- Home

- Press Releases

- Euro area economic and financial develop...

Euro area economic and financial developments by institutional sector: third quarter of 2024

- Euro area net saving increased to €820 billion in four quarters up to third quarter of 2024, compared with €804 billion one quarter earlier

- Household debt-to-income ratio decreased to 82.5% in third quarter of 2024 from 86.2% one year earlier

- NFCs' debt-to-GDP ratio (consolidated measure) decreased to 67.4% in third quarter of 2024 from 69.1% one year earlier

Published on the 28th of January 2025

Total euro area economy

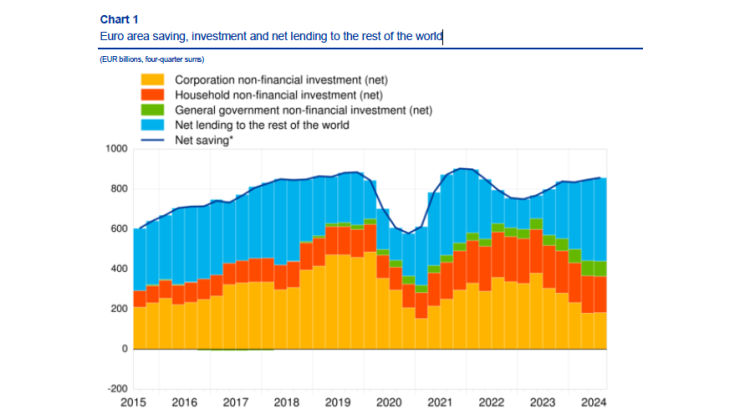

Euro area net saving increased to €820 billion (6.8% of euro area net disposable income) in the four quarters up to the third quarter of 2024 compared with €804 billion in the four quarters up to the previous quarter. Euro area net non-financial investment was broadly unchanged at €440 billion (3.7% of net disposable income), due to broadly unchanged net investment in all sectors (see Chart 1 and Table 1 in the Annex).

Euro area net lending to the rest of the world increased to €418 billion (from €405 billion previously) reflecting the increased net saving and broadly unchanged net non-financial investment. Household net lending increased to €581 billion (4.8% of net disposable income) from €561 billion. Net lending of NFCs decreased to €192 billion (1.6% of net disposable income) from €231 billion while that of financial corporations was broadly unchanged at €132 billion (1.1% of net disposable income). General government net borrowing decreased, contributing less negatively (-4.0% of net disposable income, after -4.3% previously) to euro area net lending.

* Net saving minus net capital transfers to the rest of the world (equals change in net worth due to transactions).

Households

Household financial investment increased at a broadly unchanged annual rate of 2.4% in the third quarter of 2024. Among its components, investment in currency and deposits (2.6%, after 2.3%) and investment in shares and other equity (1.3%, after 0.8%) grew at higher rates - the latter due to investment fund shares - while investment in debt securities increased at a lower rate (15.4%, after 28.4%).

Households continued to purchase, in net terms, mainly debt securities issued by general government and MFIs. Households were overall net sellers of listed shares, selling predominantly listed shares of non-financial corporations, while buying listed shares issued by the rest of the world (i.e. shares issued by non-euro area residents). Households increased their purchases of euro area investment fund shares, including those issued by MFIs (money market funds) and by non-money market investment funds, and continued to purchase investment fund shares issued by the rest of the world (see Table 1 below and Table 2.2. in the Annex).

Download the full publication

Updated on the 28th of January 2025