- Home

- Governor's speeches

- Presentation of the Annual Report of the...

Presentation of the Annual Report of the Autorité de contrôle prudentiel et de résolution (ACPR) for 2023

François Villeroy de Galhau, Governor of the Banque de France

Published on the 29th of May 2024

Press conference, Wednesday 29 May 2024

Speech by François Villeroy de Galhau, Governor of the Banque de France Chairman of the ACPR

Ladies and Gentlemen,

I am pleased to welcome you to our presentation of the Annual Report of the Autorité de contrôle prudentiel et de résolution (ACPR – Prudential Supervision and Resolution Authority), in the company of Jean-Paul Faugère, Vice-Chairman of the ACPR, Nathalie Aufauvre, Secretary General, and Alain Ménéménis, President of the Sanctions Committee.

2023 began with bank failures in the United States and the forced takeover of Credit Suisse, however, it subsequently confirmed the soundness of the French and European banking and insurance sectors, helped by the strength of our regulatory framework and supervision model. Following the rise in interest rates up until September 2023 in order to – successfully – combat inflation, we are set to reverse the interest rate cycle – most probably next week.

Despite the rapidly evolving context, French financial institutions have continued to steer their course in terms of solvency, liquidity and profitability (I). I will then look at how to reconcile financial solidity and competitiveness, by overcoming certain excessive opposition between these two notions (II).

I. The triangle of requirements

Let me start with the "triangle of requirements” – which is not a triangle of incompatibility but of “dynamic tension”. I will go through it in an order that corresponds to successive priorities over time. [Slide 4]

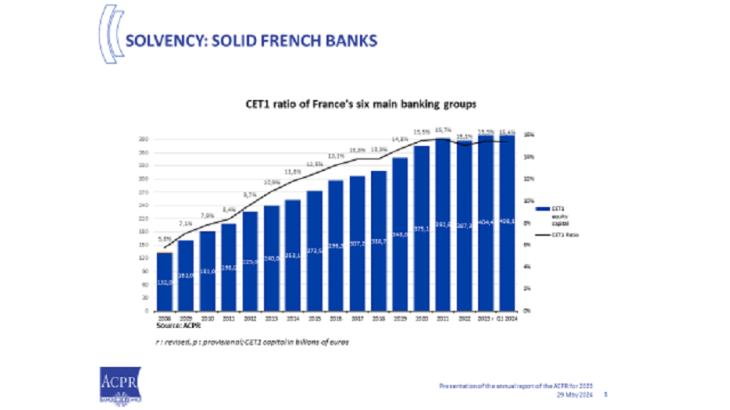

Bank solvency has been at the top of the regulatory agenda since the global financial crisis of 2008 and we have now achieved significant progress in this area, particularly in Europe and in France. The solvency ratio of France’s six main banking groups was 15.5% at end-December 2023, well above regulatory requirements. [slide 5] French banks’ own funds have more than tripled since 2008.

Among insurers, which Jean-Paul Faugère will discuss in more detail, solvency also remains at a high level (249%) – a little higher than at the end of 2022 (247%).

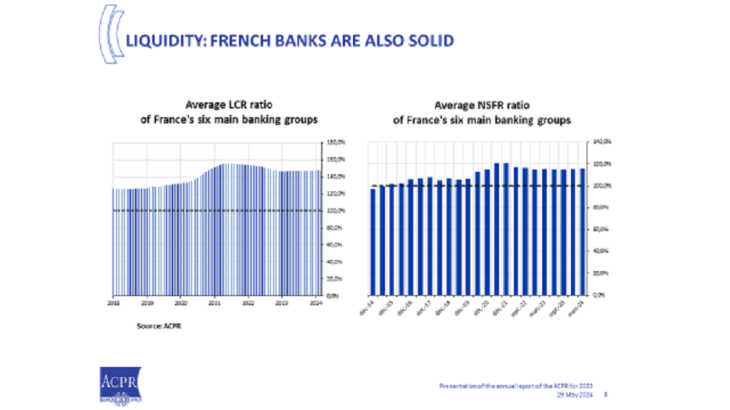

Liquidity had been the big worry in early 2023 in the wake of the Silicon Valley Bank crisis. Here too, French banks demonstrated their soundness: at the end of 2023, their aggregate LCRi stood at 147%, and their NSFRii at 115%, well above the minimum of 100% [slide 6].

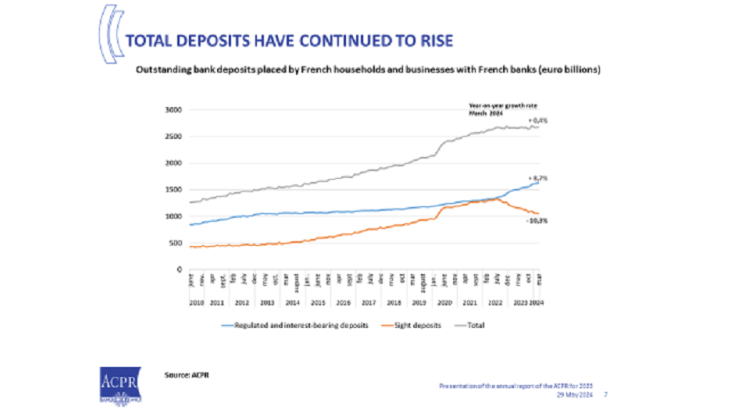

The supervisor's report does not highlight any specific vulnerability in terms of liquidity for the six main French banking groups. Although deposits have shifted from sight deposits into interest-bearing deposits and regulated savings accounts, total deposits have continued to increase slightly. [see slide 7]

Consequently, there can be no doubt: French banks can be, and are in a credit-provider mind-set. This holds true for housing loans: low figures for new housing loans are now due to demand, which remains on hold but should gradually pick up again with average lending rates back down below 4%. Loans to businesses - including SMEs - continue to register positive growth in terms of outstandings.

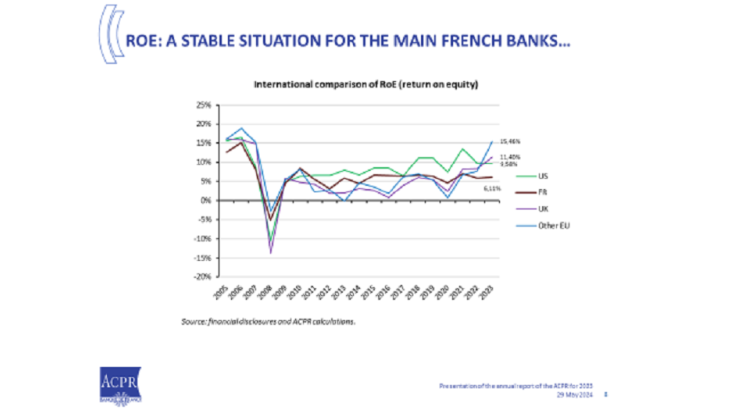

I now turn to the third vertex of the triangle, which is currently more of a specific challenge for French banks, namely profitability. Until 2022, their return on equity ratio (RoE) was comparable to that of other European and international banks, but since then, a gap has opened up, with a stable ratio in France but cyclically-driven increases elsewhere in Europe. [Slide 8]

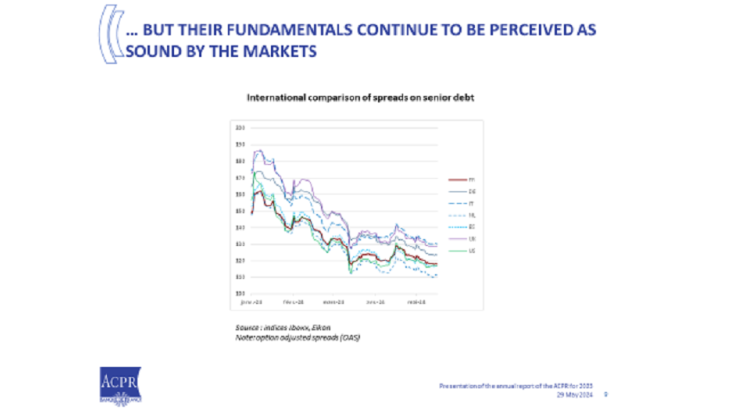

Indeed, during the interest rate hikes of 2023, French banks faced a steeper increase in their interest expense than in their interest income due to the specific features of our business model: i.e. the weight of regulated savings in liabilities and the predominance of fixed-rate housing loans on the asset side of the balance sheet. Consequently, their net banking income (NBI) declined by 3% in 2023. Elsewhere in Europe, a higher proportion of variable-rate loans resulted in a faster increase in returns on assets. Nevertheless, French banks’ net profit has remained stable thanks to both a diversified business model that combines substantial amounts of fees and income from market activities, and a low cost of risk: fixed-rate housing loans contribute to this by protecting households from exposure to rising interest rates. Spreads on senior debt reflect these fundamentals, which are rightly perceived as sound by the markets [slide 9].

However, a number of factors suggest that this challenge in terms of profitability and net interest margin is largely temporary. Since the summer of 2023, the interest rate on Livret A passbook savings accounts has been stabilised at 3% until January 2025, and the stock of fixed-rate loans is gradually being replenished at higher rates. The specific features of the French model could now prove more advantageous: the impact of future cuts in interest rates would be less marked. Although French banks’ net interest margins are tighter, they are also more stable. At the same time, the other activities of a resolutely diversified model (investment banking, insurance, wealth and asset management) could benefit from the normalisation of the interest rate environment as well as from a gradual economic recovery.

The fact remains that the French banking model is structurally defined by intermediation margins that are among the lowest in Europe, high lending volumes and a low cost of risk. This model is conducive to sound financing of the real economy and favourable to banks' customers (households as well as businesses); fortunately, it does not prevent France from having some of the largest and most resilient banks in Europe – 4 out of 8 European Global Systemically Important Banks (G-SIBs) are French. But there is no excess profitability or super bank profits in France today and this justifies the Government's decision to rule out a specific bank tax. The same goes for insurers, whose return on assets at end-2022 stood at 0.61%, firmly aligned with the European average.

II. How to reconcile solidity and competitiveness?

The competitiveness of insurers or banks is not part of regulators' formal mandate. However, this does not mean they are not concerned about it: the competitiveness of financial institutions is one of the underlying conditions of their soundness. More broadly, it is an essential lever for financing green and digital transition investments in Europe. The emphasis that is thankfully placed on the "Savings and Investment Union" - which combines the Capital Markets Union and Banking Union projects - is key to accelerating our growth and consolidating our European economic sovereignty.iii However, we need to get beyond the excessive opposition between solidity and competitiveness.

Security guidelines have served our financial system well through the recent crises, whether they be Basel III, Solvency II, or the macroprudential policies deployed by the HCSF in France, whose action is lauded by European and international authorities. This continuity imperative applies just as much to progress in supervision. Together, these elements have effectively protected the euro area – through the pandemic and then the sharp rise in interest rates – from the risk of a financial crisis and contagion from the Californian and Swiss crises.

To preserve this financial stability, the time has now come for regulatory stabilisation. This is why European supervisors and legislators are determined to ensure a level playing field between different jurisdictions and, consequently, a fair application of Basel III everywhere: nothing less…and nothing more. The aim here is neither a Basel IV nor over-transposition. Clearly, this transposition of Basel III is necessary in the United States, where it currently applies to only 13 banks – leaving a multitude of sometimes large banks subject to rules that are too lax. At the GHoSiv meeting in Basel on 13 May, the competent US authorities reiterated their commitment to implementing all aspects of the agreement fully and consistently. However, there is still uncertainty over the timetable and the exact substance of the final text. If, unfortunately, delays and/or differences in content are too significant, then Europe could – and should – postpone the entry into force of certain provisions, particularly those on market risks, as provided for in the "Banking Package" approved on 6 December last. This is clearly not our first best solution, but it is a safeguard. As regards the revision of the European Solvency II Directive, we are very satisfied with the political agreement reached by the co-legislators in December, which maintains the neutrality of requirements on the French market while supporting long-term sustainable investment and improving how the principle of proportionality is taken into account.

As regards supervision, we will be celebrating the 10th anniversary of Europe’s Single Supervisory Mechanism (SSM) here on 24 June. This will be an opportunity to recognise this great success - the euro area has more secure supervision than elsewhere - but also to stress the need to maintain balanced supervision. This must be strong in terms of its powers, proactive and intrusive, just as the ACPR has been for decades and as the SSM is now. And supervision can be strong while avoiding excessively cumbersome procedures, if it favours a risk-based approach.

We have achieved Supervisory Union, but not complete Banking Union, and this continues to hamper the emergence of pan-European banks. It is high time we leveraged the size of the European market, and aligned our financial strength with our economic clout and our savings capacity. For banks – and we see this in the United States – size is objectively a factor in competitiveness, particularly as it enables banks to amortise the cost of indispensable investments in digital technology and artificial intelligence. French and European banks are going to have to innovate even more resolutely in the tokenisation of their deposits, and in building "cutting-edge" payment and market infrastructures in conjunction with public authorities. Central bank digital currency – including wholesale currency – will be a partner in this respect and not an adversary. For their part, European authorities must relentlessly step up the fight against too many short-sighted differences in national positions and obstacles, particularly in "host" countries.

I will conclude with a quote from Auguste Comte. "To know in order to predict, to predict in order to be able”: in a more uncertain, fragmented and tougher world, rest assured that now more than ever this maxim guides the 1,065 women and men working at the ACPR who I would like to heartily congratulate for all their hard work. Thank you for your attention.

i LCR: average liquidity coverage ratio over a 12-month rolling period

ii NSFR : one-year net stable funding ratio

iii Villeroy de Galhau, F., France and Europe: from crisis management to a longer-term ambition“, Letter to the President of the French Republic, April 2024

iv Press release, Governors and Heads of Supervision reiterate commitment to Basel III implementation and provide update on cryptoasset standard, 13 May 2024

Updated on the 24th of June 2024