The recent surge in inflation prompted several governments to reduce the value-added tax (VAT) as a way to alleviate inflationary pressures. The effectiveness of this policy hinges on the extent to which VAT reductions are passed on to final consumer prices. Evidence on the effect of VAT reductions on prices amid periods of high inflation is rather scarce, mainly due to historically low inflation rates in the last decade.

This study investigates the effects on prices in Spain resulting from the temporary reduction in the VAT rate for essential food products using a novel data set with web-scraped information on supermarket prices. Announced at the end of 2022 and starting January 1, 2023, the VAT rate was decreased from 4% to 0% for specific items (such as bread, eggs, flour, milk, fresh fruits and vegetables) and from 10% to 5% for other items (including vegetable oils and uncooked pasta). The reduction in the VAT rate was designed to be a temporary measure. Initially, it was planned to revert to its original rates after six months, but due to persistent inflation in 2023, it was extended two times. It is envisaged that VAT rates will be restored to their previous levels by mid-2024.

We examine how this tax rate change was transmitted to prices using online data from several supermarket chains. The data were obtained using web scraping techniques from the Daily Price Dataset collected by the Price Setting Microdata Analysis Network (PRISMA), an initiative led by the ECB. As a first step, we categorize each product according to the official Coicop5 categories using machine learning techniques. We first use novel natural processing techniques to label a subsample and subsequently train a model to map all food products according to the official product classification. This allows us to identify accurately the products affected by the policy change. Due to the level of granularity and time frequency of the data, we reconstruct price indices at almost real-time basis and compare them against the official figures from the National Institute of Statistics (INE by its Spanish acronym), which provides data on a monthly basis.

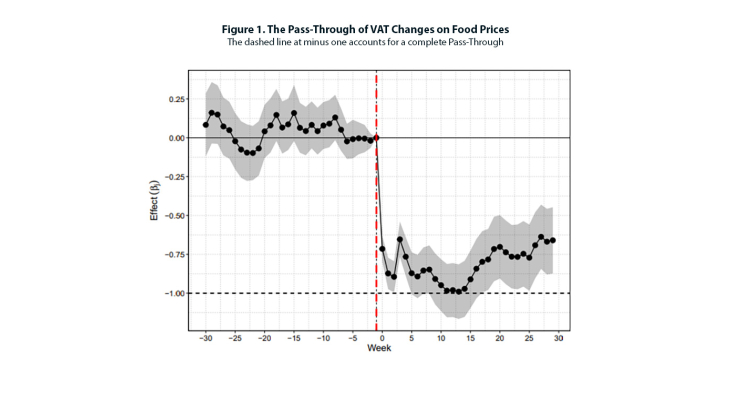

We then evaluate the degree of pass-through employing a difference-in-difference and event-study approach. We analyse the price developments of the affected products in comparison to a control group of products. The control group includes all food products that are not affected by the reform. We find that the tax reduction was almost completely transferred to prices in the initial weeks following the reform (approximately 90%). The pass-through rate was lower for products in the 4% to 0% category –the group of basic staples- (about 50%), whereas it exceeded 100% for products in the 10% to 5% category, that includes pastas and oil . The pass-through rate was higher for imported products compared to domestic products, with no significant differences observed between processed and unprocessed products or between trademark and white-label products.

Keywords: Price Rigidity, Inflation, Consumer Prices, Heterogeneity, Microdata, VAT Pass-Through.

JEL classification: E31, H22, H25