- Home

- Governor's speeches

- Resilience in Europe, and a virtuous cir...

Resilience in Europe, and a virtuous circle for Paris as a financial centre

François Villeroy de Galhau, Governor of the Banque de France

Published on the 16th of April 2024

Paris Europlace – New York, 16 April 2024

Speech by François Villeroy de Galhau, governor of the Banque de France

Ladies and Gentlemen,

It is a great pleasure to be here in New York for this Paris Europlace gathering. Today I would like to take the opportunity first to give you an update on the economic outlook on the other side of the Atlantic: Europe remains resilient, and the Eurosystem too has been successfully reining in inflation (I). I will then follow up by discussing Paris as a financial centre, where a virtuous circle has created further momentum (II).

I. Europe remains resilient, and the Eurosystem is successfully reining in inflation

Let me start with an update of the economic situation in Europe and in France. Last year, I had indicated that the likelihood of a recession in 2023 was very remote. While modest, growth did remain positive last year – at 0.5% in the euro area and 0.9% in France. Our growth forecast for the euro area stands at 0.6% in 2024,1 with a gradual recovery in consumption thanks to a rebound in real wages and high employment. Growth could then pick up significantly to 1.5% in 2025 and 1.6% in 2026, with investment resuming more markedly from 2025 onwards.

These figures are obviously lower than the 2.5% growth in the United States in 2023, expected at 2.7% this year and 1.9% in 2025.2 However, Europe’s resilience remains encouraging, as war has been raging on its soil for more than two years with strong economic knock-on effects. In the meantime – and this is excellent news for central banks as well as for the economy as a whole – the wave of inflation has subsided, dropping in the euro area from a peak of 10.6% in October 2022 to only 2.4 % last month.3

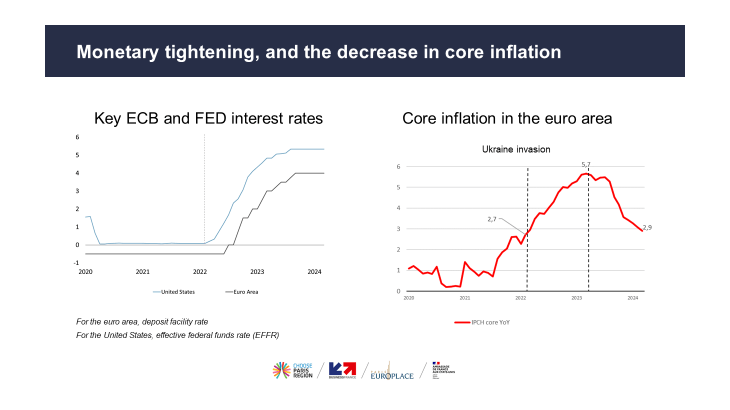

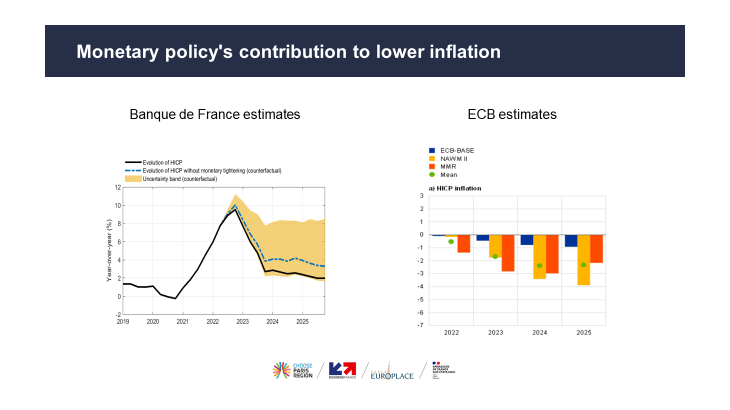

I have analysed these developments in a recent speech, "Anatomy of a fall in inflation”.4 Of course, inflation was initially fuelled by supply shocks, and so was disinflation when these shocks reversed. However core inflation – admittedly less spectacular but still covering around 70% of the average consumption basket – was more threatening because it risked being more persistent and self-sustaining. The Eurosystem therefore responded with the biggest overall interest rate hike ever, at a very sustained pace. Core inflation, after peaking at 5.7% in the euro area in February 2023, has been halved to 2.9% last month.

Monetary policy is at work, and is working. We consider, in our latest Monetary Policy Statement of April 11th,5 that the key ECB interest rates are at “levels that are making a substantial contribution to the ongoing disinflation process”.

What does that mean for our future monetary policy steps? Barring major shocks and surprises, we should decide a first rate cut early June, followed by others in a pragmatic and agile gradualism – and we will obviously monitor the possible consequences of the developments in the Middle East.

One word about public finance in France: deficit slipped unexpectedly to 5.5% in 2023, due to negative surprises on tax receipts. Although lower than on this side of the Atlantic, this deficit is obviously too high. Hence the French government was right to present last week an updated stabilisation program, with a reduction of deficits to 5.1% this year and below 3% in 2027. But the key task will be now to precise its content, and credibly achieve its implementation.

II. The virtuous circle of Paris as financial centre

Last year I highlighted the momentum of Paris as a financial centre post-Brexit, helped inter alia by its wide range of financial activities – by far the widest in the EU, ranging from global asset management to insurance and banking. Paris has in particular further grown as the hub for market activities, with most international banks having now their trading rooms and desks located and / or significantly expanded in the French capital.

This Parisian momentum is still powerfully at work, and even exceeds expectations: success breeds success! Let me quote just a few outstanding examples over recent months, which follow on the heels of a series of similar developments. Morgan Stanley announced its intention to increase its Paris-based staff to 500 in market activities,6 up from around 150 back in 2021. Barclays is weighing up the possibility of moving its EU headquarters from Dublin to Paris in order to be closer to its balance of operations, and has thus initiated dialogue with supervisors and other stakeholders.7 JP Morgan, which currently has a headcount of 900 in Paris, recently transferred there an additional 13 billion euros worth of assets.

Overall, this take-off has a significant and positive economic impact: French exports of financial services surged to 13 billion EUR in 2023 – an increase of roughly 50% compared with 2020. Total market capitalisation for Paris has remained above that of London since January 2023. The attractiveness of Paris is reflected in the new OFEX ranking,8 which was launched jointly by the Institut Louis Bachelier in France and the Centre for Financial Studies in Germany. Paris is ranked as the fifth financial centre worldwide in this index, neck and neck with number four Tokyo, and ahead of all other EU financial centres. Moreover, Moody’s recently gave Paris the best possible grade for a local authority.

Our attractiveness has been greatly enhanced since 2016, in particular thanks to reforms in French labour and tax laws, which no one has challenged subsequently given their obvious benefits: all public authorities – be they central, regional or local – have been consistent and cooperating through the last eight years, and be sure it will continue in the future. A new law sponsored by Alexandre Holroyd, a Member of Parliament, will boost our competitiveness still further. The legislative process is well underway, and we hope the law will be adopted by the end of May. If passed as proposed, it will bring several improvements, for new public listings and investment funds inter alia. And the ACPR, the French banking and insurance regulator, remains strongly committed to pursuing an open dialogue and facilitating the implementation of projects in Paris.

These French initiatives are also of great interest for Europe as a whole. In February, I strongly advocated for a Financing Union9 in order to strengthen the current Capital Market Union with a higher purpose – namely, the ecological and digital transformations, which Europe is pursuing in a resolute manner. This higher purpose calls for new and more ambitious instruments – including for equity financing. Moreover, Enrico Letta, a former Italian Prime Minister, will release this week a report on the single market with recommendations that, if followed, will bring additional growth to Europe. As you know, we are just a few weeks ahead of European elections. Whatever their precise result, these elections won’t jeopardise the construction of Europe. The current central pivot should remain unchanged, ensuring continuity and stability.

I will conclude with a celebrated American-born dancer, singer and actress, Josephine Baker, who settled in France in 1925. She actively aided the French Resistance during World War II, using her fame as a cover. She passed away in Paris in 1975, and entered the Panthéon with full honours in 2021. Today I would like to quote her most famous song: “J’ai deux amours, mon pays et Paris” (“I have two loves, my country and Paris”). I hope that this sentiment will spread throughout the financial sector in our 21st century and I can assure you once more that you will be most welcome in our City of Light. I thank you for your attention.

1 ECB, Macroeconomic Projections, 7 March 2024

2 IMF, World Economic Outlook, 16 April 2024

3 Eurostat, flash estimate March 2024

4 Villeroy de Galhau, F., Anatomy of a fall in inflation: from a successful first phase to the conditions for a controlled landing, speech, 28 March 2024

5 ECB, Monetary Policy Statement, 11 April 2024

6 Reuters, Morgan Stanley to increase Paris staff to 500 by 2025, 15 May 2023

7 Reuters, Barclays explores moving EU headquarters from Dublin to Paris, 4 August 2023

8 OFEX, Open Financial Ecosystem indeX

9 Villeroy de Galhau, F., From a Capital Markets Union to a genuine Financing Union for Transition, speech, 23 February 2024

Updated on the 16th of April 2024