate transition challenge

- The Banque de France and the ACPR are stepping up the attention paid to climate change-related risks

- The exercise by the Single Supervisory Mechanism (SSM) underlined the need for banks to accelerate efforts to develop their climate stress testing frameworks

- The European Insurance and Occupational Pensions Authority (EIOPA) conducted its first climate stress test

- First supervisory work on environmental, social and governance (ESG) disclosures by financial institutions, in accordance with European and French obligations

- Goal of redirecting capital flows to sustainable economic activities by enhancing the disclosures provided to retail investors on the ESG characteristics of investment vehicles

5. Supervision of market practices for consumer protection

- Key inspections in 2022:

- Procedures used to market life insurance contracts

- Fees charged to retail investors

- Compliance with the cap on bank fees charged to customers for account-related incidents

- Freedom to choose loan insurance for housing loans

- Joint unit with the Autorité des marchés financiers (AMF)

- Assurance Banque Épargne Info Service website: over 2 million pageviews

1,135

unauthorised websites or firms included on blacklists

6. Nationwide public service for households and companies

• Support for businesses

22

levels of risk (new rating scale)

308348

non-financial corporations rated (chiefly SMEs)

2,180

applications for credit mediation

10,232

jobs saved at 860 companies

1,000

start-ups provided with financing support

• Protection of financially vulnerable people

113081

applications for debt resolution

800k+

Over 800,000 people eligible for special “vulnerable customer” solutions

6m+

Over 6 million customers eligible for cap on incident-related fees

• More accessible communication

500000

viewers on internet and social media for the Monetary Policy Forum

9m

pageviews for our financial education resources (EDUCFI)

650

workshops for 5,300 young people enrolled in employment integration programmes at over 200 organisations

80,000

high school students received EDUCFI “passports” after completing financial literacy training

114

workshops organised for 1,200 people with literacy difficulties

2022 key figures

1. Monetary strategy

Our missions

1. Maintain a stable currency, which is an important public good:

- by participating in preparing monetary policy decisions by the Governing Council

- by implementing monetary policy decisions

- by analysing statistics and preparing economic forecasts to provide valuable insights

2. Maintain confidence in the currency in all its forms:

- by printing the Europa series of banknotes, which include innovative security features

- by putting banknotes into circulation and maintaining banknotes and coins

- by ensuring security and driving innovation for all payment instruments

- by maintaining central bank money as the anchor of the payment system

3. Consolidate our position as the central bank for markets:

- by managing the state’s foreign exchange reserves

- by ensuring the smooth functioning of capital markets, so that the Paris financial centre is secure and efficient

2022 in pictures

Quelles sont les projections des principaux indicateurs macroéconomiques français pour la période 2022-2025 ?

Chaque trimestre, la Banque de France publie ses projections macroéconomiques pour la France sur un horizon de 2 à 3 ans. Découvrez toutes les projections réalisées par les experts de la Banque de France dans cette vidéo séquencée en quatre parties.

La publication comporte une projection des principales grandeurs macroéconomiques (PIB, consommation, exportations etc.), du marché du travail (emploi et chômage), de l’inflation et des finances publiques, ainsi que des encadrés qui détaillent des questions spécifiques liées à la projection. Les projections contribuent au diagnostic macroéconomique indispensable pour la mise en œuvre de la politique monétaire.

0:16 Marion Cochard – adjointe à la cheffe de service des finances publiques – explique l’impact du prélèvement extérieur et l’évolution des finances publiques.

1:49 Matthieu Lemoine – chef du service d’analyse macroéconomique et des prévisions – présente les projections sur la croissance du PIB jusqu’en 2025.

2:40 Guy Lévy-Rueff – directeur de la conjoncture et des prévisions macroéconomiques – revient sur l’inflation et l’évolution de ses composantes.

4:46 Guy Lévy-Rueff propose un zoom sur les projections des salaires à l’horizon 2025.

Projections macroéconomiques France 2022-2025 (décembre 2022) | Banque de France

Other highlights:

- 31 March: End of asset purchases under the pandemic emergency purchase programme (PEPP).

- 9 June: The Governing Council decides to end purchases under the asset purchase programme (APP) on 1 July.

- 12 July: Publication of the Governor's letter to the President of the Republic, entitled How can we reduce inflation?

- 27 July: First policy rate increase (50 basis points, bps).

- 27 August: Speech by the Governor at Jackson Hole, entitled “Monetary policy post-pandemic – balancing between science and art, predictability and reactivity”.

- 14 September: Second policy interest rate increase (75 bps).

- 11 October: Speech by the Governor at Columbia University, entitled “What monetary policy narrative after forward guidance?”

- 2 November: Third policy interest rate increase (75 bps).

- 21 December: Fourth policy interest rate increase, raising the deposit facility rate, the main refinancing rate and the marginal lending facility rate to 2.00%, 2.50% and 2.75% respectively.

2.6%

French GDP growth (annual average rate)

5.9%

French HICP inflation (annual average rate)

8.4%

Euro area HICP inflation (annual average rate)

2.05%

Average interest rate on new housing loans in December

4

rises in central bank key interest rates

Normalising monetary policy to return to price stability

After a vigorous economic recovery in 2021, the surge in energy prices triggered by the invasion of Ukraine caused inflation to accelerate on a scale not seen in decades. In response, the Eurosystem, of which the Banque de France is a member, normalised monetary policy by halting its asset purchase programmes and raising interest rates.

1. Despite Russia's invasion of Ukraine and the sharp upward surge in prices, economic activity held firm in 2022

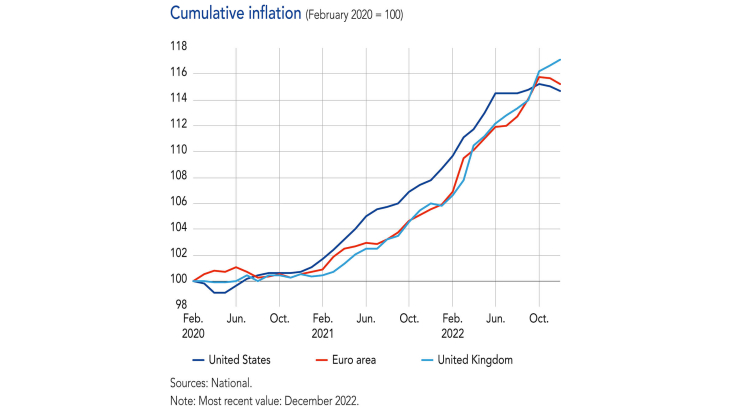

Prices climbed in 2022 at a pace not seen in decades, in both the United States and the euro area. In the previous year, inflation was initially driven by supply-side disruptions linked to the Covid-19 pandemic. In 2022, the massive increase in energy prices that followed Russia's invasion of Ukraine spread to goods and services.

A widespread return of inflation

Widespread inflation in the United States, euro area and United Kingdom

The post-Covid economic recovery drove up oil and commodity prices and created supply-side bottlenecks, which caused prices to start climbing globally from mid-2021. These factors, which remained present in the first half of 2022, were then amplified by the energy crisis following Russia's invasion of Ukraine on 24 February.

In the United States, the initial demand shock that caused inflation to begin picking up again in 2021 is fading. Ongoing monetary tightening and slackening demand combined to slow the pace of increase in energy and goods prices, and inflation appeared to peak at the start of the summer of 2022.

In the euro area, inflation primarily linked to imports in 2021 suffered an additional shock in 2022 when Russia invaded Ukraine, which pushed food, gas and electricity prices upwards. While inflation is still mainly imported, service prices have gone up, moderately for now, but the pace could accelerate in the coming months. Forecasts indicate that euro area inflation will peak in the first half of 2023.

The United Kingdom is also experiencing an inflationary shock due to higher energy and food prices and the tight labour market, which is leading to sharp wage gains.

In the United States, the euro area and the United Kingdom alike, by the end of 2022, the general level of consumer prices had increased by approximately 16% since February 2020.

Euro area activity in 2022 and outlook

In 2022, euro area economic activity was deeply affected by countervailing forces. On the one hand, the resumption of some activities, particularly in the service industry, such as accommodation, catering and tourism, supported growth and employment through to the third quarter, especially in economies in the Mediterranean region. On the other, the surge in energy prices (chiefly gas and electricity) undermined household confidence and fuelled considerable uncertainty in the business sector.

Driven initially by energy prices, inflation rose steadily over the year, spreading to other consumer items, including food, manufactured goods and services, owing to higher input costs and wages. In 2022, headline inflation and core inflation, which excludes food and energy, reached levels not seen since the euro was introduced, at 8.4% and 3.9% respectively.

Although significant fiscal measures were deployed to support purchasing power, household consumption and business investment stalled in the last months of 2022. And while euro area growth was elevated overall, at 3.5% in 2022, activity was flat in the fourth quarter, with an expansion of just 0.1%.

Activity is expected to continue to decelerate in early 2023, before picking up again towards the middle of the year. It should be buoyed by the upturn in investment, with support from the Recovery and Resilience Facility, and by the global economic rebound. The euro area economy is expected to expand by 0.5% in 2023, according to the Eurosystem’s projections for December 2022. After dropping by more than 2 percentage points, meanwhile, inflation is expected to stand at around 6% in 2023 and is projected to remain above the 2% target in 2024.

In France: activity held firm in 2022 and is expected be robust in 2023

Activity held firm in 2022

GDP growth remained sustained in France in 2022, at 2.6% on an annual averagel basis, owing to a strong post-Covid bounce that began in the second half of 2021. With the lifting of the last remaining health restrictions, which benefited several economic sectors, including market services, GDP rose by 0.5% in the second quarter of 2022, then by 0.2% in the third. Activity subsequently slowed in the fourth quarter, when it grew by 0.1%.

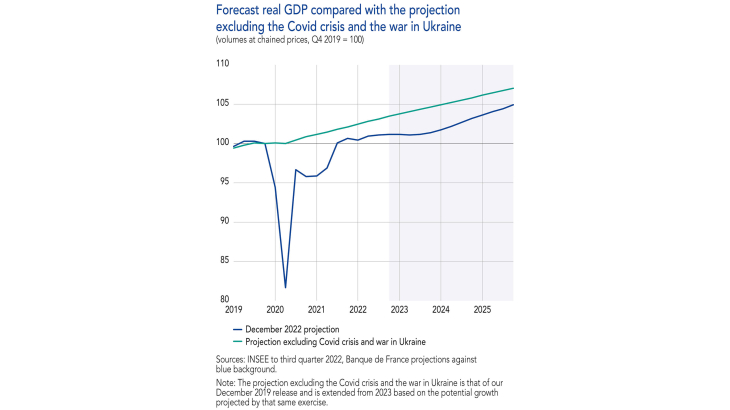

A slowdown expected for 2023, followed by recovery in 2024-25

Activity is expected to slow markedly in France in 2023, with annual GDP growth of 0.3% according to our December 2022 projections. Despite strong government support for household purchasing power, domestic demand components are set to be adversely affected by the external shock caused by the war in Ukraine. Indeed, with the shock spreading to overall prices, inflation is expected to remain at an elevated level in 2023, peaking in the first half, which will depress purchasing power and, hence, consumption. The high level of inflation will also contribute to eroding corporate profit margins, which will in turn lead to a pronounced slowdown in employment. However, this projection is subject to considerable uncertainty, as reflected in the -0.3%/+0.8% range for our growth projections. A recession cannot therefore be ruled out. However, if one were to occur, it would be small and short-lived.

Once the peak of the strain on commodity prices and energy supplies passes, a recovery phase is forecast to begin in 2024, when annual GDP growth is expected to reach 1.2%. This expansion should gain strength in 2025, with GDP gradually moving back towards its pre-Covid trend, although a substantial gap remains relative to the trend at the end of the projection horizon.

2. Our efforts to bring inflation back towards the 2% target

Fighting inflation is our responsibility and the primary objective of our mandate

The Eurosystem’s objective is to maintain price stability, i.e. inflation of 2% over the medium term.

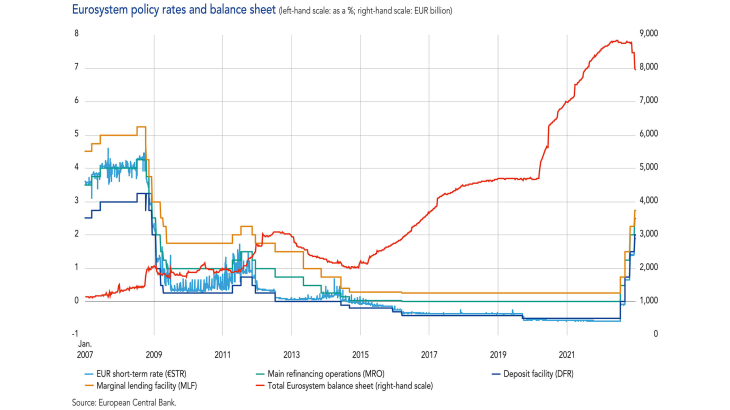

Deflationary risks between 2014 and 2021, which were exacerbated by the Covid pandemic in 2020, required a highly accommodative monetary policy:

- interest rates were cut to historically low levels to provide favourable financing conditions to households and companies;

- Eurosystem central banks set up asset purchase programmes to inject the liquidity needed for the economy to function properly.

In 2022, as inflation made a resurgence and spread to many goods and services, with the above-mentioned consequences in terms of reduced household purchasing power and corporate profitability, a resolute response was needed – and continues to be needed – to bring the level of inflation back towards 2%. This led to a change in the monetary policy stance from that which had been pursued up to that point for almost a decade. The normalisation of monetary policy in 2022 was the first stage in the fight against inflation. It will be followed by a second stage in 2023, with more rate hikes and measures to shrink the Eurosystem's balance sheet.

Withdrawal of non-standard measures and policy rate hikes

In 2022, the Eurosystem's monetary policy actions initially involved the gradual withdrawal of the support measures first introduced in 2015 to combat too low inflation and then strengthened in 2020 to offset the adverse impacts of the health crisis on the economy and inflation. Net asset purchases were halted in April for the pandemic emergency purchase programme (PEPP) and in July for the asset purchase programme (APP).

Targeted longer term refinancing operations (TLTROs) were recalibrated in October, helping to normalise bank financing costs and removing deterrents to voluntary repayment of these operations. Reducing outstanding TLTROs plays a part in reducing the size of the Eurosystem's balance sheet.

In addition, on 21 July, the Eurosystem officially stopped providing forward guidance on policy rates. Faced with geopolitical and economic uncertainty, we moved to a more responsive monetary policy, with decision-making carried out on a meeting-by-meeting basis using an analysis of changes in economic indicators.

The gradual cessation of non-standard measures was followed an increase in policy rates. An initial hike of 50 basis points (bps), or 0.5%, took effect on 27 July, ending almost a decade of negative policy rates. This was followed by two further 75 bps increases, on 14 September and 2 November respectively, and an additional 50 bps hike on 21 December, bringing the deposit facility rate to 2.00%.

A monetary strategy deployed in stages

By ceasing asset purchases – and hence the expansion of its balance sheet – and then gradually raising policy rates, the Eurosystem ended the exceptional monetary accommodation that characterised the years of excessively low inflation and that provided extremely favourable financing conditions. At end-2022, the deposit facility rate reached a level considered to be that of a nominal “neutral rate”, i.e. the theoretical equilibrium rate at which inflation neither accelerates nor decelerates.

Policy rates are the primary instrument used to implement the Eurosystem's monetary policy stance. At its meeting of 15 December 2022, the ECB Governing Council decided, based on upward revisions to the inflation outlook, to continue to raise interest rates significantly and regularly. The aim is to achieve levels that are sufficiently restrictive to ensure a timely return of inflation to the 2% medium-term target. Keeping interest rates at restrictive levels will over time reduce inflation by dampening demand and will also guard against the risk of a persistent upward shift in inflation expectations.

At the same December meeting, the Governing Council also announced that from the beginning of March 2023 onwards, the portfolio of assets acquired through monetary policy operations would begin declining at a measured and predictable pace.

3. After being exceptionally favourable for some time, financing conditions are normalising

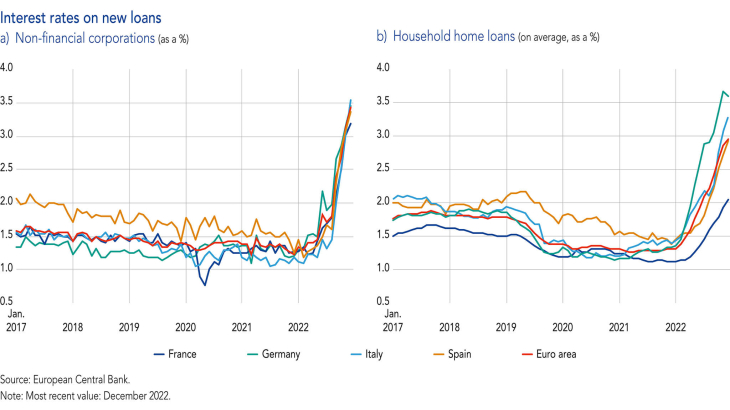

Interest rates on loans to individuals and companies are rising gradually from record low levels

After several years of historically low nominal and real interest rates, bank rates rose gradually in 2022.

The cost of bank loans to non-financial corporations increased in France by approximately 191 bps between December 2021 (1.3%) and December 2022 (3.2%), which was less than in Germany (225 bps) and Spain (213 bps). The cost of market financing for companies rose faster than the cost of bank financing in 2022, especially for large businesses.

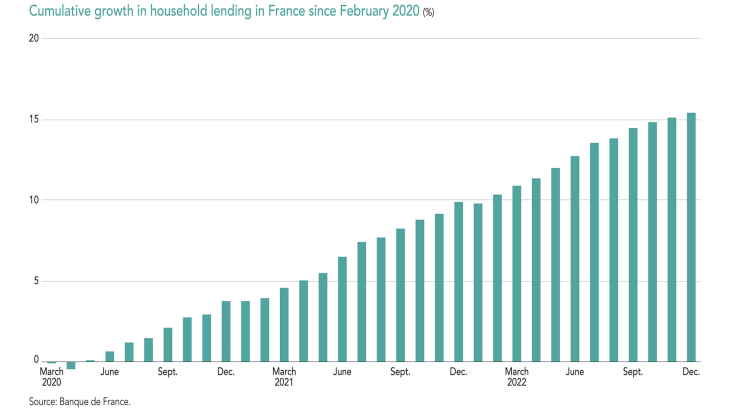

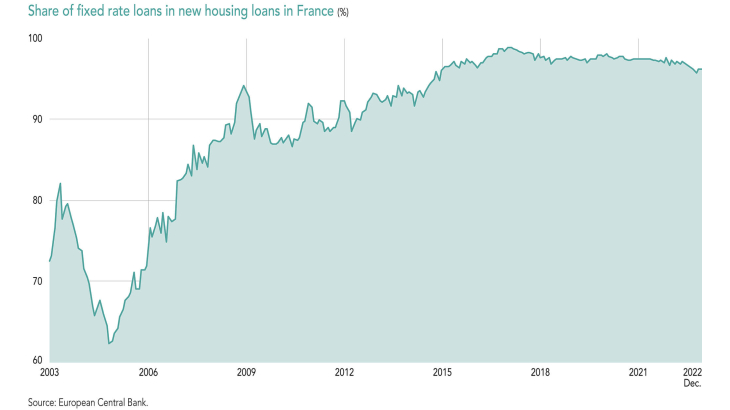

The cost of bank loans to French households went up at the same time. From a low of 1.1% in December 2021, the average interest rate on housing loans reached 2.05% in December 2022, which was a far more gradual increase than that seen in other European countries. The increase only affected new loans, as existing housing loans are virtually all at fixed rates.

The increase of recent months, which has generally been more gradual and smaller than in other European countries, has brought interest rates closer to their medium-term average, reflecting the return to a normalised situation.

Households and companies show good resilience to the energy shock

On behalf of the government, the Banque de France manages the overindebtedness procedure, which seeks to provide solutions to difficulties experienced by overindebted individuals. In this capacity, the Bank uses data that enable it to assess the financial position of households. In 2022, the number of applications for household debt resolution fell compared with 2021, confirming the trend decline in these challenging situations (see Chapter 3: "Services to the economy and society").

In 2022, companies also made less use of credit mediation services than in 2021. However, we must remain on our guard: the net debt of French companies, measured by total bank loans and debt securities minus cash (including the securities of collective investment schemes), gradually rose by approximately EUR 83 billion in 2022 (cumulative, over 12 months). This growth reflects increased take-up of equipment loans, but also the reduction in cash reserves built up during the Covid period.

4. Currency in all its forms

Launch of the National Payments Committee and creation of the Directorate General Cash – Retail Payments

The National Payments Committee (CNMP) was established on 4 October 2022. It coordinates organisations and innovation relating to all payment instruments, including cash. It is chaired by the Banque de France and brings together representatives of government, the payment industry, consumers and merchants.

The committee has already issued recommendations to ensure that disabled or digitally excluded people have access to inclusive and high-quality payment instruments.

A Directorate General Cash – Retail Payments was set up to act as a hub for all the staff that work with retail payment instruments, from printing banknotes and issuing and maintaining euro banknotes and coins in circulation, to conducting research and supervising cash and non-cash payment instruments, such as payment cards, credit transfers, direct debits, cheques and digital currency. With the support of its staff, whose expertise and innovative capabilities are widely recognised, the new Directorate General will execute the Bank's task of making sure that people can exercise their freedom to choose from a range of accessible, safe and modern payment instruments, which will maintain confidence in the currency.

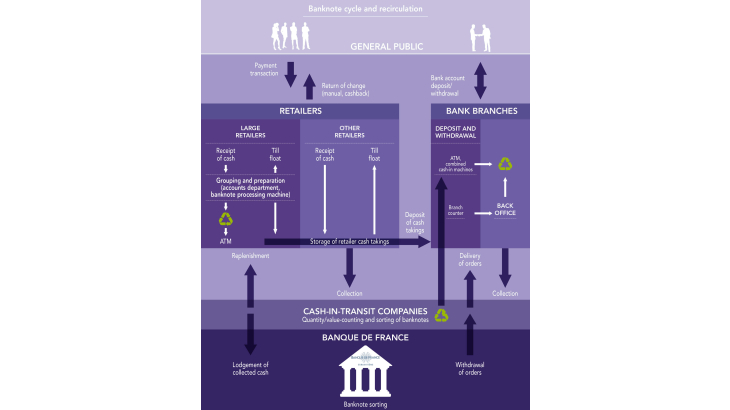

Banknote manufacturing and quality of cash in circulation

The Banque de France plays a leading role in manufacturing banknotes for the Eurosystem. It also prints banknotes that circulate in over 20 countries and provides advisory and support services in the area of banknote expertise and currency issuance. In 2022, it printed over one billion euro banknotes (€5, €20 and €50 denominations). It also delivered around two billion banknotes in other currencies to major foreign central banks.

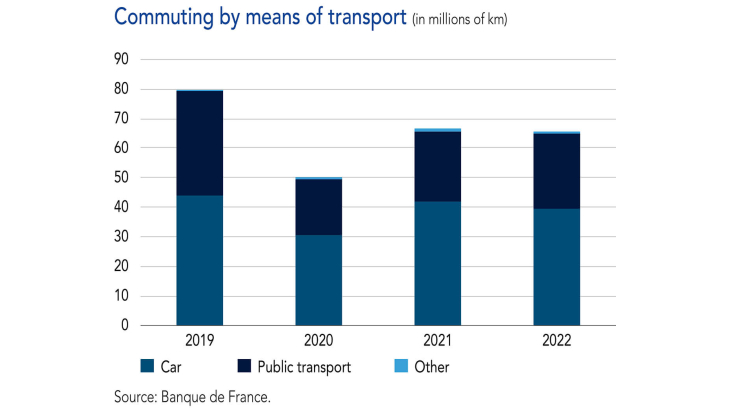

The findings of the SPACE II survey released in late 2022 showed that cash remains the most widely used means of payment in the euro area, although its share of the total is shrinking. In France, the share of cash payments in shops fell from 57% of transactions in 2019 to 50% in 2022.

Under its national cash management strategy, the Banque de France enhanced its nationwide organisation in 2022. Acting in partnership with cash-in-transit companies, it set up auxiliary banknote storage facilities across the country to help the cash industry operate even more efficiently.

Getting ready for the digital euro

In July 2022, the Eurosystem set out the main goals that could justify introducing a digital euro. This new euro, which would be made available to the general public, would be a central bank currency for the digital era. It would thus help to preserve the anchoring role of central bank money. A digital euro could also help to strengthen Europe's economic efficiency and strategic autonomy.

The Governing Council validated guidelines on certain design features that would contribute to the achievement of these objectives, in parallel with the forthcoming European legislative work on the legal basis and characteristics of this new form of public money. To ensure that the digital euro is integrated into the existing payments ecosystem, it would be distributed by approved payment services providers, including commercial banks, which would handle the management of future digital euro accounts or portfolios and customer relations. In addition, steps would be taken to affirm the digital euro's role as a payment instrument and not an investment asset. For example, holding caps would be established, as they are with Livret A passbooks in France.

The Eurosystem's investigation phase will continue until the end of 2023. At that point, the Governing Council will decide whether to move on to the realisation phase. This phase, which would last approximately three years, could pave the way for issuance of a digital euro by 2026-27. Such issuance would require a legal basis and approval from Member States and the European Parliament.

Focus

Household inflation expectations survey

The high level of inflation is an issue for French citizens in their daily lives and a key concern of the Banque de France. A prerequisite for price stability is that prices and wages set today do not incorporate expectations of sustained price increases in the future. In such a case, price increases could become self-sustaining, fuelling an inflationary spiral.

It is therefore vital for the Banque de France and the ECB to understand how inflation expectations are formed, particularly by households. For the first time, in 2022, the Banque de France commissioned CSA, a research firm, to conduct a survey, which involved 5,054 residents aged 18 and over. The survey was carried out between the end of April and mid-June 2022, i.e. approximately two months after the start of the war in Ukraine and the pronounced rebound in inflation. The survey's main findings were as follows:

- 60% of French residents surveyed think that inflation and purchasing power are the main economic challenges right now.

- 82% of households think that monetary policy has a rather significant or a significant impact on their purchasing power.

- Inflation expected by households is linked to the level of inflation that they perceived over the previous year.

- Perceived inflation levels vary from household to household. These differences are partially due to the characteristics of respondents, including gender, age and educational level. They also depend on the frequency of certain purchases and movements in prices to which they are particularly sensitive, especially fuel.

Addressing structural challenges to strengthen growth and reduce inflation over time

Supply-side policies need to take over from demand-side policies to boost potential growth. By mitigating vulnerability to shocks, for example through greater energy diversification or by increasing the skills available on the labour market, supply-side policies help to ease long-term inflationary pressures. They also improve the economy's resilience to future shocks and transitions.

France needs to conduct three transitions, two of which – the environmental and digital transitions – are challenges that are shared by the whole of Europe. During these transitions, obstacles to the reallocation of resources to future sectors, such as inadequate skills on the labour market, could hold back productivity gains and stoke persistent inflationary pressures.

A third challenge is specific to France and concerns the supply and quality of labour. Hiring challenges and the job vacancy rate, which reached record high levels in 2022, testify to growing strains on the labour market. These curtail the ability of France's industrial fabric to make adjustments.

For this reason, the economic transition must be accompanied by structural policies designed to facilitate research and innovation, the dissemination of technologies and skills-building in the labour force. Regulatory incentives, implementation of the green taxonomy and supports to redirect financing and promote the emergence of green technologies are necessary to decouple GDP growth from that of greenhouse gas emissions. Proactive labour market policies should help the elderly to improve their access to employment and bolster efforts to promote lifelong and vocational training.

Monetary Policy Forum

Euro area central banks have been keen to communicate more about their mandate to their citizens. They want to understand people's concerns and to be more educational and transparent when explaining the monetary policy executed by the Eurosystem and decided on by the ECB Governing Council.

Pursuing the goal of clarity not only fulfils a vital democratic responsibility, it also promotes economic efficiency: a monetary policy that is better understood by all economic participants, including households and businesses, will be transmitted to the economy more successfully and hence be more effective.

With this in mind, the Banque de France conducted a survey between April and June 2022 of 5,000 French residents to measure their expectations in an environment of unusually heightened economic uncertainty (see Focus above: "Household inflation expectations survey"). Respondents identified inflation and purchasing power as their top concerns.

The Banque de France presented the findings of the study at the Monetary Policy Forum held on 6 July 2022 at the Banque de France's head office in Paris. The Governor, alongside Nathalie Aufauvre (Director General Financial Stability and Operations) and Olivier Garnier (Director General Statistics, Economics and International) fielded people's questions about monetary policy, inflation and many other topics. The event was attended by over 250 participants and watched by around 500,000 contacts on the internet and social media.

2. Financial stability

Our missions

1. Ensure the soundness of the financial sector:

- prudential supervision of banks and insurance firms

- protection of customer interests

2. Anticipate and prevent risks:

- assessment of new risks

- contribution to regulatory changes

- support for banks and insurance firms as they navigate the digital transformation

3. Ensure the smooth functioning and security of payments:

- prevention of systemic risks

- smooth functioning of payment and market infrastructures

2022 in pictures

Other highlights:

- 1 January: Decision D-HCSF-2021-6 of the Haut Conseil de stabilité financière (HCSF – High Council for Financial Stability) on lending standards for housing loans enters into force.

- 17 February: The ACPR publishes its first report on governance of climate change risk in the insurance sector.

- 24 March: The Network for Greening the Financial System (NGFS) publishes a report on the macroeconomic and financial implications of nature-related risks.

- 30 June: The Banque de France publishes its semi-annual report on the assessment of risks to the French financial system; the second report came out on 27 December.

- 6 September: The NGFS publishes the third edition of the climate scenarios.

- 20-21 September: The Banque de France conducts a crisis management test within the framework of the Paris Resilience Group.

- 27 September: The Banque de France organises an international conference on crypto-assets and financial stability, and the role played by central banks in this ecosystem.

- 27 December: The HCSF adopts a decision (D-HCSF-2022-6) regarding the increase in the countercyclical capital buffer to 1% (definition in the chapter to come), in the wake of the decision of 7 April (D-HCSF-2022-1) on an initial 0.5% increase.

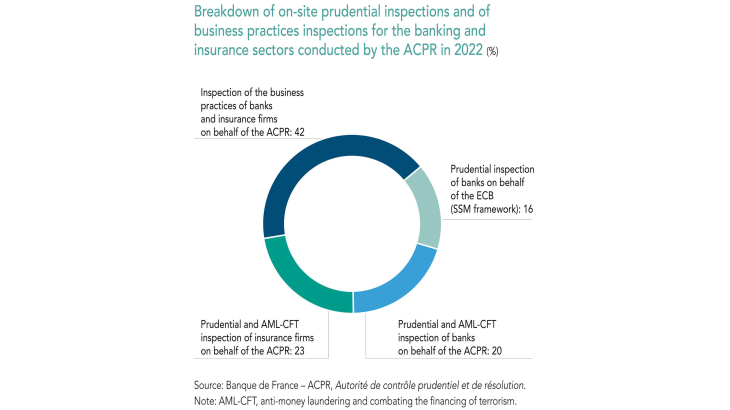

206

on-site inspections of insurance firms and banks and their business practices (excl. Single Supervisory Mechanism or SSM inspections)

38

inspections performed on behalf of the ECB (SSM framework)

14.9%

Common Equity Tier 1 ratio of the six main French banking groups

250%

Average solvency capital requirement coverage ratio for supervised insurance corporations

34%

French banks’ share of the total assets of euro area banks

35%

French insurers’ share of the total assets of euro area insurance corporations

Strengthening the resilience of the French financial system

The Banque de France, together with the High Council for Financial Stability (HCSF), is responsible for the stability of the financial system. The Prudential Supervision and Regulation Authority (ACPR), an administrative authority attached to the Banque de France, also pursues this objective by supervising banks and insurers and protecting their customers. Amid persistent international tensions, the initiatives carried out contributed significantly to the resilience of the French financial system.

1. The French financial sector absorbed the shocks triggered by the war in Ukraine

A robust financial sector that swiftly adapted to the crisis

Effective implementation of European sanctions

In response to the war in Ukraine, the Banque de France offered its technical and operational expertise to help prepare and implement financial sanctions against Russia. It also took part in international discussions aimed at preventing any efforts to thwart the sanctions as well as their impacts on financial stability. As soon as the first sanctions were published, the Autorité de contrôle prudentiel et de résolution (ACPR – Prudential Supervision and Resolution Authority) sent out a questionnaire to supervised institutions in order to identify the accounts and transactions involved, and measure any operational challenges encountered. The answers to the questionnaire showed that, aside from a few initial one-off problems, institutions were able to take on the resulting additional workload. On-site investigations were also conducted to make sure Russian assets were frozen as instructed.

The financial sector remained robust

With an average CET1 ratio of 14.9% at end-December 2022, the six main French banking groups maintained a substantial margin over the minimum regulatory capital requirement. Although the cost of risk rose due to the war in Ukraine and the worsening macroeconomic environment, it remained under control and was well below that observed during the health crisis. For their part, French insurers significantly exceeded their capital requirements and their capital has been increasing since the end of 2021, in line with the rise in interest rates.

A financial sector that fully played its role in response to the energy crisis

Enhanced supervision

The war in Ukraine triggered a sharp rise in gas and electricity prices, also increasing their volatility. Given the risks posed to financial stability, the Banque de France and the ACPR stepped up their supervision of French institutional exposures to these markets.

The crucial role of banks as liquidity providers

In March and August 2022, price fluctuations spurred a peak in initial margins demanded by central counterparties (CCPs) to cover increased risks (see Focus below: "The role of CCPs"). French non-financial corporations exposed to derivative markets successfully weathered the associated liquidity tensions by drawing on liquidity provided by banks. French banks, which are particularly active in the energy derivatives market in Europe, play a key role as intermediaries between their customers and the clearing houses. They demonstrated a significant capacity to absorb shocks and remained resilient, with overall exposures to the energy sector contained in relation to their total capital.

Enhanced surveillance to address heightened cyber risk

A real threat

The conditions created by the war in Ukraine proved particularly conducive to the advent of potentially destabilising cyberattacks. The acceleration of the digitalisation of the financial sector has generated vulnerabilities that could be exploited by hackers. Pirating methods are becoming increasingly sophisticated and pose an ever-greater threat to all sectors.

Necessary enhancement of resilience in response to cyberattacks

The Banque de France and the ACPR took a proactive approach to implementing the EU’s Digital Operational Resilience Act (DORA). DORA harmonises requirements applicable to all financial institutions and innovates by introducing direct supervision of “critical” third-party providers. Both institutions are extensively involved in multiple working groups and coordination systems in France (such as the Paris Resilience Group, chaired by the Banque de France, which mobilised 1,700 Paris financial market professionals), in Europe and at the international level.

Cross-border cooperation is critical in order to curb systemically hazardous cyber crises. After the G7 successfully carried out its first major cyberattack simulation in 2019, the Banque de France and the ACPR continuously worked to bolster their international cyber resilience partnerships, organising a joint cyber crisis management test with the Monetary Authority of Singapore in June 2022. In January 2022, the European Systemic Risk Board (ESRB) called for the creation of a pan-European systemic cyber incident coordination framework aimed at better combating cyberattacks targeting the financial system.

2. Macroeconomic and financial uncertainties call for continued vigilance

Monitoring vulnerabilities associated with the financial markets and financing conditions

Strong volatility on the financial markets

In 2022, the financial markets were beset with strong volatility, in response to rising interest rates in an uncertain environment marked by constantly climbing inflation, the normalisation of monetary policies and an economic downturn. Increasing sovereign debt yields were accompanied by shrinking liquidity, but the market continued to function smoothly and risks of European sovereign debt fragmentation were contained. Corporate bond issuance waned, particularly for high-yield issuers (presenting a greater risk of payment default), and was offset by an upturn in bank loans, the cost of which rose less quickly than the cost of market debt. Equity markets experienced substantial corrections, reflecting the impact of rising risk-free rates on valuations. They could see further adjustments, given the slowdown in growth and earnings prospects.

Non-banking financial intermediaries are a source of risks

These major fluctuations have thus far arisen in an orderly fashion, but isolated tensions have appeared, particularly on the UK sovereign debt market. This episode of stress underscores the risk represented by non-banking financial intermediaries exposed to leverage (investing by taking on debt, which generates risk). Their liquidity requirements can amplify adverse market volatility, with the potential for systemic destabilisation. Available data indicate that the level of leverage of French investment funds is under control. However, contagion triggered by stress caused by less resilient non-resident entities cannot be ruled out. The Banque de France works with the Financial Stability Board (FSB) to analyse the vulnerabilities of non-banking intermediaries. It supports the development of regulatory responses aimed at better addressing their risk and increasing transparency on their exposures.

Monitoring the impact of rising inflation and interest rates

The situation of non-financial agents was stable

Despite a high level of debt compared with their European and international counterparts, French non-financial corporations and households enjoy limited exposure to interest rate risk thanks to their predominantly fixed-rate debt. The repayment capacity of companies was bolstered by their high level of activity and low default rate. As regards households, the improvement in credit standards for housing loans proves the merit of France's financing model for house purchases, which is based on the borrower’s repayment capacity and should not be affected by changes in the residential housing market, where prices are continuing to climb. The creditworthiness of the French government remained strong, but the debt path was weakened by measures to offset high energy prices, as well as by the deteriorating macroeconomic outlook and rising interest rates.

Banks and insurance firms are sound, but caution is necessary

Banks displayed a robust balance sheet structure and continued strong earnings, which should be underpinned in the medium term by an increase in net interest income (see Focus below: "Interest rate risk for banks and insurance firms"). Cost of risk remained on the low side, but the Banque de France and the ACPR are calling for conservative provisioning policies due to the uncertainty weighing on the credit risk outlook. Insurance firms also enjoy a high level of capital, allowing them to absorb the impact of rising inflation and interest rates (which vary depending on firms’ activities).

New macroprudential measures in response to strong lending dynamics and heightened cyclical risks

Ensuring housing debt remains sustainable

The HCSF set out credit standards for housing loans in a recommendation issued in 2019, which became legally binding in January 2022 on the proposal of the Governor of the Banque de France. The Bank has now capped the maximum debt-service-to-income ratio at 35% for a maturity of no more than 25 years. Credit institutions can deviate from these criteria with a flexibility margin of up to 20% of the amount of new quarterly issued housing loans. By ensuring that the household repayment burden is not excessive, this measure helps improve the sustainability of their debt. As a result, lending has become more secure, with a significant decrease in the share of loans exceeding these thresholds, without adversely affecting the momentum of housing loans, which remained robust in 2022.

Anticipating cyclical risks

The HCSF began rebuilding the credit protection reserve (countercyclical capital buffer1) after the Covid 19 crisis, which had led to it being reduced. Despite economic and geopolitical uncertainties, lending continued to grow sharply in 2022, while debt levels were already high. Given the persistence of vulnerabilities and the level of risks, the HCSF decided to increase the buffer to 0.5% in March 2022, then to 1% in December 2022, with a 12-month implementation deadline. It is not planning on an additional hike in 2023. The countercyclical capital buffer is designed to be relaxed immediately if required in order to combat risk and shore up the long-term supply of credit to the real economy. The HCSF also maintained the exposure limits of systemically important banks to highly leveraged French large companies.

3. The Banque de France and the ACPR are assisting with structural changes to the financial system

Regulating the digitalisation of finance

A bumpy road for the crypto-assets market

After growing sharply in 2020 and 2021, the size of the crypto-assets market fell almost threefold compared with its peak in November 2021, dropping to USD 800 billion in market capitalisation at end-2022. Amid uncertain economic and geopolitical conditions, investors elected to reduce their exposure to these high-risk assets. Several incidents, including the collapse of the blockchain protocol Terra and the fraud-related failure of crytpo conglomerate FTX, exacerbated this decline. These chaotic events demonstrate the relevance of warning messages issued by the authorities. At this stage, the crypto-assets market does not appear to present a systemic risk, due to its small size (relatively limited, at around 1% of global market capitalisation) and its weak overlap with traditional finance. That said, the lack of reliable data and expansion of contagion channels call for a cautious approach. This is why the Banque de France promotes internationally coordinated regulation, founded on the “same activity, same risk, same regulation” principle.

Welcome European regulation

The European Union, a pioneer in this area, plans to adopt an initial regulatory text on crypto-assets in 2023, stemming from a political agreement obtained under the French presidency of the EU Council, with an entry into force scheduled for the second quarter of 2023.

The Markets in Crypto-Assets (MiCA) regulation should take effect in the second quarter of 2024 for covered crypto-assets (backed by a traditional currency for example), referred to as stablecoins, and in late 2024 for crypto-asset service providers. The MiCA regulation introduces a harmonised framework for crypto-asset issuers and service providers. The extensive involvement of the Banque de France and the ACPR in negotiations helped ensure that a balanced compromise was reached. MiCA does not cover certain segments of the crypto-assets sector, however, such as decentralised finance (DeFi) and non-fungible tokens (NFTs), set to be addressed in dedicated reports by the European Commission and subject to legislative proposals where applicable.

In addition to its efforts to regulate crypto-assets, the Eurosystem is continuing its work on a central bank digital currency (CBDC). The investigation phase of the digital euro, launched in October 2021, led to the definition of project targets and guidelines on certain design features (described in the Monetary Strategy chapter).

The global challenge of the climate transition

A climate transition requiring support

The rise in energy prices has highlighted the strong dependence of European economies on fossil fuels. Unfortunately, short-term measures aimed at reducing dependence on Russian gas mean using even more fossil fuels. As a result, the climate transition may be pushed back due to the current energy crisis, raising the likelihood of a “disorderly transition” (difficulty in achieving the goals of the Paris Agreement).

The Banque de France and the ACPR have sharpened their focus on climate change risks. In the euro area, the Single Supervisory Mechanism (SSM), to which the ACPR contributes, conducted a test in 2022 that underscored the need for banks to ramp up their efforts to develop their climate stress test framework. The European Insurance and Occupational Pensions Authority (EIOPA) also completed its first climate stress test in 2022, measuring the impact of a disorderly transition on the balance sheets of supplementary occupational pension institutions. For its part, the ACPR continued working with insurance firms to prepare the next climate stress test, in the wake of the pilot test conducted in 2020-21.

Non financial information: a tool for recharting a course towards more sustainable investments

In 2022, the ACPR began exercising its role in supervising environmental, social and governance (ESG) information published by financial institutions, in accordance with European and French regulations. The aim of these regulations is to redirect capital flows towards sustainable economic activities by improving the information provided to investors on the ESG characteristics of investment vehicles. In a bid to strengthen the quality of these publications, the Banque de France resolutely supports the adoption of European and international standards with the goal of expanding and harmonising the ESG information disclosed by non-financial companies.

4. Supervision of market practices to protect customers

As part of its mission to protect the customers of banks and insurance firms, the ACPR ensures that business practices duly incorporate customer interests. Inspections continued in 2022 on the marketing of life insurance contracts and fees charged to investors, compliance with caps on bank fees charged to customers for account operation incidents, and the freedom to choose payment protection insurance for housing loans. The ACPR also focused on the regulatory compliance of advertising documents (with a recommendation pertaining to sustainable finance arguments), the quality of precontractual information (particularly in the case of unsolicited marketing), the consumer loan approval process, and payments in instalments (sharply on the rise).

Working alongside the Autorité des marchés financiers (AMF – Financial Markets Authority), the ACPR continued to investigate the marketing of financial products to vulnerable elderly persons. The website Assurance Banque Épargne Info Service (ABEIS, abe infoservice.fr – more than 2 million pages viewed in 2022) and the telephone hotline provide the general public with information and practical and neutral advice on financial products, as well as scams and financial sector professional identity theft (which was on the rise again in 2022). The authorities ended up blacklisting more than 1,135 names of unauthorised sites or parties.

Focus

The role of CCPs

Central counterparties (CCPs) contribute to financial stability by managing the counterparty risk of participants and limiting their liquidity requirements by clearing their transactions. A CCP effectively becomes the buyer for each seller and the seller for each buyer, thus ensuring that the participants’ transactions are smoothly processed. To hedge the credit risk taken on for each participant, the CCP collects pre-financed resources, including initial margins, variation margins and a pooled default fund.

Given the stabilising role played by CCPs during the 2008 crisis, the G20 called for clearing to play a stronger role in the roadmap adopted at the 2009 Pittsburgh Summit.

The March 2020 shock triggered by the Covid-19 crisis and then the 2022 energy crisis have underscored the need for CCPs to better address the vulnerabilities of market participants and the potential procyclical effect of margin calls. For example, the volatility of commodity prices sparked a sharp rise in initial margins, which may have encouraged certain market participants to switch to OTC markets. This trend has heightened counterparty risk and reduced the transparency of market transactions.

Multiple reviews were launched as a result and are still in progress. On the international stage, in September 2022 the Basel Committee on Banking Supervision (BCBS), the Committee on Payments and Market Infrastructures (CPMI) and the International Organisation of Securities Commissions (IOSCO) published a joint Review of Margining Practices that identified six areas for further policy work, such as evaluating the responsiveness of non-centrally cleared IM models to market stresses. At the European level, in June 2020 the European Systemic Risk Board (ESRB) issued recommendations aimed at governing procyclical CCP practices.

Interest rate risk for banks and insurance firms

French banks and insurers are expected to benefit from rising interest rates in the medium term.

In the coming quarters, banks should enjoy a positive impact from orderly interest rate hikes on their net interest income, thanks to the predominance of non-interest-bearing or fixed-rate liabilities on their balance sheets. For a 200 basis-point shock, the net interest income of banks should increase by 15% on average, with significant disparities depending on the institution. In the short term, however, the cost of deposits is set to climb faster than the return earned on assets.

For insurance firms, the consequences of rising interest rates and inflation vary depending on their activities. Non-life insurers offering long-term guarantees are more vulnerable to the effects of inflation on the cost of claims. Rising interest rates expose life insurers to the risk of policy surrenders by insured parties, which were nevertheless limited and offset by positive inflows in 2022. A gradual rise in interest rates will allow insurers to reinvest their prior investments at maturity in more lucrative assets.

3. Services to the economy and society

Our missions

- Support and guide companies, especially the smallest ones:

- support for VSEs and SMEs

- credit mediation

- Serve individuals, in particular the most vulnerable:

- assistance with overindebtedness, right to a bank account

- database management, control of bank fees

- Promote understanding of the economy and better management of personal finances:

- implementation of France’s economic and financial education strategy, which the Banque de France is responsible for executing

- major initiatives and partnerships, including with the Ministry for National Education and Youth

- Provide financial services for the state:

- holding the French Treasury's bank account

- managing government debt auctions

2022 in pictures

Other highlights

- 10 March: Second annual spring event for start-ups at Citéco (Cité de l’Économie).

- 22 April: Signature of an amendment to the public service contract of 17 February 2012 between the Banque de France and the government.

- 22 June: Publication of the 2021 annual report of the Observatory for Banking Inclusion.

- 24 June: Publication of the 2021 annual report of the Trade Credit Observatory.

- September: Signature of four partnership agreements between the National Credit Mediation body and organisations involved in dealing with business difficulties.

- 10 October: First Business Forum, which was attended by 450 people from the world of entrepreneurship, including business leaders, representatives from professional networks, institutions and Banque de France employees.

- 24 October: : 3414 – inauguration of a one-stop helpline for consumers to connect with the Banque de France's services.

- 15 and 17 November: : Participation in the Journées de l’économie (JÉCO) conference in Lyon, which addressed the topic of “Economic bifurcation: what lies ahead?”

33,264

bank accounts opened under the right to a bank account procedure

8,779

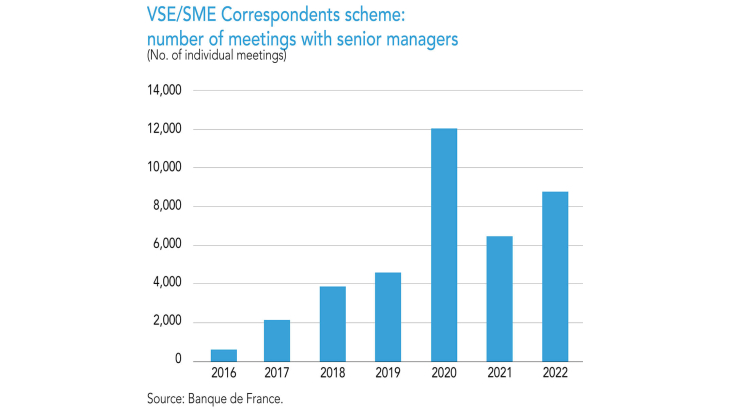

referrals to our 102 VSE-SME correspondents

The Banque de France, a local partner for households and businesses

The Banque de France is a public institution with a nationwide presence through its branch network. This enables it to deliver a high-quality public service to households and companies around the country and to address their needs in a challenging economic environment. The Banque de France is also a provider of financial services to the state and the European Union.

1. The Banque de France is expanding and enhancing its business services

Enhanced expertise to serve companies

A new and more accurate rating scale

On 8 January 2022, the Banque de France modified its rating scale to assess the financial health of rated companies more accurately. The scale also reflects adjustments to the rating methodology to meet European requirements for external credit assessment institutions, aimed at evaluating companies’ risks more effectively as well as their capacity to deal with such risks.

The rating, which has been expanded to include additional indicators and financial analysis ratios, is now more detailed, with 22 risk levels, compared with 13 previously, in accordance with new European credit risk assessment standards. The refined rating system will help to improve the resilience of the financial system and the quality of financing provided to the economy.

Recognition of climate-related risks

The Banque de France continued work aimed at better capturing the exposure of companies to climate risks when assessing their performance. As they ready themselves for the low-carbon transition, firms are adapting their business models and getting organised to meet market requirements. At the request of regulators, they are going to have to publish a wide range of extra-financial disclosures, notably in connection with implementation of the Corporate Sustainability Reporting Directive (CSRD)2 which comes into effect at the end of 2024 for large companies.

Against this backdrop, in 2022 the Banque de France began in-house trials of a prototype climate indicator to measure the progress made by companies in the low-carbon transition. A partnership was signed with the French Environment and Energy Management Agency (ADEME) in March 2022 to apply some of the core elements of the agency’s Assessing low-Carbon Transition (ACT) methodology to the development of tools to assess company transition trajectories.

New business support tools

A personal space for senior company managers on the Banque de France website

In 2022, the Banque de France began the process of creating a personal space for senior company managers, which will be available in 2023. The new space will act as a one-stop gateway to a suite of services aimed specifically at company managers. Using their secure login, any legal representative of a company will be able to access their firm's rating, his or her management indicator,3 any business-related correspondence and online business positioning and analysis (OPALE) reports. Representatives can also see key indicators for their companies and compare them against those of their industry. The tool will provide a new channel to connect with the Banque de France, as managers will be able to submit questions via the personal space. It is the result of a participative approach (surveys and individual interviews with a panel of managers) that will be continued in 2023.

OPALE, an enhanced assessment tool for businesses

In early 2022, substantial changes were made to the online financial assessment service (OPALE) provided free of charge to company managers. Ten or so additional ratios and aggregates were added, with analyses made available to company leaders. OPALE’s two modules – Analysis and Simulation – give executives easy access to robust, instantly available financial expertise.

The analysis module allows them to measure and compare company performances and to identify strengths and room for improvement through four analytical themes. The simulation module is designed to prepare forward-looking scenarios to assess the financial impact of projects and management decisions, especially on cash flow. With OPALE, which they can use either on their own or with assistance, company managers have a handy tool to support decision-making and communication with financial partners.

ACSEL: supporting the regional economies

Last year saw the completion of several major “regional economy” projects aimed at enhancing the local economic cyclical and structural analyses (ACSEL) offered to local decision-makers. ACSEL studies can be used to examine the economic and financial situation of a given geographical area, sector of activity or set of companies. By applying artificial intelligence tools to the 1,254 établissements publics de coopération intercommunale (EPCI – public inter-municipal cooperation structures), which include major cities as well as groupings formed from smaller communities, and harnessing socio-economic criteria, four regional profiles were created, offering new scope for drawing comparisons.

New indicators were also added to measure regional performances against not just the national average but also “expected” performance levels, the exposure of a given sector to globalisation, or the functioning of the local labour market. These innovations, which enhance the Banque de France's financial expertise, were added to one of the ACSEL modules in November 2022.

Initiatives to serve businesses locally

Supporting VSEs and SMEs through a nationwide presence

Over the past six years, the Banque de France has provided support to more than 38,000 project leaders and company managers. In 2022, 8,779 entrepreneurs were assisted by the Bank's 102 department-based VSE-SME correspondents, whose task is to field questions from entrepreneurs during their business journey and to quickly assess their company’s situation, in order to steer them towards the right correspondents. The service is free and confidential (see Focus below: "Payment times: a year of raising awareness among companies").

Strengthening support for innovation with start-up correspondents

In 2020, the Banque de France deployed a network of start-up correspondents in every region and in each “French Tech Capital”, with the aim of supporting and rating these firms while taking into account the specific features of the start-up growth model. The number of start-ups identified and rated by the Banque de France has more than doubled in the space of three years (around 2,000 balance sheets rated in 2022), creating the need to train specialised analysts and contact persons to deliver broader regional coverage. Around 1,000 start-ups were assisted in their efforts to obtain financing. The Bank published a study on their financial situation4 which underlined the vibrant growth of French Tech.

Credit mediation still working to help businesses

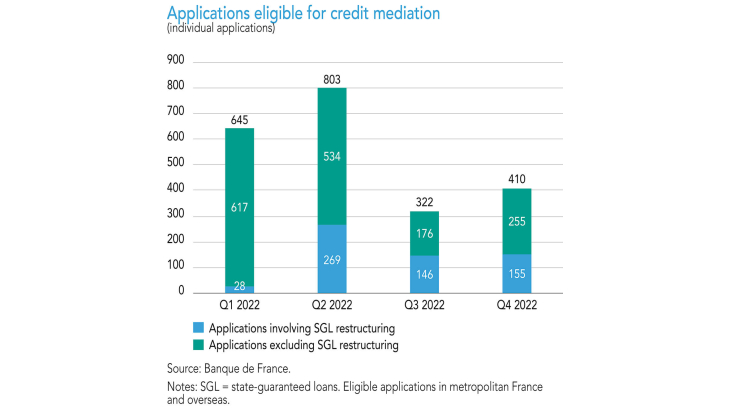

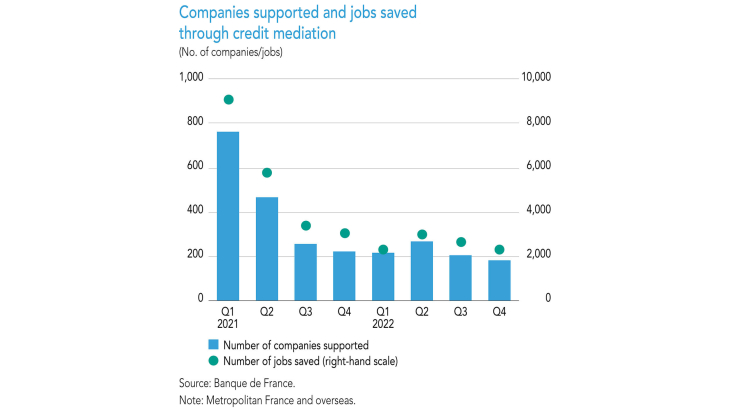

In 2022, applications for mediation (2,180 cases) fell by 45% compared with 2021. Reduced demand, at a time when companies are showing good overall resilience, is also a sign of favourable access to credit.

A small number of these applications (598) concerned restructurings of state-guaranteed loans (SGLs), in accordance with the industry agreement of 19 January 2022.

The vast majority of applications (78%) came from very small enterprises (VSEs, fewer than 11 employees) operating in the services sector (52%) and, to a lesser extent, in trade (22%) and construction (13%).

Interventions by department-based mediators supported 860 companies and saved 10,232 jobs across the country.

In the context of macroeconomic uncertainty, the mediation scheme developed new partnerships with organisations involved in identifying and resolving business difficulties, such as the Centre national d’information sur la prévention des difficultés des entreprises (CIP – National Centre for Information on the Prevention of Business Difficulties), the Conseil national des greffiers des tribunaux de commerce (CNG – National Council of Commercial Court Registrars) and La Clinique de la Crise (crisis support network), among others.

2. The Banque de France continued its work to promote financial inclusion

A simpler and stronger multi-channel system to communicate with the public

Launched in 2016, efforts to upgrade and streamline the channels through which members of the public can communicate with the Banque de France are continuing, with the aim of making the institution accessible to everyone, especially the most vulnerable.

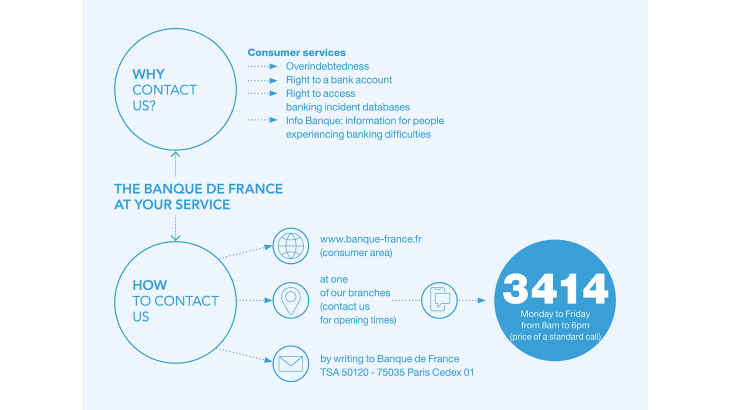

Since October 2022, Banque de France employees have staffed a one-stop helpline number, 3414, which replaced more than 200 existing numbers. For the cost of a local call, members of the public can use this helpline from 8 a.m. to 6 p.m. to reach the most appropriate department for the subject of the call.

Anyone wishing to use the Banque de France's services may do so through the channel of their choice, including via its website, which had approximately 270,000 open accounts at end-2022, or at the Bank’s branches, where meetings are primarily by appointment.

An objective of preventing financial difficulties

The incident databases managed by the Banque de France, including the Fichier central des chèques (FCC – Central Cheque Register) and the Fichier national de remboursement des crédits aux particuliers (FICP – National Register of Household Credit Repayment Incidents), aim to prevent financial difficulties and overindebtedness. Banks use them in their loan approval processes and to identify customers who are struggling financially. In 2022, the number of incidents reported to the FICP was on a par with that of 2019, while the number of reports to the FCC was more or less the same as in 2021.

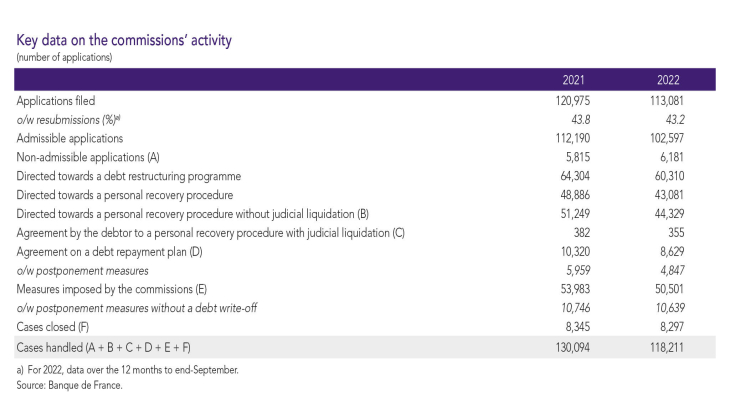

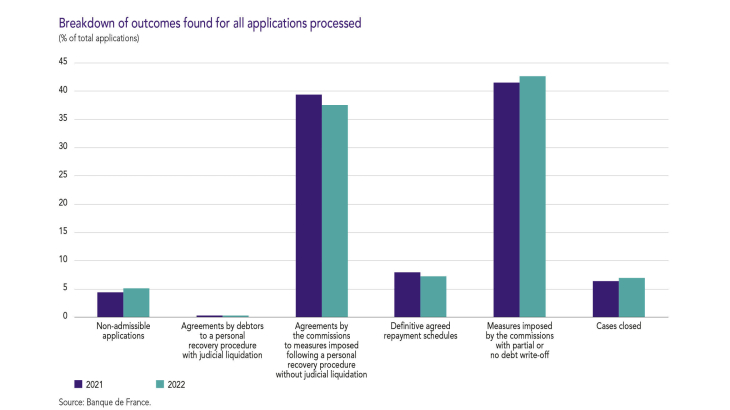

A major role in dealing with excess debt situations

Banque de France staff provide the secretariat for the departmental Household Debt Commissions, manage the procedure for dealing with cases of household overindebtedness and implement solutions to assist households to get out of difficult financial situations. They meet with individuals, assess their applications, contact creditors and propose solutions to the Household Debt Commissions, which then make their decisions. Since May 2022, France’s Loi en faveur de l’activité professionnelle indépendante (API – Self-employed Professional Activity Act) has opened up the procedure to sole proprietors, but only upon a referral to a judge ruling on commercial matters.

This free system ensures, as soon as the application is accepted, protective measures for the debtor (suspension of enforcement procedures, interest and repayments, prohibition of rejection fees, restoration of housing benefits, etc.).

The number of applications submitted fell from 120,975 in 2021 to 113,081 in 2022, which is close to pre-pandemic levels, although the number of monthly applications stabilised as of August. Information on the activity of the Household Debt Commissions can be found in the financial inclusion barometer and in Appendix 6.

Work by the Observatory for Banking Inclusion

The members of the Observatoire de l’inclusion bancaire (OIB – Observatory for Banking Inclusion) held two plenary meetings in 2022 but also continued to share their views on social conditions each month. The observatory provides a forum for banks and structures providing assistance to jointly monitor developments in the situation of households by analysing bank account-related incidents and the take-up of different schemes (see Focus below: "Financial inclusion councils set up across the country").

Improved detection of vulnerabilities, first noted in 2021 following the entry into force of measures recommended by the Observatory, continued. More than four million people are currently identified as vulnerable, but over six million people are actually eligible to have their fees capped, thanks to improved detection and the inclusion of situations of temporary vulnerability.

Efforts to deploy the special scheme for vulnerable customers continued and helped over 800,000 people at end-2022.

3. The Banque de France, steering body for the national strategy for economic, budgetary and financial literacy (EDUCFI)

The Banque de France is in charge of executing the EDUCFI strategy nationwide, alongside 29 partners from the public, non-profit and private sectors. In line with criteria set down by the Organisation for Economic Cooperation and Development (OECD), which state that financial literacy information should be unbiased, reliable, accessible and free of charge, it aims to ensure that everyone has access to a useful framework for making financial decisions.

Economic, budgetary and financial literacy training for young people

EDUCFI passports, which are issued to third and fourth-year secondary school students who have completed a financial literacy course, are becoming more widespread. Designed to convey a basic introduction to budgetary and financial topics, the scheme was delivered by educators to 2,200 third and fourth-year classes in 2021-22, or 80,000 students. In 2022-23, all secondary schools will teach the passport training course to at least two of their third-year classes, raising awareness among 400,000 students, or about half the total number of students at that level.

The Banque de France and its partners also staged EDUCFI workshops for 31,000 volunteers from the National Universal Service programme. The goal in 2023 is to reach 45,000 young people.

Tackling monetary and financial issues, the ABC de l’économie collection offers more than 90 educational resources to members of the public, secondary and post-secondary students and educators.

The Banque de France has also teamed up with the Ministry for National Education and Youth to run two high-school competitions: the Prize for Economic Excellence in Science and Management Technologies, in partnership with Citéco (see Focus below: "Citéco: delivering a diverse line-up of educational services") and IEDOM-IEOM (3,450 participants in 2021-22), and the Generation €uro competition with the European Central Bank (700 participants).

Fostering better public understanding of budgetary and financial challenges, especially among the most vulnerable members of society

Around 650 EDUCFI workshops were organised for 5,300 young people enrolled in employment integration programmes at over 200 organisations, including local youth guidance centres, second-chance schools, Apprentis d’Auteuil, an organisation that helps disadvantaged youth, and the public employment service, along with 114 workshops for 1,200 people with literacy difficulties and their support persons during the events staged as part of France’s national illiteracy prevention campaign.

New training programmes are being made available to social actors on scams and online banking. In addition, measures tailored to social services (hospitals, correctional facilities, national defence) are being carried out to address best practices in management of personal finances and financial inclusion.

Helping entrepreneurs, particularly more isolated ones, to gain a better grasp of companies’ financial management challenges

The EDUCFI awareness-raising programme for entrepreneurs is expanding, notably to include the public employment service and business incubators, with videos and modules on topics such as the balance sheet, equity, equity financing and bank/business relationships.

Spreading EDUCFI messages through broader channels

Under the EDUCFI strategy, the Banque de France manages the websites: ABC de l’économie, Mes questions d’argent and Mes questions d’entrepreneur. In addition to many podcasts, it offers free educational content on social media, including all of its educational videos and webseries on the Educfi Banque de France YouTube channel. At the end of 2022, these digital services were expanded to include educational digital games, such as Scènes d’argent, a narrative game, and a digital version of the # Aventure Entrepreneur game.

4. The Banque de France provides financial services to the state and to Europe

Management of the Treasury’s accounts

At the government's request, the Bank manages the Treasury's accounts and associated payments (see Focus below: "Banking services provided to the Treasury" and "Execution of the public service contract in 2022").

Auctions of securities issued by the European Commission

To finance the NextGenerationEU recovery plan adopted on 17 September 2020,5 with an amount of EUR 800 billion up to 2026, the European Commission decided to issue securities through an auction system. Following its selection by the Commission in 2021, the Banque de France auctioned Commission securities worth a total of EUR 85.1 billion (in 32 auctions) in 2022. Thanks to its automated auction system, the Banque de France provides the Commission with the technical support and expertise it needs to raise funds rapidly and at low cost.

Focus

Payment times: a year of raising awareness among companies

Whereas France’s 2008 Law on the Modernisation of the Economy (LME) spurred a significant decrease in payment times, the situation has ceased to improve over recent years and has actually deteriorated at large enterprises (LEs) and intermediate-sized enterprises (ISEs). Responding to this, the Banque de France launched a campaign to raise awareness among the different stakeholders – but especially companies – about long payment times.