- Home

- Governor's speeches

- “Markets and minds: upholding the transa...

“Markets and minds: upholding the transatlantic partnership”

François Villeroy de Galhau, Governor of the Banque de France

Published on the 23rd of April 2025

Atlantic Council, Washington DC – 23 April 2025

Speech by François Villeroy de Galhau, Governor of the Banque de France

Ladies and Gentlemen,

I am honoured to take the floor here at the Atlantic Council, just a few blocks from Franklin Park and Lafayette Square. Washington’s geography reminds every passerby of the enduring bond between our two nations – a bond forged in shared struggles, and anchored in common values. As the Marquis de Lafayette, “hero of the two worlds”, once wrote to George Washington: “Humanity has won its battle. Liberty now has a country.” From the very start, the cause of liberty has been one we have carried together, across the Atlantic, and I strongly wish it still is.

Let me also remind you with gratitude that Dean Acheson, a transatlantic statesman who played a key role in the creation of the Atlantic Council, as well as the Marshall plan and the Bretton Woods institutions, was instrumental in the early steps of European integration. He viewed it as essential to a stable and prosperous Atlantic order, built on peace, democracy and market economy. He urged the French government to take the bold step leading to the Schuman Declaration of 9 May 1950, and hence laid one of the cornerstones of what would become the European Union. For him, as for many Americans, the EU was not designed to “screw the US”, on the contrary. Robert Schuman, at that time French Foreign Affairs Minister, remains for me a figure of profound admiration: he embodied the spirit of Franco-German reconciliation – a legacy I feel personally connected to, having grown up like him in that very region where our two nations meet.

Hence, I will highlight that the transatlantic partnership has been so far strong and balanced, as no other worldwide (I). But the US trade policy shift will harm the global economy – starting at home (II). Lastly, I will trace out a path for a European moment, if we seize this opportunity (III).

1. Mutual gains across the Atlantic: a strong and balanced economic partnership

1.1. A strong and balanced EU-US economic relationship

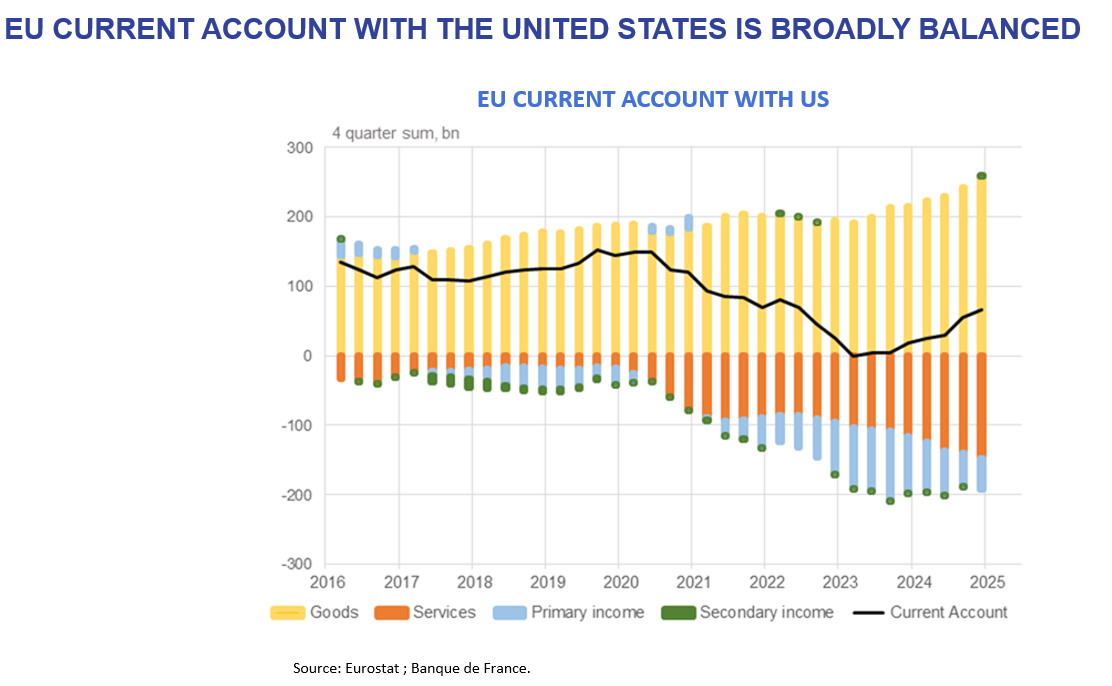

The United States and the EU are the world’s two largest economies, maintaining one of the largest bilateral economic relationships. While the EU runs a trade in goods surplus with the United States (USD 234 billion in 2023), the services deficit has widened substantially in the last years (USD 125 billion in 2023) . Net primary income flows in favor of US firms – mostly composed of investment income such as profits and asset returns – also offset the trade in goods surplus, ultimately leading to a balanced current account (USD 19 billion in 2023).

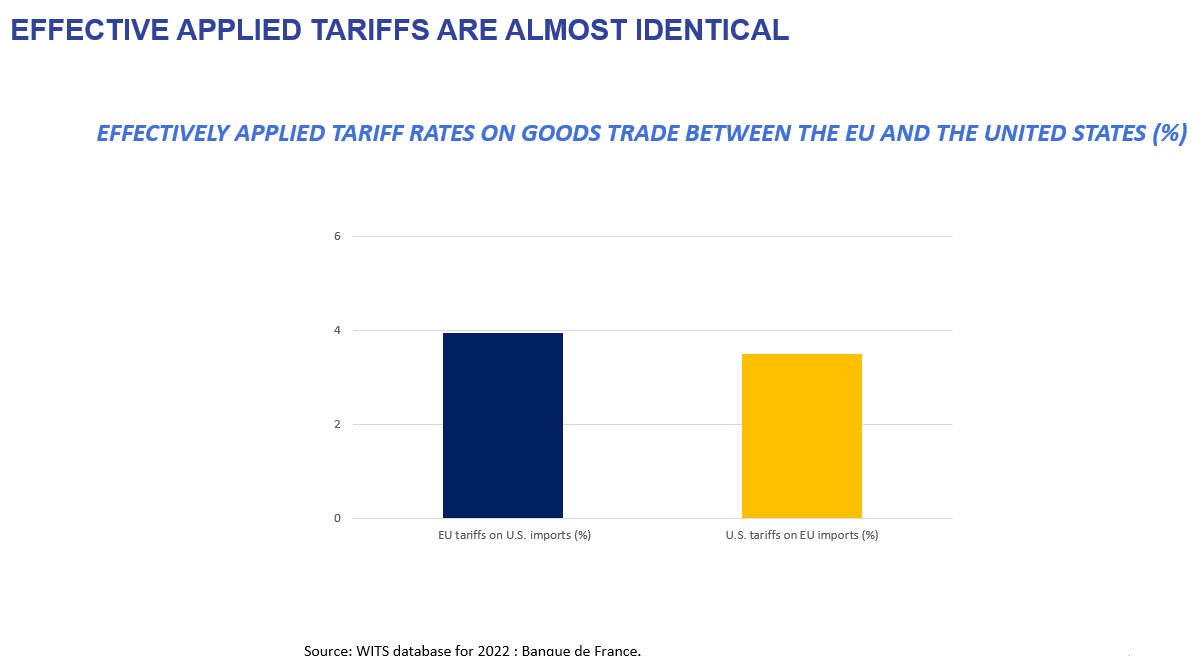

The effective applied tariffs between the EU and the United States were close before recent developments, with the EU imposing a 3.95% tariff on US products, while the United States applied a 3.5% tariff on EU productsiii .

And let me remind here the obvious: value-added tax (VAT) is not a customs duty; it is levied on the final value of imported and domestically produced goods equally, like the sales tax in the US.

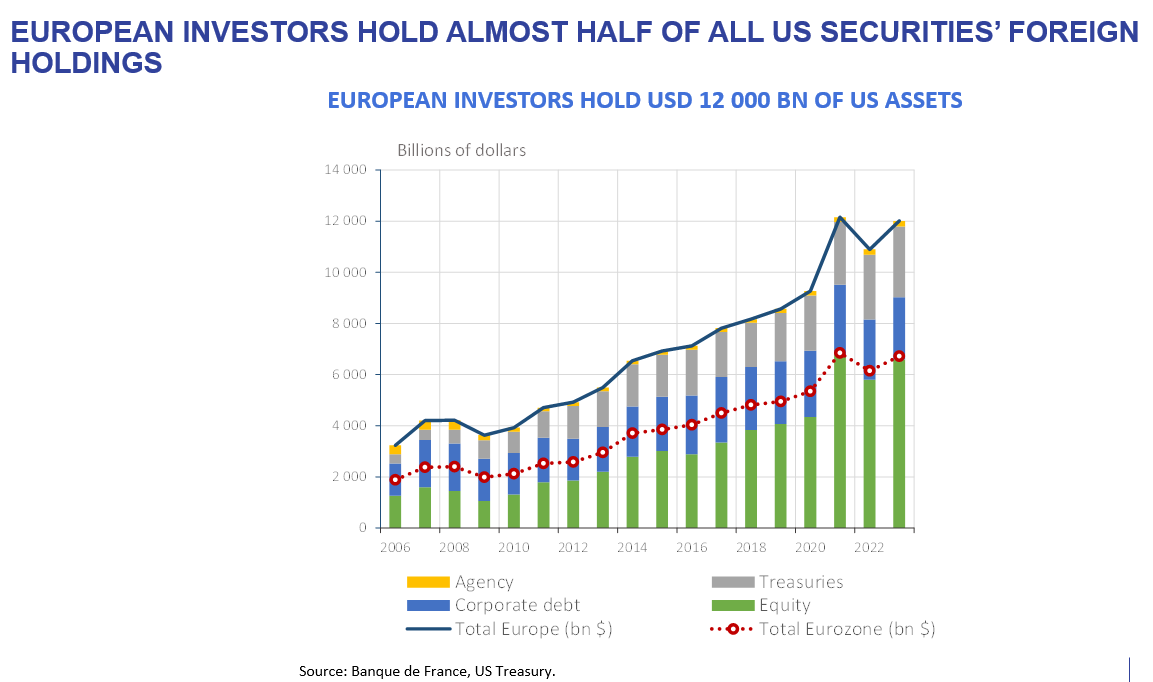

European majority-owned affiliates directly employed an estimated 5.3 million US workers in 2023iv. European based investors play a crucial role in the strength of the US economy, representing close to 50% of all foreign holdings of US securities in 2023v.

For centuries, ideas have crossed the Atlantic alongside goods and capital. Today, this legacy lives on through an interconnected research ecosystem, with 120,000 European researchers currently working in the United States, and countless institutional partnerships between universities, labs, and firms.

2. The US policy shift on trade will harm the global economy – starting at home

I don’t mean that the latest globalization wave was a fairy tale: it had its problems and its imbalances, both social + and financial. But the current lose-lose game will obviously increase them, and in no way solve them. The new measures announced as well as the increasing unpredictability, constitute a major negative shock to the global economy, but first and foremost to the US economy.

According to convergent analyses by most US and international banks and yesterday by the IMF, the United States could suffer in 2025 from an average estimated loss of around one percentage point in annual growth and a similar-sized rise in underlying inflation. There could even be a US recession, which was unthinkable three months ago. But bad news for the US is bad news for all, including for Europe. According to preliminary assessments, there could be a direct negative impact of at least a quarter of a percentage point to euro area GDP growth in 2025. The impact on inflation remains more uncertain but could be as a whole on the downside. Our baseline scenario for France and the euro area remains that of an exit from inflation – returning to our 2% target this year – without a recession.

Financial markets reacted very negatively to these trade announcements with the very unusual combination of a sharp drop in US equity indexes, a rise in US long term bond yields, and a broad-based decline in the US dollar value. The economic uncertainty may possibly threaten financial stability. Such deeply disruptive effects would also result from attacks on the independence and credibility of central banks. Let me on this occasion express again my gratitude to Fed’s Chair Powell, who admirably shows how a central banker must behave.

Independent from political impatience, our monetary policies are also autonomous from one another across the Atlantic. This in no way precludes – I can assure you – a continuous, trusted, and indispensable dialogue, which is more necessary than ever for global financial stability. But this autonomy is precisely what allows each of us to fulfil our domestic price stability mandate. In Europe, this is made possible by one of the greatest institutional achievements of the 1990s: the creation of the euro. I was personally in Maastricht thirty-three years ago, and much more recently in Francfort last week, for our latest decision to cut interest rates. There is currently no inflationary risk in Europe, and we can now almost say: “mission accomplished” when it comes to bringing inflation back to our 2% target: the significant deceleration of wages is another proof thereof. It is therefore both fair and appropriate that, compared to the Federal Reserve or the Bank of England, the European Central Bank has started cutting rates earlier, faster, and likely further this year. While this supports activity in the short term, the key to strengthening European growth remains structural — through a broader mobilisation of our internal resources.

3. Nurturing Europe’s inner strengths to match America’s best: a “3i’s” strategy

3.1 A path forward to preserve the mutually beneficial economic relationship

Let us use the 90-day pause to seriously talk. The least economically harmful option would be indeed to negotiate – a bold European proposal, zero-for-zero tariffs for industrial goods, is already on the table – and then de-escalate the situation rather than setting off a transatlantic spiral of tariff hikes. So far, Europeans have reacted in a remarkably united and calm manner. The European Commission has prepared a series of retaliatory measures – in case they are unfortunately needed – but has deferred their application.

Furthermore, Europe and the United States must still commit to a “pragmatic multilateralism”, focused on some practical themes of common interest, including, to name just a few, financial stability, cross-border payments and crypto-assets, cybersecurity, the fight against financial crime and the prevention of extreme climate events. Let us resolutely preserve and support the multilateral institutions such as the IMF and World Bank, born and hosted in this great country – and city.

3.2 Scaling up Europe: the 3i’s agenda

If the current situation has a silver lining, it is to possibly usher the European moment: Europe, despite its limitations, as a haven of economic predictability and confidence, rule of law, social cohesion. But it will not happen without bold moves. We can already see clear signs of it with the impressive shift of the next German government. It is obvious on Defence, but let me focus today on Economy, as the other pillar. We need a “general mobilisation” focusing on three imperatives, 3‘i’s, taking the best of the impressive economic success of America, or if you prefer, size multiplied by muscle multiplied by speed. First, we need to integrate the single market more. This means making the most of its size – as large in GDP terms as the United States – by removing internal barriers in several areas such as services and energy. We also need to invest better, giving priority to the most promising breakthrough innovations, and particularly those related to AI. To succeed, we need to build financial muscle through a genuine Savings and Investments Union (SIU) fostering more our abundant private savings towards equity and venture capital. Finally, we need to innovate faster. Europe needs simplification: less bureaucracy, fewer procedures and shorter deadlines. But simplification is not deregulation, the European approachvi will remain firm on the objectives, but be more nimble in design.

And to successfully implement these three imperatives, we urgently need a binding, visible and not too distant calendar: such a calendar will mobilise all our political and economic forces, as did in the past the 1 January 1993 for the single market and the 1 January 1999 for the single currency.

Let me now conclude. The transatlantic partnership has always delivered more by combining open markets with clear rules and shared trust. As the great French writer Victor Hugo envisioned:vii "A day will come when there will be no other battlefields but markets opening to trade and minds. […] A day will come when these two great groups, the United States of America and the United States of Europe, will stand face to face, reaching out across the seas, exchanging their products, their commerce, their industries, their arts, and their genius." That day, alas, has grown more distant in recent times, and the transatlantic sky has darkened considerably. But even in the storm, we must not lose sight of our long-term course. You, the American people, will decide what must be said and fought for on your side of the Atlantic, as loud and clear as necessary. As Europeans, our task is clear: to strengthen our own side of the ocean: let us, in the very name of the Atlantic spirit, seize the European moment.

i Dean Acheson (1893–1971) served as US Secretary of State under President Truman from 1949 to 1953. A key architect of the postwar international order, he played a central role in the creation of the Marshall Plan, NATO, and the Bretton Woods institutions. He was also instrumental in supporting European integration and co-founded the Atlantic Council in the early 1960s to promote transatlantic cooperation.

ii Data from Eurostat and Banque de France calculations

iii American Chamber of Commerce for the EU (2025), Annual Survey of Jobs, Trade and Investment between the United States and Europe Amcham TAE 25 V6.indd

iv American Chamber of Commerce for the EU (2025), Annual Survey of Jobs, Trade and Investment between the United States and Europe Amcham TAE 25 V6.indd

v US Treasury (2023), Foreign Portfolio Holdings of U.S. Securities, shla2023r.pdf

vi Villeroy de Galhau (F.) (2025), A European approach to simplification: avoiding three misconceptions, and suggesting concrete milestones, speech, 11 April

vii Victor Hugo, speech at the Peace Congress, August 1849.

Download the full publication

Updated on the 23rd of April 2025