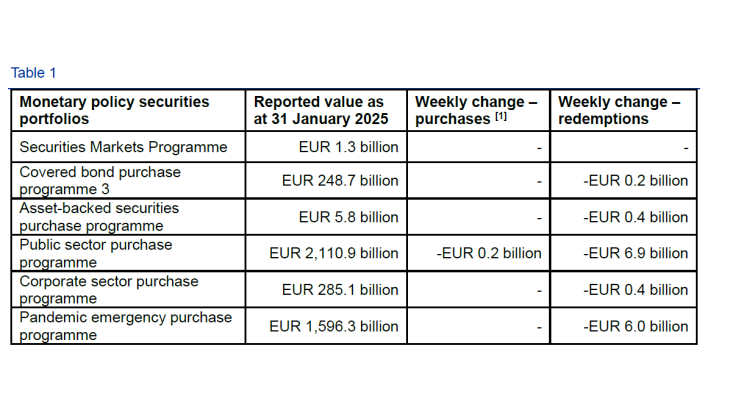

Consolidated financial statement of the Eurosystem as at 31 January 2025

In the week ending 31 January 2025 the net position of the Eurosystem in foreign currency (asset items 2 and 3 minus liability items 7, 8 and 9) increased by EUR 0.3 billion to EUR 346.1 billion.

Published on the 4th of February 2025