1. At a time of increasing digital use, bankcards maintained their status as the primary everyday payment method

The use of cashless means of payment in the real economy has increased overall since the health crisis. This trend continued in 2022, with 29.5 billion transactions accounting for around EUR 42,500 billion exchanged (compared with 24.9 billion transactions for EUR 28,500 billion in 2019).

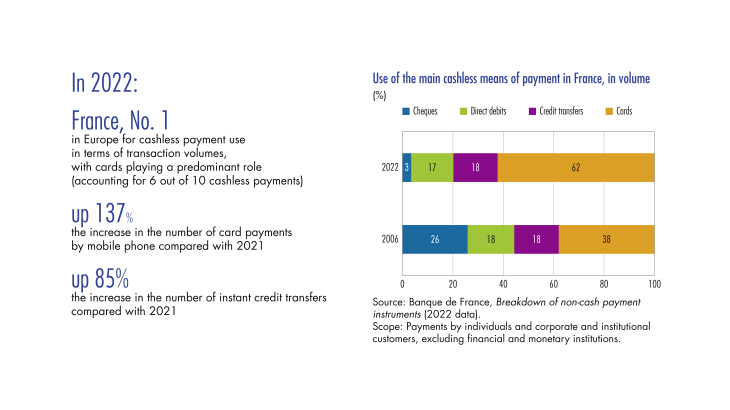

The proportion of cashless payments made by card has risen steadily over the past ten years. Thanks to their diverse applications – in store, remotely and on mobile phones – cards continued to be the most widely used means of payment in terms of volume of transactions in 2022. Bankcards now account for more than 60% of cashless payments, up from 46% in 2012 (see Chart 1). Bankcards thus stand apart from other means of payment, whose use has remained relatively stable (credit transfers and SEPA Direct Debits) or has followed a downward trend (cheque payments have declined by 64% in terms of volume since 2012).

Against this backdrop of dynamic change, the most innovative uses are showing the strongest growth rates. Some cashless methods have become firmly established, such as contactless card payments, which first came into use in 2012 with a EUR 20 payment limit, and were subsequently boosted by two successive regulatory increases to the payment ceiling in September 2017 (EUR 30) and May 2020 (EUR 50). This surge in contactless payments has notably been to the detriment of cash and traditional (contact) bankcard uses. Now, more than six face to face card payments out of 10 (see Chart 2 below) are contactless, for average amounts of less than EUR 20, and this means of payment has become an important part of the household payment landscape.

Card payment by mobile phone is also growing rapidly year on year (up 177% in 2021 and 137% in 2022) and now accounts for almost 6% of face to face card payments and a little under one in every 10 contactless payments.

At the same time, retailers are under pressure to install terminals (some of which are increasingly sophisticated), to cater to all these card payment use requirements: the number of point of sale terminals has therefore increased substantially over the past two years (up 27% on 2020).

[To read more, please download the article]