- Home

- Deputy governors' speeches

- The policy mix in a world of supply shoc...

The policy mix in a world of supply shocks

Agnès Bénassy-Quéré, Second Deputy Governor of the Banque de France

Published on 6th of November 2024

Agnès Bénassy-Quéré, Deputy Governor of the Banque de France

University of Bordeaux, 3 October 2024

Ladies and Gentlemen, dear Students,

Today I would like to discuss with you the policy mix in a world of supply shocks, a subject of growing importance in the global economic landscape. I will share my views on how monetary and fiscal policy should adapt to this new macroeconomic environment.

The conventional policy mix

Let me start by recalling what the conventional policy mix is. Imagine a funnel, like the one described by James Tobin (1987). Above, we have monetary policy, represented by the M-tap, and fiscal policy, denoted by the F-tap. These two policies feed into the funnel, which represents aggregate demand. This demand flows into a container below, whose water level symbolises supply. The splashes represent production (Y) and the general price level (P).

Chart 1: James Tobin's funnel

Source: B.Q., for Bartsch et al. (2020).

This conventional view of the policy mix shows how the combination of monetary and fiscal policies influences activity and prices through its impact on aggregate demand. However, these two ‘demand-side’ policies are not entirely substitutable. Table 1 summarises their differences.

Table 1. Main differences between monetary policy and fiscal policy

Monetary policy affects demand indirectly, via interest rates, while fiscal policy acts directly, via public spending such as investment or intermediate consumption by general government, or indirectly, via taxes and transfers. Monetary policy decisions can be taken rapidly, but their transmission to the economy is slow, generally taking around 18 months. Conversely, the discretionary part of fiscal policy is subject to a slow legislative process but, once implemented, can have a faster impact on demand. Automatic stabilisers, on the other hand, by definition do not require decisions: if scales remain unchanged, taxes and transfers vary automatically over the economic cycle.

To give a concrete example: if the government decides to send cheques to households (a discretionary policy), these cheques can be spent immediately, having a swift impact on demand. By contrast, when the European Central Bank (ECB) lowers interest rates, the impact on the real economy takes time to manifest.

Another important aspect to consider is the impact of these policies on government debt. Monetary policy influences debt accumulation directly through interest rates, and indirectly through the impact of this policy on activity and prices. Fiscal policy directly affects the primary balance. Like monetary policy, it also affects the accumulation of government debt through its impact on nominal GDP.

It should also be noted that monetary policy is almost always a blunt instrument, affecting the economy as a whole, whereas fiscal policy can be more targeted, affecting specific sectors or groups of the population. During the pandemic, the ECB intervened in the short-term corporate bond market to unlock this specific market segment, but this was an exception rather than the rule. In general, the ECB acts through policy rates, which affect all lender and borrower interest rates at the same time.

In an open economy with a high degree of international capital mobility, the Mundell-Fleming model teaches us that monetary policy is reinforced by its external transmission channel (e.g.an unanticipated interest rate cut by the ECB leads to a depreciation of the euro). Similarly, the fact that exchange rates are fixed within the euro area (by construction in a monetary union) increases the impact of the fiscal policy implemented by individual Member States.

How effective both policies are depends very much on their credibility: monetary easing has a greater impact if the markets consider it to be sustainable, because in this case long-term interest rates fall, and not just policy rates. Fiscal policy, on the other hand, has a greater impact on activity if government debt is considered to be sustainable, because here fiscal expansion is not offset by a rise in the household savings rate (neo-Ricardian effect).

Finally, both policies can be constrained. As regards monetary policy, interest rates cannot fall below a slightly negative level. As regards fiscal policy, European rules and market pressure can prevent a government from responding to a negative shock to activity.

The European policy mix under pressure from supply shocks

The implementation of the policy mix is specific to the euro area in that monetary policy is defined for the area as a whole, while fiscal policies are decided at the Member State level. The policy mix corresponds to the first diagonal in Table 2: monetary policy reacts to ‘symmetric’ shocks, which affect aggregate demand in the euro area as a whole, aiming to stabilise prices; fiscal policies react to specific (or ‘idiosyncratic’) shocks, aiming to stabilise the national output gap (the gap between actual and potential output at country level).

During the decade of too-low inflation that followed the global financial crisis and the euro area sovereign debt crisis (2009-19), the European Commission and the European Fiscal Board tried to promote the coordination of fiscal policies so as to steer the overall fiscal stance and thus bolster monetary policy action (top left-hand cell of Table 2). In 2014, Mario Draghi himself, the then President of the ECB, called for fiscal policy to support the efforts of monetary policy to raise the level of aggregate demand and the rate of inflation: “It would be helpful for the overall stance of economic policy if fiscal policy could play a greater role alongside monetary policy”.1 However, these appeals went unheeded, as governments are bound by their national constituencies.

Coordination of fiscal policies may also be useful where shocks differ across Member States. During the euro area sovereign debt crisis of the early 2010s, many experts argued in favour of coordinated but differentiated fiscal policies, to ensure that the countries affected by the crisis did not simultaneously suffer from a loss of external demand from other European countries. These appeals met with the same obstacles: the coordination of decentralised fiscal policies is no substitute for a federal budget, which is very limited in the euro area.

The bottom right-hand cell in Table 2 (price stabilisation in the face of specific shocks) remained empty until the energy crisis erupted in 2021.

Table 2. The policy mix in the euro area

While demand shocks cause activity and prices to move in the same direction, supply shocks cause them to move in opposite directions. For example, a rise in energy prices leads to an increase in inflation and a fall in production and consumption. If this type of shock occurs, there is a risk of a conflict between monetary policy and fiscal policy: the central bank would tighten monetary policy to fight inflation, while governments would stimulate the economy to support production.

The energy crisis of 2021-22 provided us with a concrete example of this problem. European governments, including France, responded to the rise in energy prices by supporting household purchasing power and providing aid to businesses (fiscal expansion). At the same time, the ECB raised its policy rates by 450 basis points (4.5 percentage points) between July 2022 and September 2023 (monetary tightening).

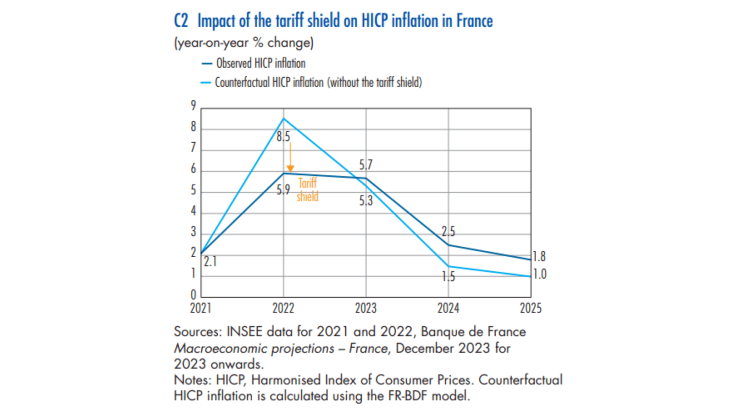

The impact of this cocktail was initially uncertain. In reality, fiscal measures have often taken the form of "tariff shields" which have directly curbed consumer prices. According to Lemoine, Petrovich and Zhutova (2024), tariff shields reduced inflation by around 2.6 percentage points (pp) in France in 2022, before raising inflation by a cumulative 2.2 pp over the 2023-25 period (Chart 2), with a fiscal cost of around 1.1% of GDP in 2022 and 2023. These measures have had a significant impact on inflation. For the euro area as a whole, Dao et al (2023) find that the measures also had an impact of around -2 pp on inflation in 2022.

However, governments have benefited from the drop in energy prices in 2023-24, but this temporary increase in revenues was not sufficient to offset spending in 2021-22. Going forward, because of the level of government debt, euro area governments may not be able to implement such massive support again should another inflationary episode occur, particularly in the event of persistent shocks..

Chart 2:

Can the policy mix ignore supply shocks?

Would it be possible for the policy mix to stick to its traditional roadmap of responding only to demand shocks, leaving the economy to adjust to supply shocks on its own? This question differs when it comes to fiscal policy or monetary policy.

Fiscal policy

When prices rise, particularly energy prices, one might assume that the government has no need to intervene, particularly in France where the minimum wage and means-tested social benefits are index-linked. Furthermore, the savings accumulated by households during the pandemic should have enabled them, by 2021-22, to cushion the impact of the shock on their consumption. However, a number of factors justify government intervention:

- First, the ratchet effect must be taken into account. There is a risk that people who lost their jobs during the crisis will remain unemployed, even after the level of energy prices, purchasing power and consumption has returned to its initial level. This phenomenon can create structural unemployment that is difficult to reverse.

- Second, indexation can lead to second-round effects. Increasing wages and benefits in response to inflation can fuel an inflationary spiral, where price and wage rises are mutually reinforcing. The government may decide to mitigate these second-round effects.

- Third, there is a political economy aspect to consider. The government is increasingly seen as an insurer against economic risks. Citizens expect the state to intervene to mitigate the impact of economic shocks, creating political pressure for government intervention.

- Lastly, household perceptions must be taken into account. Surveys carried out by the Banque de France show that individuals focus their attention on a small number of prices, generally energy and food products, which are also the most volatile (see Bignon and Gautier, 2023). This perception bias may make people feel poorer, even when real purchasing power is preserved, prompting the government to take action to limit the most salient price rises.

These factors explain why governments often have to intervene in response to supply shocks, even when indexation mechanisms are in place for the most vulnerable households.

Monetary policy

The European Central Bank defines price stability as an inflation rate ‘close to 2% over the medium term’. This definition allows for temporary deviations from the 2% target.

According to Dupraz and Marx (2023), the optimal response to a temporary shock in commodity prices would be to ‘look through’ without reacting forcefully, provided that inflation expectations remain ‘anchored’, which assumes that the 2% target remains credible over the medium term. However, short-term deviations in the inflation rate can have lasting effects that can undermine this general principle.

- First, the pass-through of input prices is often asymmetric, particularly in the food sector: price rises are passed on more quickly and more significantly than price falls, which can lead to persistent inflation.

- Second, sudden price adjustments, particularly in the energy and food sectors, can cause inflation expectations to become de-anchored. As households and businesses pay much greater attention to these visible price changes, they could raise their expectations of inflation in the longer term, which could prove to be a self-fulfilling prophecy.

- Third, the forecasting errors resulting from these shocks can lead to a misallocation of economic resources and therefore, ultimately, to a weakening of potential growth, which can reinforce inflationary pressures. A study by Ropele, Gorodnichenko and Coibion (2024) focusing on Italy highlighted this phenomenon during the last inflationary episode.

Given these challenges, Reichlin and Zettelmeyer (2024) suggest that we should accept a longer stabilisation period for supply shocks than for demand shocks. This approach would allow monetary policy to adapt with greater flexibility to different types of economic shock, while maintaining its price stability objective over the medium term.

Towards a new policy mix

There is no consensus on the impact of climate change and the green transition on activity and inflation, as this largely depends on how the transition is implemented. However, it is likely that supply shocks - whether temporary or persistent - will become more frequent than in the past. In order to address this challenge, a more flexible policy mix may be required.

Fiscal policy could become more targeted and flexible. In the event of a negative supply shock, for example, the government may wish to prioritise support for investment, so as not to delay the transition and thus protect itself against future supply shocks. In the same vein, Fornaro and Wolf (2023) propose temporarily subsidising corporate investment when monetary policy is tightened. This could mitigate the adverse impact of monetary tightening on economic activity while promoting long-term growth. Cox et al (2024), for their part, argue that in the event of a supply shock, fiscal policy should be targeted at the sectoral level and neutral at the aggregate level. What all these proposals have in common is that monetary policy should be left with the task of stabilisation at the aggregate level, giving priority to price stability.

Monetary policy, meanwhile, could adopt a more differentiated approach to supply shocks. For example, the ECB could focus more on core inflation (excluding energy and food) rather than headline inflation during temporary energy shocks. However, as it is generally not known at the outset whether shocks will be temporary or persistent, a hybrid approach will probably be necessary.

Debates on the green transition generally focus on their comparative costs in terms of activity. The above discussion suggests that models should be developed to compare the impact of different strategies in terms of inflation too. A study by the Banque de France (Allen et al., 2023) shows that, depending on the instruments used, the transition could be inflationary or disinflationary.

The idea of using monetary policy to support the green transition itself raises a number of questions:

- First, adding a new objective to the central bank mandate could weaken its ability to achieve its primary objective of price stability. This would run counter to the Tinbergen rule, which states that an economic policy instrument should have a single objective. This principle is currently reflected in very concrete terms: with central banks normalising their balance sheets (quantitative tightening), ‘green quantitative easing’ (whereby the central bank buys ‘green’ assets on the financial markets) seems contradictory.

- Second, the greening of monetary policy could open up a Pandora's Box: why limit ourselves to the ecological transition, leaving aside the digital transition, reindustrialisation and financing population ageing?

- Lastly, it is important to remember the Fisher equation: in the medium term, the real interest rate (nominal interest rate minus inflation rate) is independent of the nominal rate. Thus, aside from in the very short term, keeping policy rates low in order to foster the transition would be ineffective. Rather, the resulting inflation could cause expectations to become de-anchored, term premia to rise and, ultimately, long-term real interest rates to increase, which are those that count for investment.

This does not mean that central banks should have no involvement in the green transition. On the contrary, global warming and the transition may have drastic consequences for price stability and financial stability, both of which are at the core of their missions. In this regard, their contribution is primarily to:

- Firmly anchor inflation expectations, in order to limit price uncertainty in the medium term and thus help flatten the real interest rate curve.

- As part of banking supervision, monitor the disclosure of climate risks and conduct "green" stress tests to assess the resilience of the financial system to the risks associated with climate change.

The Banque de France and the Autorité de Contrôle Prudentiel et de Résolution are strongly committed to this strategy, within the framework of the Eurosystem and its Single Supervisory Mechanism, via the Network for Greening the Financial System (NGFS), whose Secretariat is provided by the Banque de France. Moreover, thanks to the development of a ‘climate indicator’, it will be possible to assess the position of each significant French company in relation to the climate transition trajectory, and thus better steer investments. Lastly, the Banque de France actively strives to green its own activities and its non-monetary investment portfolios. It is ranked first by Positive Money in terms of greening, out of all the G20 central banks.

The fact remains that central banks are not in the forefront in this area: they can support the transition but not initiate it, since the instruments for influencing private investors' incentives (carbon pricing, regulations) are in the hands of governments.

Thank you for your attention.

References

Allen, Th., Boullot, M., Dées, S., de Gaye, A., Lisack, N., Thubin, C. and O. Wegner (2023), “Using Short-Term Scenarios to Assess the Macroeconomic Impacts of Climate Transition”, Banque de France working paper No. 922, wp922_0.pdf (banque-france.fr)

Bartsch, E., Bénassy-Quéré, A., Corsetti, G., and X. Debrun (2020, « I’ts all in the mix: how monetary policy and fiscal policy can work or fail together », Geneva Report on the World Economy 3, geneva23.pdf (cimb.ch).

Bignon, V., and E. Gautier (2023), ‘French housholds and inflation in 2023’, Banque de France Bulletin No.242, November, French households and inflation in 2023 – The virtuous triangle of “information, knowledge and trust” contributes to price stability | Banque de France (banque-france.fr)

Cox, L., Feng, J., Müller, G., Pasten, E., Schoenle, R., and M. Weber, (2024), “Optimal monetary and fiscal policies in disaggregated economies”, CEPR discussion paper No. 19340.

Dao, M., Dizioli, A., Jackson, Ch., Gourinchas, P.-O., and D. Leigh (3023), “Unconventional Fiscal Policy in Times of High Inflation”, IMF working paper No. 178, Unconventional Fiscal Policy in Times of High Inflation (imf.org).

Draghi, M. (2014), Luncheon Address: “Unemployment in the Euro Area”, Luncheon address, Jackson Hole Conference, Federal Reserve Bank of Kansas City, 2014Draghi.pdf (kansascityfed.org)

Dupraz, S., and M. Marx (2023), « Anchoring Boundedly Rational Expectations”, Banque de France working paper No. 936, WP936_0.pdf (banque-france.fr).

Fornaro, L. and M. Wolf (2023), « The scars of supply shocks: Implications for monetary policy”, Journal of Monetary Economics, 140, pp. 18-36.

Lemoine, M., Petronevich, A. and A. Zhutova (2024), “Energy tariff shield in France : what is the outcome?”, Banque de France Bulletin No.253, Energy tariff shield in France: what is the outcome? | Banque de France (banque-france.fr)

Positive Money (2024), Green Central Banking Scoreboard, Green Central Banking Scorecard - Green Central Banking.

Reichlin, L., and J. Zettelmeyer (2024), « The European Central Bank must adapt to an environment of inflation volatility”, Bruegel Policy Brief, juin, The European Central Bank must adapt to an environment of inflation volatility (bruegel.org).

Ropele, T., Gorodnichenko, Y. and O. Coibion (2024), “Inflation Expectations and Misallocation of Resources: Evidence from Italy”, American Economic Review: Insights, 6(2), pp. 246-261, Evidence from Italy - American Economic Association (aeaweb.org).

Tobin, J. (1987), “The Monetary-Fiscal Mix in the United States”, Chapter 14 in Policies for Prosperity, MIT Press.

Download the full publication

Updated on the 6th of November 2024