- Home

- Publications and statistics

- Publications

- AI and the growth of data centres: chall...

AI and the growth of data centres: challenges for the copper market

Post No.402. The rapid development of artificial intelligence is boosting demand for the metals needed for the electronic components used in data storage systems, such as copper. These increased needs are further contributing to the booming demand for copper linked to the energy transition, and accentuating the imbalance in this market, with risks for financial stability.

Chart 1: Forecast of annual demand for copper by data centres located in North America

Artificial intelligence: driving the demand for copper

The adoption of artificial intelligence (AI) – and more specifically generative AI – has ramped up since early 2023 when ChatGPT opened up to the general public. This technology presents both opportunities and risks for the financial sector (Banque de France, 2024). Global investments in generative AI have skyrocketed, from USD 2.6 billion in 2022, to over USD 20 billion in 2023 (Our world in data, 2024), and the number of AI-related patents filed has increased sharply in recent years.

This growth in the development of AI generates an increase in the demand for electronic components used in data storage systems (chips, printed circuit boards), which are made from metals such as gold, copper, palladium and platinum. Among these metals, copper possesses essential properties for electronic systems, such as its electrical conductivity and resistance to corrosion. In particular, it is used in data centres for electrical power supply, cooling systems and connectivity. For example, the construction of Microsoft's data centre in Chicago required 2,177 tonnes of copper. BHP mining corporation has estimated that the annual global demand for copper from data centres dedicated to AI is expected to increase sixfold to 3 million tonnes by 2050, or about 9% of global demand in 2050, up from 500,000 tonnes in 2024 (BHP, 2024). This sharp increase in demand could put pressure on the precious metals market and potentially lead to a risk of shortages if it occurs too quickly.

The acceleration in the growth of AI also results in an increasing demand for electricity with the creation of new data centres for developing new generative AI. By 2030, electricity consumed by AI is expected to account for 3% to 4% of global demand (S&P Global, 2023).

The demand for copper stemming from the growth of AI increases the risk of an imbalance between supply and demand, which has also been identified in the energy transition. The transition also requires metals, including copper, which are essential for the production of renewable energy (wind turbines, solar panels), energy storage (batteries) and recharging infrastructure for electric vehicles (Banque de France, 2023). Annual copper consumption for a low-carbon energy system is therefore expected to increase from 7.9 million tonnes in 2025, to 17.3 million tonnes in 2050, according to the International Energy Agency.

The increasing demand for copper could create risks for the copper market

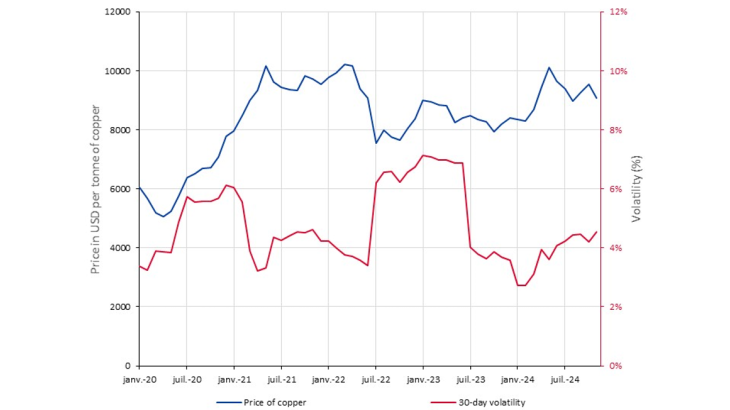

The copper market is especially sensitive to the macroeconomic climate and geopolitical risks, and in particular to the economic situation in China, which accounts for over half of global demand. Therefore, the economic slowdown in China, particularly in the real estate sector, which is a major driver of demand, and the uncertainties surrounding the prospects for recovery, contributed to the increased volatility of copper prices in 2024 (Chart 2).

Chart 2: Price of copper and 30-day volatility

In 2024, copper producers identified a mismatch between growing demand and production capacity, and warned of the risk of high volatility. Fears over copper shortages could put significant pressure on the markets in the coming years.

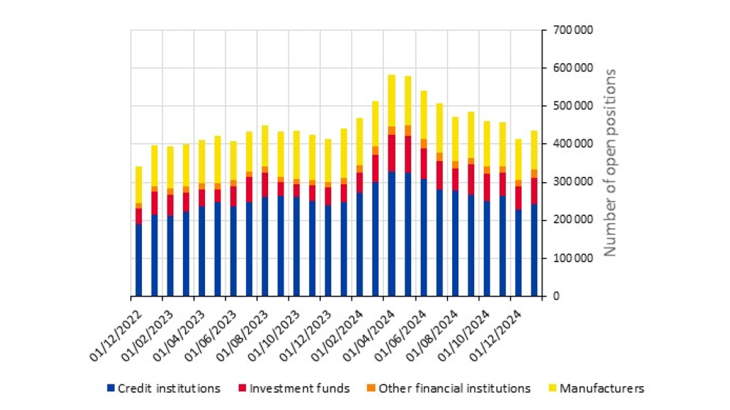

Speculative positions on the copper market could also fuel volatility. Between 2023 and 2024, annual volumes of copper futures contracts rose by 10.5% on the London Metal Exchange (LME) and by 6.8% on the Chicago Mercantile Exchange (CME). Investment fund speculative long positions on LME futures contracts have been rising since early 2023 and peaked in May 2024 at 16.5% of total open positions (Chart 3). Long hedge positions of the copper industry have been broadly stable since early 2023 and represent around 20% of total open positions (LME, 2025).

Chart 3: Long open positions on LME copper futures contracts

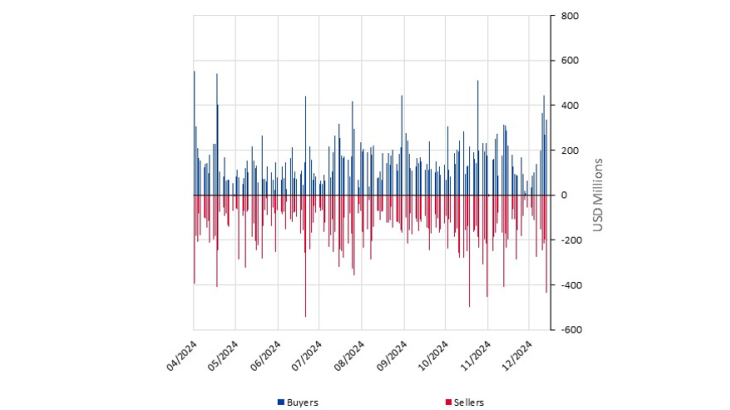

Trading by certain speculative investment funds already contributed to high price volatility in 2024, pushing the price of copper to an all-time high of USD 11,000 per tonne in May. Two peaks in transactions on copper futures contracts originating from investment funds with European counterparties were identified in early May 2024 (Chart 4). Speculative investment funds are therefore betting on a boom in AI and a sharp rise in demand. Indeed, copper futures prices rose by 5% in 2024 in line with these positions. Speculative positions can also impact copper producers, who use short positions on futures contracts to hedge against a fall in prices. In the event of a sharp rise in the price of copper, producers may be forced to buy back copper to cover their short positions, which has a procyclical effect of increasing prices and can lead to losses for producers.

Chart 4: European investment fund transactions in copper futures contracts in 2024

Note: The scope of EMIR data for this chart includes all transactions carried out by a European investment fund or by a non-European investment fund with a European counterparty.

Episodes of high volatility have already occurred in the metals markets, leading to collateral impact on the financial position of certain market participants.

In 1995, Sumitomo, a large Japanese trading company, was involved in a major manipulation of the copper market. The company had built up massive futures positions on the LME, controlling up to 5% of global supply and artificially driving up prices. Discovery of the fraud resulted in significant losses for Sumitomo (USD 1.8 billion) and a sharp drop in copper prices of more than 30%.

More recently, in March 2022, the price of nickel jumped by 270% and reached record levels following the invasion of Ukraine, resulting in the suspension of trading by the LME. To contain market volatility, the LME imposed daily price caps on other metals and banned orders placed outside of this daily price cap. This episode highlighted the major risks for commodity markets: on the one hand, their sensitivity to geopolitical events, which can trigger sudden and unpredictable fluctuations; on the other hand, the danger of excessive speculative positions, which can cause the market to crash due to the margin call process (Banque de France, 2022). Margin calls are a safety mechanism necessary for the smooth functioning of derivatives markets, however they can also provide a channel for transmitting market shocks.

Download the full publication

Updated on the 22nd of April 2025