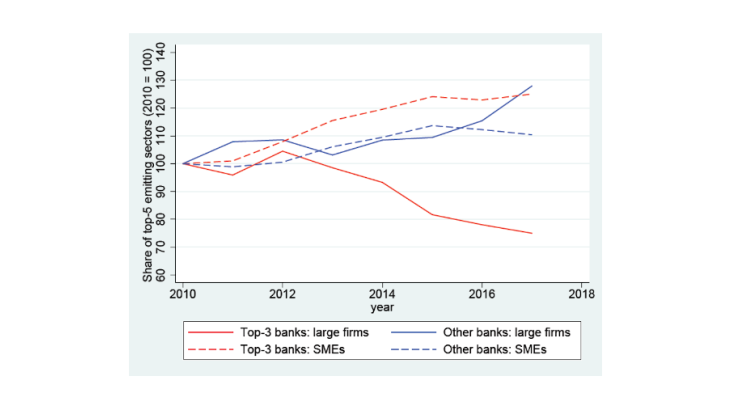

Note: share of loans to the five most greenhouse gas intensive sectors of the three banks with the best climate performance score on average over 2010-2016 (red), denoted as “Top 3”, compared to that of three other banks (o/w one unrated, blue). Scores are computed by the British company CDP based on banks’ answers to a questionnaire. Solid line: loans to LE/IE. Discontinuous line: loans to SMEs.

The energy transition requires financing significant investments in low-carbon activities and rapidly redirecting public and private funding currently allocated to the most carbon-intensive companies and industries. In recent years, several major French banking groups have stepped up their social and environmental responsibility (SER) commitments and communicated extensively about their increasing consideration of climate issues (plans for totally or partially exiting coal and non-conventional oil, financing of renewable energy production facilities, etc.). A survey conducted in 2019 by the ACPR among the main French banking groups shows that progress has been made in taking into account the financial risks induced by climate change and the policies implemented to contain it.

However, there is a lively debate on the reality and relative importance of these commitments. Environmental NGOs denounce the still high level of funding for the most polluting activities, which is in conflict with banks' public declarations (Oxfam, 2020). The latter challenge the methodologies used by NGOs to assess banks’ carbon footprint and highlight the growing importance of their green financing. Behind the battle of figures, the difficulty of measuring banks’ carbon footprint via the activities they finance is real.

In a recent study, we attempt to shed light on this debate by mobilising detailed data on business lending in France by five major banking groups that account for around two-thirds of loan outstandings. Thanks to our rich source of information, the Banque de France credit register, we are able to track changes in the loans granted by each bank to companies in 50 industries in the private non-financial sector between 2010 and 2017. A distinction is made within each industry between "large" enterprises (including so-called intermediate-sized enterprises, i.e. with more than 250 employees) and SMEs. For each industry, we have additional information on the intensity of greenhouse gas (GHG) emissions produced in France (in kg emitted per euro of value added), compiled by Eurostat as part of the European Air Emissions Accounts (AEA). Finally, we measure banks' pro-climate commitment concisely against a score issued by CDP, a British company specialised in climate rating. CDP assesses the pro-climate performance of more than 8,000 listed companies worldwide based on their responses to a detailed questionnaire, aligned on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD, a working group set up by the G20 Financial Stability Board). This score (ranging here from 1 to 5 - 5 corresponding to the highest level of climate "performance") is based on voluntary declarations: it reflects by construction banks’ displayed commitments in terms of taking climate risk into account and contributing to the transition.

Do statements translate into action, and if so, to what extent?

The objective of our study is simple: assessing whether banks finance less the most carbon-intensive sectors when they display higher levels of pro-climate commitment. Chart 1 provides a first intuitive answer: it tracks the evolution since 2010 of the share of loans to the five most GHG-intensive sectors (petroleum product refining, air transport, metallurgy, agriculture, non-metallic mineral production such as glass and cement), responsible for half of the emissions of the 50 sectors in 2016. For each type of borrower (large or small enterprises), the three large banking groups with the highest average CDP score over the 2010-2016 period are compared with three large banking groups with lower (or no) average CDP scores. The chart shows that the share of the most polluting sectors in lending to large enterprises tends to decrease for banks that report on average a higher level of climate commitment. On the other hand, banks’ sectoral lending policy to small enterprises seems unrelated to their climate performance score.

Our econometric tests confirm this first impression in a more rigorous framework, which takes into account the potential influence of other factors (credit supply shocks at bank-level and demand shocks at industry-level). We observe that a higher CDP climate score is associated with lower growth of loans extended to the five largest GHG-emitting sectors. However, this correlation is entirely explained by banks’ lending policy to large enterprises. On the other hand, banks’ lending policy to SMEs across sectors that emit more or less GHGs seems to be unrelated to banks' climate commitment. According to our estimations, a CDP score spread of 3 (out of 5) translates into a relatively lower annual growth rate in lending to these five sectors of about 5 to 7 percentage points (depending on the specifications). However, this partial reallocation of funding does not appear to be sufficient to cause a significant decrease in emissions at sector level over the period under review.

Of course, these results should be interpreted with caution. First, the scope of the funding considered is restricted by our source to direct loans to companies resident in France. It ignores market financing (bonds and equities), which is an important source of funding for large enterprises, and financing extended abroad. Second, correlations are established, but not causality: a bank may seek to improve its CDP score because it anticipates a spontaneous decrease in its lending to certain polluting sectors whose activity in France is declining. Finally, sector classification, although valuable, has limitations for our exercise (for example, the "land transport" sector includes rail and road transport).

What can we learn from this exercise?

First of all, our results suggest that the climate commitment displayed by banks is not simple "greenwashing". A logic of reducing exposure to certain carbon-intensive sectors seems to be at work when the latter is stronger, at least as regards lending to large enterprises in France, which does not mean that current efforts are sufficient.

Second, the carbon impact of lending to SMEs does not currently seem to be taken into account. There are potentially many reasons for this omission (unsuitability of internal reporting systems, lack of visibility of actions in this area, etc.). The lack of data on the carbon footprint of SMEs, which have no legal reporting obligation on this matter, is undoubtedly one of them. However, the emissions of VSE-SMEs are estimated in the broadest sense at around 14% of French emissions (Bonduelle and Goujon, 2018). Improving, in a form suited to the constraints of small businesses, the collection of information on these emissions is therefore an avenue that should not be neglected in order to speed up the "decarbonation" of bank lending and the transition to a low-carbon economy.