- Home

- Governor's speeches

- Europe’s monetary and economic sovereign...

Published on the 11th of June 2024

2024 Paris Finance Forum – Paris, 11 June 2024

Speech by François Villeroy de Galhau, Governor of the Banque de France

Ladies and Gentlemen,

It is a pleasure to be taking part in the Paris Finance Forum, and I wish to warmly thank Augustin de Romanet and Jean-Charles Simon for their invitation. Paris keeps gaining momentum as a financial centre post-Brexit, and has since last year in particular further grown as the hub for market activities. This Parisian momentum even exceeds expectations: success breeds success!

Today’s conference comes at a very special moment: five days ago, our Eurosystem decided to cut its key policy rates by 25 bps, marking a decisive shift. And two days ago, the European elections were completed, and consequently French elections were called. As an independent central banker, my role is obviously not to make political comments. But as I prepared these remarks before the election, I intended to stress on a common aspiration of many Europeans: sovereignty, and elaborate on two sides of it: monetary sovereignty (I), and then move on to economic sovereignty (II).

I. Monetary sovereignty

The euro is a huge popular success, which most Europeans – irrespective of their votes – support: 78% of euro area citizens, and 74% of French according to the latest Eurobarometer published end-May. i We are gradually emerging from the inflationary crisis that has affected our economies and fellow citizens since the Russian invasion of Ukraine. Inflation peaked at 10.6% in October 2022 for the euro area as a whole, and has since receded to 2.6% in May 2024. ii Beyond the reversal of the initial supply shocks, monetary policy has also made a substantial contribution to the disinflationary process – between 1 and 2% inflation avoided this yeariii –, by dampening credit and demand and by “reanchoring” inflation expectations sufficiently close to our 2% target. Therefore, the time had come for a first cut and having a somewhat less restrictive monetary policy.

This de facto creates a temporary divergence between monetary policies in the euro area and the United Sates. On the other side of the Atlantic, inflation has been proving stickier than expected a few months ago, and even though economic activity slowed down during the first quarter, it remains more sustained than in the euro area. However, this divergence primarily reflects a difference of timing rather than a difference of orientation, and is expected to have limited spillover effects on the euro area due to offsetting channels.

On the one hand, there might be some downward pressures on the euro/dollar exchange rate, which have so far remained contained as it has already been discounted by markets. However, one of the great advantages of having built the European currency is that the euro area has a large economy: our single market is the same size as that of the US market and is hence less influenced by the exchange rate, whose pass-through to consumer prices is lower than 10%. If the dollar strengthened by around 1% against the euro, it would increase the euro area price index by less than 0.1%; according to a Banque de France study, the pass-through could even be smaller, around 0.05 pp. On the other hand, high for longer interest rates in the US might exert some upward pressures on global long-term bond yields and therefore have a tightening effect on financial conditions in the euro area.

To sum up, taking into account those two opposite channels of contagion, US monetary policy on balance should not greatly affect that of the euro area. Thanks to the euro, Europe has gained in monetary sovereignty. Besides, the comparison of the monetary stance in the US and the euro area must take into account the spread between the levels of the neutral interest rate (r*) that can achieve price stability, due in particular to differences in demographic and productivity trends. In the United States, it could be close to one percentage point higher than in the euro area, where it is estimated at between 2% and 2.5%.

This neutral level is not necessarily the destination for the current rate-cutting phase in the euro area; it simply shows that we have significant leeway to lower our rates before exiting restrictive territory. As regards our next rate cuts, I plead for a “pragmatic gradualism”, both on the timing, without haste nor procrastination, and on our terminal rate. When we say we are data driven, let me clarify one thing: we are monitoring actual inflation data (in particular those on services), but monthly figures will be volatile this year due to base effects on energy; this “noise” is not very meaningful, and hence we are still more “outlook driven” and will look closely at the inflation forecast. We remain confident that barring an external shock, we will bring inflation back to our 2% target by next year, and that we will reach it with a soft rather than a hard landing. It will be a lot better path for our European citizens, their income and their jobs, and for the healthy conduct of fiscal policies.

Talking of fiscal policies, let us stress that of the United States, which could significantly affect the level of long-term interest rates. A large US fiscal deficit tightens financial conditions and fuels US inflation. According to the IMF it is expected to reach close to 6.5% of GDP in 2024, whereas the fiscal deficit in the euro area should stand at 2.9% of GDP. Furthermore, new European fiscal rules and gradual economic recovery should hopefully be conducive to fiscal consolidation, which will contribute to reduce inflation and long-term interest rates. Let me now turn to the question of European economic sovereignty.

II. Economic sovereignty

The world has become tougher and more fragmented: “slowbalisation”, a word tested by the IMF, v captures it well. As economic and financial relationships are increasingly weaponised, many countries are seeking to reinforce their resilience to external shocks – be they wilful or not. This is true for the US, vi and should be so for Europe which suffered from its past reliance on Russian energy.

Economic sovereignty has therefore been a growing focus of attention throughout Europe, and rightly so: no single country has the economic clout to be in a position to respond to global challenges on its own. The European Commission has already launched many actions to strengthen our common economic security. vii That said, we must recognise that, in the fragmented world of 2024, our continent has three potentially contradictory wishes: (i) stronger social and environmental rules; (ii) greater trade openness; and (iii) maintaining competitiveness.

How can these contradictions be reconciled? The ‘Draghi report’ in July will come up with its own answers. There is obviously no simplistic solution: yes, we need to simplify the rules, while keeping the core principles of our climate standards. Yes, we need a more muscular and faster Europe in tomorrow's trade negotiations, without lapsing into protectionism, which would make no sense at national level but would also be a great loss at European level. Europe’s soft power is based on compliance with international rules and multilateralism. Our Union is a very open economy (40% of its total trade takes place with third countries), and has widely benefited thereof. But it must remedy its existing and potential vulnerabilities. One of the main obvious steps is to de-risk and reduce our dependencies to critical imports, by diversifying supply sources.

But beside reducing our vulnerabilities, I am sure that there are two strengths that we can and must beef-up. Neither of them involves additional public expenditure: we obviously no longer have the means to use and abuse fiscal largesse. Rather, through two economic reforms, Europe has ample leeway to build inner strength, in order to fully unlock its potential. viii

First, we must leverage our size through the single market. The EU is now one of the largest markets in the world, comprising 450 million people and 23 million firms. The single market has already boosted European GDP by between 8% and 9%, according to firm estimates. ix While often seen as a thing of the past – the glorious economic legacy of Jacques Delors –, it is clearly a subject for the future. The IMF estimates that a 10% reduction in internal barriers and frictions would generate significant gains, of around 7% of GDP, x for the benefit of all EU countries. In his report published in April, Enrico Letta made several proposals in that regard: ix among others, he proposes the introduction of a “fifth freedom”, focusing on research, innovation, knowledge and education; and indeed this is where Europe has its greatest potential for growth. The EU should not break ranks: investments should not go to countries where governments are more able and willing to provide state aid, but should ensure the best use of economic resources. xii Subject to greater national fiscal discipline, Europe could and should arm itself with a common fiscal capacity, giving priority to common public goods. xiii

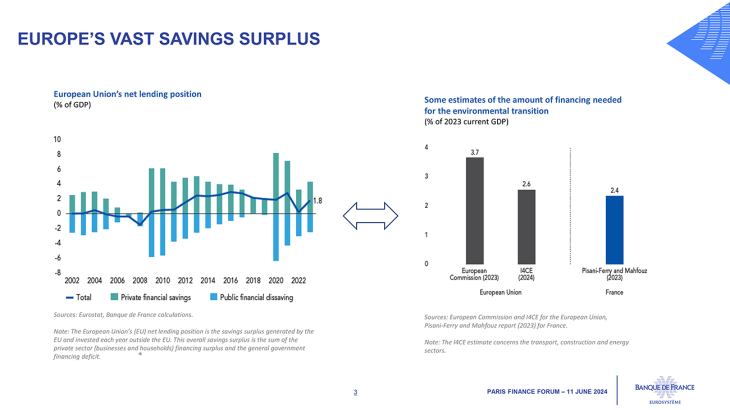

Second, Europe must align its financial power with its economic heft, and with investments needs stemming from two transformations for the future: digital, and climate. This is obviously a conviction we all share at Europlace: for too long Europe has left financial strength to others; for too long it has neglected its asset of competitive banks and financial institutions. In this respect, France is better equipped and more lucid in Europe, because France has the advantage of having very strong banks and financial institutions. Europe must tap into the "unknown resource" of its vast savings surplus to finance them: all in all, after deducting public deficits, the EU’s net lending position amounts to almost 2% of GDP, and more than EUR 300 billion.

The Capital Markets Union could be rebranded to reflect its higher purpose – for instance a Savings and Investments Union. xiv New ambitious instruments need to be deployed; let us focus our efforts on a few selected levers, of which I will now provide three examples to complement the Noyer Report. xvi Equity financing, which is crucial for innovation but an area in which Europe lags far behind the United States: it accounts for a mere 84% of GDP in the euro area, compared with 173% across the Atlantic. This funding could be boosted by an ambitious public-private partnership, with the possibility of public backing for pan-European venture capital funds. Furthermore, green securitisation, provided it is sufficiently secure, could boost banks' capacity to finance green projects by several hundred billion euro a year. At the end of 2023, European regulations paved the way for using the European Green Bonds label (EuGB) for green securitisation, provided that the funds raised on bank balance sheets - for example by securitising housing loans - are allocated to European Taxonomy-aligned sustainable activities. Finally, as we celebrate the 10th anniversary of the Supervision Union and the success of the SSM (single supervisory mechanism), the Banking Union is still incomplete. This continues to hamper the emergence of pan-European banks. For banks – and we see this in the United States – size is objectively a factor in competitiveness, particularly as it enables banks to amortise the cost of indispensable investments in digital technology, artificial intelligence, and going forward in the tokenisation of deposits and assets. Europe must transpose Basel 3: not less, but not more. There will be no Basel 4, and we are confident the US authorities will transpose, even if we are very attentive to their timing. European authorities must relentlessly step up the fight against too many short-sighted differences in national positions and obstacles. We shouldn’t fear bigger, cross-border European banks – if managed and supervised closely –, we should on the contrary foster them.

Let me conclude by paraphrasing Raymond Aron about the victory in the war in 1939. We can believe in the success of the European economy, but on one condition: that we have the will to be successful. xvii In a more fragmented and tougher world undergoing profound transformation, Europe has effective levers at its disposal. Our economic destiny is largely in our own hands, and minds. This conviction should be the mainstay of our confidence. Thank you for your attention.

iStandard Eurobarometer 101 – Spring 2024, May 2024

iiEurostat, flash estimate, 31 May 2024

iiiVilleroy de Galhau (F.), Anatomy of a fall in inflation: from a successful first phase to the conditions for a controlled landing, speech, 28 March 2024

ivIMF, Fiscal monitor, April 2024

vIMF, Charting globalization’s turn to slowbalisation after global financial crisis, 8 February 2023

viSee for instance Remarks by National Security Advisor Jake Sullivan on Renewing American Economic Leadership, 27 April 2023

viiEuropean Commission, An EU Approach to enhance economic security, 20 June 2023

viiiVilleroy de Galhau (F.), France and Europe: from crisis management to a longer-term ambition, Letter to the President of the French Republic, April 2024. French version: La France et l'Europe : de la gestion des crises à une ambition de plus long terme, Lettre au Président de la République, avril 2024

ixEuropean Commission, A European industrial strategy. A single market that delivers for businesses and consumers, March 2020

xIMF, Geoeconomic Fragmentation: what’s at Stake for the EU, 30 November 2023

xiLetta (E.), Much more than a market, April 2024

xiiGopinath, G., Europe in a fragmented world, speech, 30 November 2023

xiiiButi (M.), When will the European Union finally get the budget it needs?, December 2023

xivAs proposed by Enrico Letta in the aforementioned report published in April 2024

xvVilleroy de Galhau (F.), France and Europe: from crisis management to a longer-term ambition, Letter to the President of the French Republic, April 2024. French version: La France et l'Europe : de la gestion des crises à une ambition de plus long terme, Lettre au Président de la République, avril 2024

xviNoyer (C.), Developing European capital markets to finance the future, April 2024

xviiIn 1939, Raymond Aron wrote: “I also believe in the final victory of democracies, but on one condition, that they want to be victorious”.

Updated on the 24th of June 2024